How AI and marketing automation are reorganizing the automotive industry

How AI and marketing automation are reorganizing the automotive industry Munich, January 2026 A utomotive Marketing Under Pressure — Competing

WANT TO DISCOVER MORE?

SEARCH

Insights On Air | Berylls by Alixpartners Podcast

Raw Materials • Rare Earths • Chips. They’ve all disrupted production before. None are secured for the future. The risk of recurrence? Higher than ever. The car of the future isn’t just about batteries and software. It’s built on fragile supply chains, exposed to geopolitics and resource nationalism. Every OEM knows: the next disruption is not a question of if, but when. Weiterlesen...

Guest:

Christian Grimmelt (Partner)

Hört hier die neue Episode: Spotify , Apple , Podigee

Die Episode ist auf Englisch aufgezeichnet.

Berylls by Alixpartners

Das sind wir

Gemeinsam sind wir noch schlagkräftiger – Berylls Strategy Advisors und Berylls Mad Media verschmelzen zu Berylls by AlixPartners, unter dem sehr renommierten und international aufgespannten Dach von AlixPartners. Die herausragende Expertise von Berylls als Strategie-, Vertriebs- und Digitalberatung vereint sich mit dem Beratungsangebot von AlixPartners, in den Bereichen Restrukturierungs-, Transformations- und Performance Improvement-Services zu einem Perfect Match.

Als Berylls by AlixPartners werden wir unser ambitioniertes Wachstum fortsetzen und mit den weiter gefassten Services zu einem noch stärkeren Beratungsteam für die gesamte Automobil- und Mobilitätsindustrie.

Unser Anspruch

Wir verstehen es als unseren Auftrag, eine nachhaltige, wirtschaftlich erfolgreiche Zukunft für die globale Automobilitätsbranche mitzugestalten, indem wir Automobilität zu Ende denken.

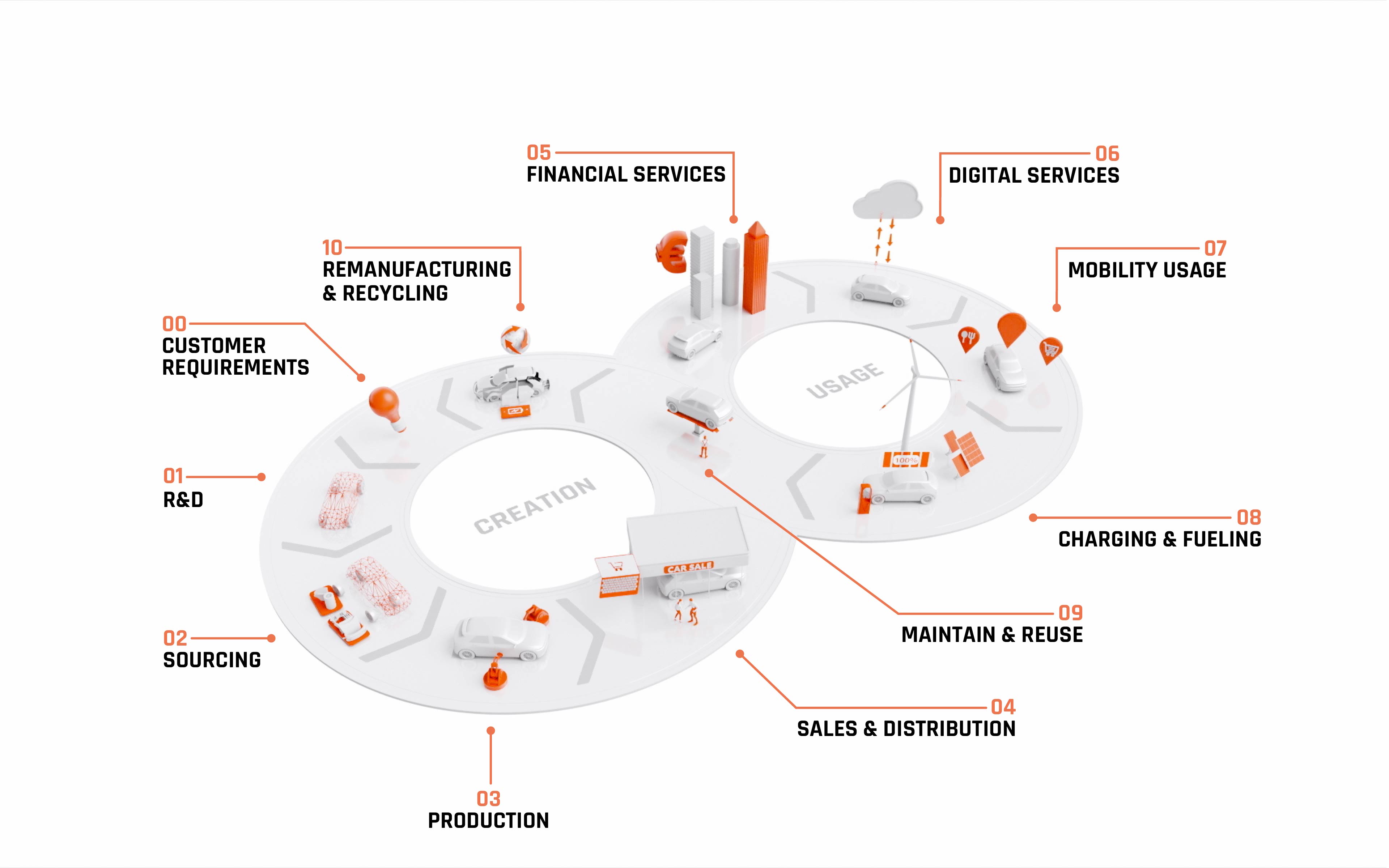

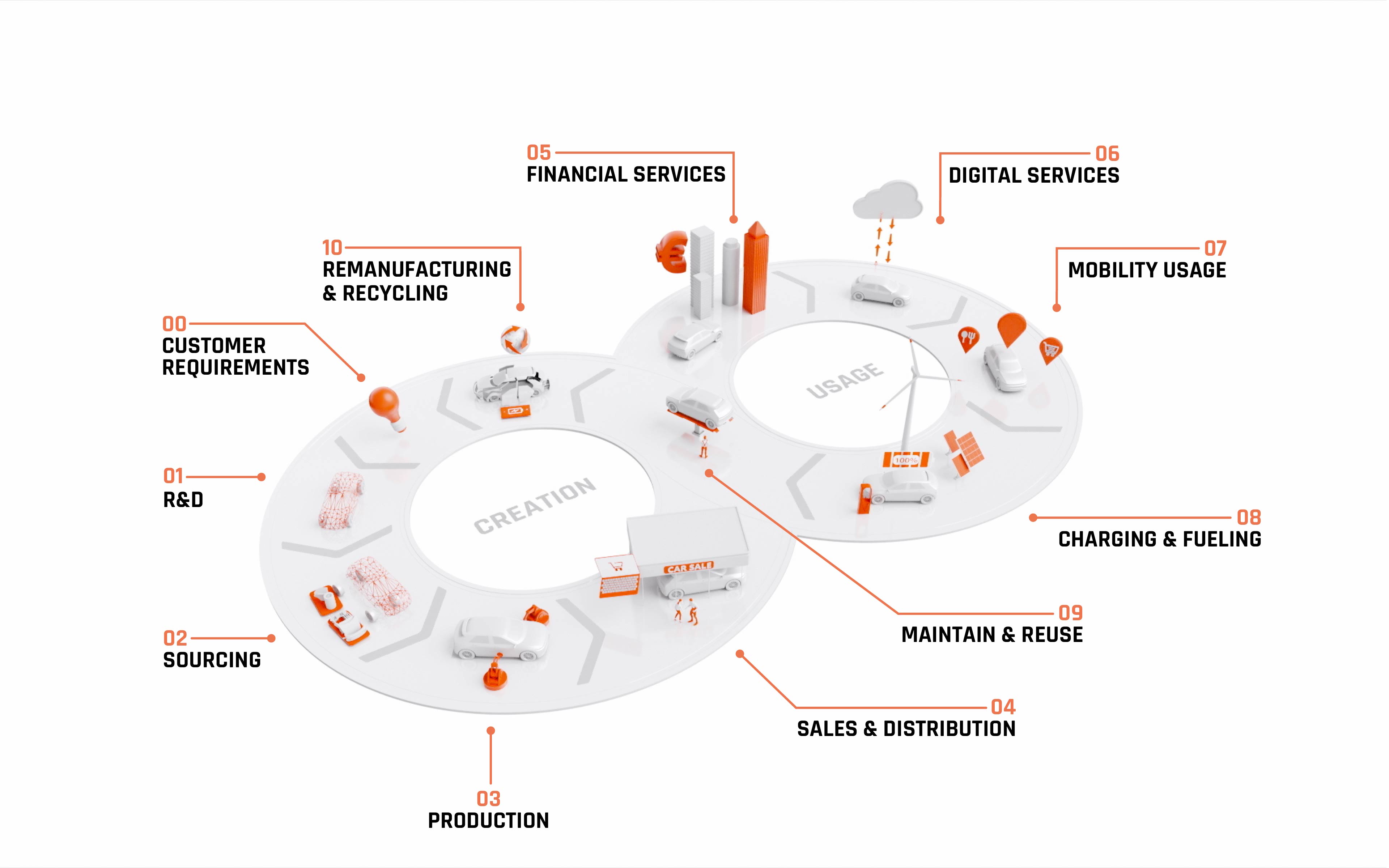

Unseren Ansatz nennen wir den Berylls Loop. Er umfasst die komplette Wertschöpfungskette der Automobilindustrie und bildet den Kern unseres Schaffens.

Insights On Air | Berylls by Alixpartners Podcast

Nachhaltigkeit ist nicht weiter nur ein Kostenfaktor - vielmehr wird sie mehr und mehr ein Treiber für das Kerngeschäft. In der aktuellen Podcast-Episode sprechen wir darüber, wie Automobilunternehmen 'grüne' Initiativen in profitable Strategien umwandeln und einbetten. Von Rohstoffketten bis hin zu neuen Modellen von Mobilitätslösungen.

Hört hier die neue Episode: Spotify , Apple , Podigee

Die Episode ist auf Englisch aufgezeichnet.

Das neueste zu Berylls by Alixpartners

Die globale Unternehmensberatung AlixPartners hat Berylls und damit das Beratungsgeschäfts von Berylls Strategy Advisors und Berylls Mad Media übernommen. Das Closing ist zum 31.05.2024 erfolgt.

Durch den erfolgreichen Vollzug der Übernahme werden die Dienstleistungen der übernommenen Unternehmensberatungs-Einheiten ab sofort unter dem Namen „Berylls by AlixPartners“ angeboten. Die Übernahme umfasst rund 160 Berylls Mitarbeitende, dadurch wächst AlixPartners in der DACH-Region auf rund 400 Mitarbeitende.

Our mission

Thinking Automobility End-To-End

Our mission is to create a sustainable as well as economically viable future for the global automobility industry by thinking automobility end-to-end.

Our approach to accomplishing this we call the Berylls Loop. It covers the entire automotive value chain end-to-end and is at the heart of everything we do.

00 Kundenanforderungen

Am Anfang steht für uns immer der Kunde. Wir unterstützen unsere Klienten dabei, die Bedürfnisse ihrer Kunden zu benennen und daraus Anforderungen für physische und digitale Produkte abzuleiten.

DIENSTLEISTUNGEN

Bewertung der Auswirkungen des Verteidigungsministeriums auf den Fahrzeugabsatz

Herausforderung

Lösung

Ergebnis

Marktmodell für urbane Mobilität

Herausforderung

Lösung

Ergebnis

Neupositionierung des Marken- und Produktportfolios zur Anpassung an neue Lifestyle-Segmente

Herausforderung

Lösung

Ergebnis

Berylls Use Case Enabler Matrix

Herausforderung

Lösung

Ergebnis

01 Forschung & Entwicklung

Wir unterstützen Kunden dabei, Produktideen umzusetzen, ganz gleich, ob es sich dabei um Plattformen, Module, Komponenten oder Dienstleistungen handelt. Gemeinsam definieren wir Angebote, die physische Produkte um digitale Dienste ergänzen.

DIENSTLEISTUNGEN

Nachhaltigkeit, Portfoliostrategie, Software & Architektur, Transformation, Neue Geschäftsfelder, E-Mobilität, Autonomes Fahren, Mobilitätsdienste

Entwicklung von Führungsteams im Kontext des autonomen Fahrens

Herausforderung

Lösung

Ergebnis

Gestaltung einer zukunftssicheren Produktlinienorganisation

Herausforderung

Lösung

Ergebnis

Umstellung des Tier-1-Geschäftsmodells vom Verbrennungsmotor auf E-Mobilität

Herausforderung

Lösung

Ergebnis

Task Force für die Entwicklung eines HV-Bordladegeräts

Herausforderung

Lösung

Ergebnis

AD-Technologiedienstleister PMI

Herausforderung

Lösung

Ergebnis

Szenariobasierte Bewertung der Tier-1-Portfoliostrategie

Herausforderung

Lösung

Ergebnis

E-Mobilitäts-Akademie: Up-Skilling für E-Mobilität über alle Kompetenzstufen

Herausforderung

Lösung

Ergebnis

02 Einkauf & Beschaffung

Wir helfen unseren Kunden, ein leistungsfähiges Liefernetzwerk aufzubauen und hier die richtigen Entscheidungen zu treffen. Außerdem unterstützen wir sie dabei, ihre Zulieferer weiterzuqualifizieren sowie neue Beschaffungs- und Liefermodelle für Software-basierte Anwendungen zu entwickeln.

DIENSTLEISTUNGEN

Operations, Software & Architektur, M&A und Transaktionen, Transformation

Sicherstellung der Eignung von OEM- und Zuliefererorganisationen für die "Zelle von morgen"

Herausforderung

Lösung

Ergebnis

Strategische Leitlinien für widerstandsfähige Lieferketten

Herausforderung

Lösung

Ergebnis

Organisatorische Neugestaltung der Beschaffungsabteilung

Herausforderung

Lösung

Ergebnis

A123 48V Batterie Task Force

Herausforderung

Lösung

Ergebnis

Task Force will Premium-SUV in den USA einführen

Herausforderung

Lösung

Ergebnis

Qualifizierung von Zweitlieferanten für Kabelbäume

Herausforderung

Lösung

Ergebnis

Qualifizierung von Lieferanten für Sitzbezüge

Herausforderung

Lösung

Ergebnis

Bewertung der Preisgestaltung und Programm zur Befähigung von Anlagen

Herausforderung

Lösung

Ergebnis

Globales Programm zur Qualitätsverbesserung

Herausforderung

Lösung

Ergebnis

03 Produktion

Wir unterstützen unsere Kunden bei der Einführung von neuen Produktlinien, Technologien und Anwendungen. Unsere Taskforce-Teams greifen ein, wenn es kritisch wird: Wir helfen ihnen, Engpässe, Qualitätsmängel und Anlaufverzögerungen zu beheben.

DIENSTLEISTUNGEN

CASE STUDIES

Zielbildentwicklung für Produktionsanlage eines Premium-OEM

Herausforderung

Lösung

Ergebnis

Strategie- und Organisationsentwicklung für die Industrialisierungsfunktion eines Premium-OEM

Herausforderung

Lösung

Ergebnis

Standortwahl Europa

Herausforderung

Lösung

Ergebnis

Einführung und Unterstützung des Aufbaus einer Infrastruktur für eine innovative Karosseriewerkstatt für Elektrofahrzeuge

Herausforderung

Lösung

Ergebnis

Einführung und Unterstützung des Aufbaus einer Infrastruktur für eine innovative Karosseriewerkstatt für Elektrofahrzeuge

Herausforderung

Lösung

Ergebnis

Entwicklung einer Back-up-Lösung für einen Kabelbaumlieferanten

Herausforderung

Lösung

Ergebnis

Magna CCMi-Einführungs- und Standort-Exzellenz-Team

Herausforderung

Lösung

Ergebnis

Magna Kamtek: Umstrukturierung und Standortqualität

Herausforderung

Lösung

Ergebnis

Unterstützung der Markteinführung von Magna-Batterietabletts auf der grünen Wiese

Herausforderung

Lösung

Ergebnis

Synchronisierte Produktion in der Einzelfertigung eines Karosseriewerks

Herausforderung

Lösung

Ergebnis

Unterstützung der Markteinführung und des Anlaufs von zwei innovativen Leichtbau-Elektrofahrzeugen

Herausforderung

Lösung

Ergebnis

04 Verkauf & Vertrieb

Wir helfen unseren Klienten, das passende Markteinführungskonzept zu definieren, die Vertriebsorganisation fit für die Zukunft zu machen und innovative digitale Erlebniswelten zu gestalten. Dazu gehören digitale Instrumente und Prozesse, die auf allen Kanälen ein neues Kundenerlebnis ermöglichen.

DIENSTLEISTUNGEN

CASE STUDIES

Implementierung eines nahtlos-integrierten kanalübergreifenden Kundenerlebnisses

Herausforderung

Lösung

Ergebnis

Digitale Sales & Marketing Transformation für einen deutschen OEM auf HQ- und europäischer Ebene

Herausforderung

Lösung

Ergebnis

Implementierung eines Transformationsprogramms für Vertrieb und Marketing bei einem deutschen Premium-OEM

Herausforderung

Lösung

Ergebnis

Entwicklung eines Zielbetriebsmodells für Vertrieb und Marketing

Herausforderung

Lösung

Ergebnis

Marketingplanung und Reverse Funnel Intelligence

Herausforderung

Lösung

Ergebnis

CX-Ausführungsrahmen für den Direktvertrieb

Herausforderung

Lösung

Ergebnis

Zukünftige zielgerichtete Marketingprozesse und -architektur

Herausforderung

Lösung

Ergebnis

Vertriebs- und Marketing-Trichter KPI & BI

Herausforderung

Lösung

Ergebnis

Programm-Management Automobil-E-Commerce

Herausforderung

Lösung

Ergebnis

Kundeninteraktion auf Gemeinschaftsebene

Herausforderung

Lösung

Ergebnis

Go-to-Market-Strategie für BEVs für eine Volumenmarke in Europa

Herausforderung

Lösung

Ergebnis

Regionalisierung der Vertriebs- und Marketingorganisation einer großen Premiummarke

Herausforderung

Lösung

Ergebnis

Globales Marketing-Zielbetriebsmodell für eine große Premium-Automarke

Herausforderung

Lösung

Ergebnis

Portfoliostrategie für OEM-Top-End-Sub-Marken

Herausforderung

Lösung

Ergebnis

Transformation des physischen Einzelhandels für einen Premium-OEM

Herausforderung

Lösung

Ergebnis

05 Finanzdienstleistungen

Wir unterstützen sowohl konzerneigene als auch konzernunabhängige Finanzdienstleister, Flottenbetreiber und Mobilitätsanbieter bei der Entwicklung und Umsetzung von innovativen Finanzierungs- und Versicherungsangeboten sowie Ertrags- und Eigentumsmodellen. Das Ziel: den Ertrag je Fahrzeug über dessen gesamten Lebenszyklus zu maximieren.

DIENSTLEISTUNGEN

CASE STUDIES

Carsharing-Strategie und Umsetzung

Herausforderung

Lösung

Ergebnis

Entwicklung einer Strategie für Finanzdienstleistungen

Herausforderung

Lösung

Ergebnis

VaaS-Strategie

Herausforderung

Lösung

Ergebnis

H2 Carsharing-Konzept und Umsetzung

Herausforderung

Lösung

Ergebnis

Carsharing-Strategie

Herausforderung

Lösung

Ergebnis

Carsharing und Abonnement CDD

Herausforderung

Lösung

Ergebnis

Entwicklung der globalen 2030-Strategie für einen weltweit führenden OEM-Captive

Herausforderung

Lösung

Ergebnis

Produkt- und Dienstleistungsinnovationsstrategie für ein deutsches OEM-Leasingunternehmen (Captive)

Herausforderung

Lösung

Ergebnis

Multi-Cycle-Verkaufsmodell zur Maximierung des Vehicle Lifetime Value (VLV)

Herausforderung

Lösung

Ergebnis

06 Digitale Dienste

Wir helfen Kunden beim Übergang von den Hardware-basierten Lösungen von heute zu den Software-basierten Angeboten von morgen, indem wir digitale Produkte und Erfahrungen skalieren, die lückenlos mit der realen Welt verbunden sind.

DIENSTLEISTUNGEN

Software & architecture, Transformation, Konnektivität, Daten

CASE STUDIES

Strategie für mobile Anwendungen

Herausforderung

Lösung

Ergebnis

Metaverse

Herausforderung

Lösung

Ergebnis

IT-Standortstrategie

Herausforderung

Lösung

Ergebnis

Gezielte Digitalisierung des Kundenerlebnisses einer Luxusautomarke der Oberklasse

Herausforderung

Lösung

Ergebnis

Modellierung der Software-Marktgröße

Herausforderung

Lösung

Ergebnis

Aktualisierung und Umsetzung der Strategie

Herausforderung

Lösung

Ergebnis

Neugestaltung der digitalen Wertschöpfungskette

Herausforderung

Lösung

Ergebnis

SW-Produktstrategie

Herausforderung

Lösung

Ergebnis

Kommerzielle Due-Diligence-Prüfung SW-Testing-Tool-Unternehmen

Herausforderung

Lösung

Ergebnis

07 Mobilitätsnutzung

Neue Anbieter und Start-ups im Mobilitätsbereich unterstützen wir in der Anfangsphase, von der Entwicklung ihres Zielbildes und Betreibermodells über Preisstrategien und die Auswahl der Zulieferer bis hin zu der ersten Produktversion und der Markteinführung.

DIENSTLEISTUNGEN

Portfolio strategy, Software & Architektur, Mobilitätsdienste, Konnektivität

CASE STUDIES

AD-Strategie für die Markteinführung

Herausforderung

Lösung

Ergebnis

Firmengebäude des Pooling-Dienstleisters

Herausforderung

Lösung

Ergebnis

Unterstützung bei Geschäftsaufbau und Skalierung

Herausforderung

Lösung

Ergebnis

Entwicklung einer Mobilitätsstrategie und Ausgliederung der Mobilitätseinheit

Herausforderung

Lösung

Ergebnis

Zielbild Mobilität

Herausforderung

Lösung

Ergebnis

Überprüfung der Mobilitätsstrategie

Herausforderung

Lösung

Ergebnis

Überprüfung des Portfolios der Mobilitätsdienste

Herausforderung

Lösung

Ergebnis

Entwicklung eines Robo-Taxi-Fernverkehrsdienstes

Herausforderung

Lösung

Ergebnis

Strategie und Marktmodell der Mikromobilität

Herausforderung

Lösung

Ergebnis

Ride-hailing CDD

Herausforderung

Lösung

Ergebnis

Unterstützung bei der Markteinführung des autonomen Fahrdienstes

Herausforderung

Lösung

Ergebnis

Modulare Architekturstrategie für einen Anbieter von Mobilitätslösungen

Herausforderung

Lösung

Ergebnis

Identifizierung künftiger Geschäftsmöglichkeiten im Bereich der Mobilität und Entwicklung entsprechender Geschäftsmodelle

Herausforderung

Lösung

Ergebnis

08 Laden & Tanken

Wir helfen Kunden, Strategien, Geschäftsmodelle und Komplettlösungen rund um den Ladevorgang zu entwickeln.

DIENSTLEISTUNGEN

Nachhaltigkeit, Software & Architektur, Mobilitätsdienste, Konnektivität, Daten

CASE STUDIES

Übergang des Geschäftsmodells vom "Tanken" zum "Laden"

Herausforderung

Lösung

Ergebnis

Kundenreise "Laden"

Herausforderung

Lösung

Ergebnis

Ladestrategie 2030

Herausforderung

Lösung

Ergebnis

Ladestrategie 2030

Herausforderung

Lösung

Ergebnis

Identifikation von Wertschöpfungspotenzialen entlang der Wertschöpfungskette von Elektrofahrzeugen

Herausforderung

Lösung

Ergebnis

Untersuchung von Geschäftsmöglichkeiten und potenziellen Geschäftsmodellen im Bereich der Wasserstoffmobilität

Herausforderung

Lösung

Ergebnis

Gestaltung einer kostenpflichtigen Customer Journey durch den gesamten Kundenlebenszyklus

Herausforderung

Lösung

Ergebnis

09 Wartung & Wiederverwendung

Wir unterstützen Klienten im Bereich Service und Kundendienst dabei, Produkte, Betriebsmodelle und Kundenerlebnisse aufzusetzen. Dabei decken wir auch mehrzyklische Vertriebs- und Ertragsvarianten ab und berücksichtigen Governance-Anforderungen, Bewertungskennzahlen sowie Matching- und Verteilungsalgorithmen.

DIENSTLEISTUNGEN

Portfolio Strategie, Future sales

CASE STUDIES

Multi-Cycle-Verkaufsmodell zur Maximierung des Vehicle Lifetime Value (VLV)

Herausforderung

Lösung

Ergebnis

Transformation des physischen Einzelhandels für einen Premium-OEM

Herausforderung

Lösung

Ergebnis

Entwicklung einer Gebrauchtwagenstrategie für einen großen Premium-Autohändler

Herausforderung

Lösung

Ergebnis

Bewertung des Geschäftsmodells eines nachhaltigen Ersatzteilunternehmens

Herausforderung

Lösung

Ergebnis

10 Wiederaufbereitung & Recycling

Wir helfen Kunden, den Ansatz der Kreislaufwirtschaft bereits bei der Produktentwicklung zu berücksichtigen, entwerfen Strategien für Wiederverwendung, Wiederaufbereitung und Recycling und entwickeln Second-Life-Lösungen für den Einsatz ausgedienter Autobatterien.

DIENSTLEISTUNGEN

CASE STUDIES

Bewertung des Geschäftsmodells eines nachhaltigen Ersatzteilunternehmens

Herausforderung

Lösung

Ergebnis

Strategische Optionen und Zielbildentwicklung im Recycling

Herausforderung

Lösung

Ergebnis

Beim Laden der Videos ist ein Fehler aufgetreten.

Scroll Down to explore more

Scroll Up to go back

Scroll Down to explore more

Scroll Up to go back

Scroll Down to explore more

Scroll Up to go back

Scroll Down to explore more

Scroll Up to go back

Scroll Down to explore more

Scroll Up to go back

Scroll Down to explore more

Scroll Up to go back

Scroll Down to explore more

Scroll Up to go back

Scroll Down to explore more

Scroll Up to go back

Scroll Down to explore more

Scroll Up to go back

Scroll Down to explore more

Scroll Up to go back

Scroll Down to explore more

Scroll Up to go back

Scroll Down to explore more

Scroll Up to go back

Scroll Down to explore more

00 Kundenanforderungen

Am Anfang steht für uns immer der Kunde. Wir unterstützen unsere Klienten dabei, die Bedürfnisse ihrer Kunden zu benennen und daraus Anforderungen für physische und digitale Produkte abzuleiten.

DIENSTLEISTUNGEN

CASE STUDIES

Bewertung der Auswirkungen des Verteidigungsministeriums auf den Fahrzeugabsatz

Herausforderung

Lösung

Ergebnis

Marktmodell für urbane Mobilität

Herausforderung

Lösung

Ergebnis

Neupositionierung des Marken- und Produktportfolios zur Anpassung an neue Lifestyle-Segmente

Herausforderung

Lösung

Ergebnis

Berylls Use Case Enabler Matrix

Herausforderung

Lösung

Ergebnis

01 Forschung & Entwicklung

Wir unterstützen Kunden dabei, Produktideen umzusetzen, ganz gleich, ob es sich dabei um Plattformen, Module, Komponenten oder Dienstleistungen handelt. Gemeinsam definieren wir Angebote, die physische Produkte um digitale Dienste ergänzen.

DIENSTLEISTUNGEN

Nachhaltigkeit, Portfoliostrategie, Software & Architektur, Transformation, Neue Geschäftsfelder, E-Mobilität, Autonomes Fahren, Mobilitätsdienste

CASE STUDIES

Entwicklung von Führungsteams im Kontext des autonomen Fahrens

Herausforderung

Lösung

Ergebnis

Gestaltung einer zukunftssicheren Produktlinienorganisation

Herausforderung

Lösung

Ergebnis

Umstellung des Tier-1-Geschäftsmodells vom Verbrennungsmotor auf E-Mobilität

Herausforderung

Lösung

Ergebnis

Task Force für die Entwicklung eines HV-Bordladegeräts

Herausforderung

Lösung

Ergebnis

AD-Technologiedienstleister PMI

Herausforderung

Lösung

Ergebnis

Szenariobasierte Bewertung der Tier-1-Portfoliostrategie

Herausforderung

Lösung

Ergebnis

E-Mobilitäts-Akademie: Up-Skilling für E-Mobilität über alle Kompetenzstufen

Herausforderung

Lösung

Ergebnis

02 Einkauf & Beschaffung

Wir helfen unseren Kunden, ein leistungsfähiges Liefernetzwerk aufzubauen und hier die richtigen Entscheidungen zu treffen. Außerdem unterstützen wir sie dabei, ihre Zulieferer weiterzuqualifizieren sowie neue Beschaffungs- und Liefermodelle für Software-basierte Anwendungen zu entwickeln.

DIENSTLEISTUNGEN

Operations, Software & Architektur, M&A und Transaktionen, Transformation

CASE STUDIES

Sicherstellung der Eignung von OEM- und Zuliefererorganisationen für die "Zelle von morgen"

Herausforderung

Lösung

Ergebnis

Strategische Leitlinien für widerstandsfähige Lieferketten

Herausforderung

Lösung

Ergebnis

Organisatorische Neugestaltung der Beschaffungsabteilung

Herausforderung

Lösung

Ergebnis

A123 48V Batterie Task Force

Herausforderung

Lösung

Ergebnis

Task Force will Premium-SUV in den USA einführen

Herausforderung

Lösung

Ergebnis

Qualifizierung von Zweitlieferanten für Kabelbäume

Herausforderung

Lösung

Ergebnis

Qualifizierung von Lieferanten für Sitzbezüge

Herausforderung

Lösung

Ergebnis

Bewertung der Preisgestaltung und Programm zur Befähigung von Anlagen

Herausforderung

Lösung

Ergebnis

Globales Programm zur Qualitätsverbesserung

Herausforderung

Lösung

Ergebnis

03 Produktion

Wir unterstützen unsere Kunden bei der Einführung von neuen Produktlinien, Technologien und Anwendungen. Unsere Taskforce-Teams greifen ein, wenn es kritisch wird: Wir helfen ihnen, Engpässe, Qualitätsmängel und Anlaufverzögerungen zu beheben.

DIENSTLEISTUNGEN

CASE STUDIES

Zielbildentwicklung für Produktionsanlage eines Premium-OEM

Herausforderung

Lösung

Ergebnis

Strategie- und Organisationsentwicklung für die Industrialisierungsfunktion eines Premium-OEM

Herausforderung

Lösung

Ergebnis

Standortwahl Europa

Herausforderung

Lösung

Ergebnis

Einführung und Unterstützung des Aufbaus einer Infrastruktur für eine innovative Karosseriewerkstatt für Elektrofahrzeuge

Herausforderung

Lösung

Ergebnis

Einführung und Unterstützung des Aufbaus einer Infrastruktur für eine innovative Karosseriewerkstatt für Elektrofahrzeuge

Herausforderung

Lösung

Ergebnis

Entwicklung einer Back-up-Lösung für einen Kabelbaumlieferanten

Herausforderung

Lösung

Ergebnis

Magna CCMi-Einführungs- und Standort-Exzellenz-Team

Herausforderung

Lösung

Ergebnis

Magna Kamtek: Umstrukturierung und Standortqualität

Herausforderung

Lösung

Ergebnis

Unterstützung der Markteinführung von Magna-Batterietabletts auf der grünen Wiese

Herausforderung

Lösung

Ergebnis

Synchronisierte Produktion in der Einzelfertigung eines Karosseriewerks

Herausforderung

Lösung

Ergebnis

Unterstützung der Markteinführung und des Anlaufs von zwei innovativen Leichtbau-Elektrofahrzeugen

Herausforderung

Lösung

Ergebnis

04 Verkauf & Vertrieb

Wir helfen unseren Klienten, das passende Markteinführungskonzept zu definieren, die Vertriebsorganisation fit für die Zukunft zu machen und innovative digitale Erlebniswelten zu gestalten. Dazu gehören digitale Instrumente und Prozesse, die auf allen Kanälen ein neues Kundenerlebnis ermöglichen.

DIENSTLEISTUNGEN

CASE STUDIES

Implementierung eines nahtlos-integrierten kanalübergreifenden Kundenerlebnisses

Herausforderung

Lösung

Ergebnis

Digitale Sales & Marketing Transformation für einen deutschen OEM auf HQ- und europäischer Ebene

Herausforderung

Lösung

Ergebnis

Implementierung eines Transformationsprogramms für Vertrieb und Marketing bei einem deutschen Premium-OEM

Herausforderung

Lösung

Ergebnis

Entwicklung eines Zielbetriebsmodells für Vertrieb und Marketing

Herausforderung

Lösung

Ergebnis

Marketingplanung und Reverse Funnel Intelligence

Herausforderung

Lösung

Ergebnis

CX-Ausführungsrahmen für den Direktvertrieb

Herausforderung

Lösung

Ergebnis

Zukünftige zielgerichtete Marketingprozesse und -architektur

Herausforderung

Lösung

Ergebnis

Vertriebs- und Marketing-Trichter KPI & BI

Herausforderung

Lösung

Ergebnis

Programm-Management Automobil-E-Commerce

Herausforderung

Lösung

Ergebnis

Kundeninteraktion auf Gemeinschaftsebene

Herausforderung

Lösung

Ergebnis

Go-to-Market-Strategie für BEVs für eine Volumenmarke in Europa

Herausforderung

Lösung

Ergebnis

Regionalisierung der Vertriebs- und Marketingorganisation einer großen Premiummarke

Herausforderung

Lösung

Ergebnis

Globales Marketing-Zielbetriebsmodell für eine große Premium-Automarke

Herausforderung

Lösung

Ergebnis

Portfoliostrategie für OEM-Top-End-Sub-Marken

Herausforderung

Lösung

Ergebnis

Transformation des physischen Einzelhandels für einen Premium-OEM

Herausforderung

Lösung

Ergebnis

05 Finanzdienstleistungen

Wir unterstützen sowohl konzerneigene als auch konzernunabhängige Finanzdienstleister, Flottenbetreiber und Mobilitätsanbieter bei der Entwicklung und Umsetzung von innovativen Finanzierungs- und Versicherungsangeboten sowie Ertrags- und Eigentumsmodellen. Das Ziel: den Ertrag je Fahrzeug über dessen gesamten Lebenszyklus zu maximieren.

DIENSTLEISTUNGEN

CASE STUDIES

Carsharing-Strategie und Umsetzung

Herausforderung

Lösung

Ergebnis

Entwicklung einer Strategie für Finanzdienstleistungen

Herausforderung

Lösung

Ergebnis

VaaS-Strategie

Herausforderung

Lösung

Ergebnis

H2 Carsharing-Konzept und Umsetzung

Herausforderung

Lösung

Ergebnis

Carsharing-Strategie

Herausforderung

Lösung

Ergebnis

Carsharing und Abonnement CDD

Herausforderung

Lösung

Ergebnis

Entwicklung der globalen 2030-Strategie für einen weltweit führenden OEM-Captive

Herausforderung

Lösung

Ergebnis

Produkt- und Dienstleistungsinnovationsstrategie für ein deutsches OEM-Leasingunternehmen (Captive)

Herausforderung

Lösung

Ergebnis

Multi-Cycle-Verkaufsmodell zur Maximierung des Vehicle Lifetime Value (VLV)

Herausforderung

Lösung

Ergebnis

06 Digitale Dienste

Wir helfen Kunden beim Übergang von den Hardware-basierten Lösungen von heute zu den Software-basierten Angeboten von morgen, indem wir digitale Produkte und Erfahrungen skalieren, die lückenlos mit der realen Welt verbunden sind.

DIENSTLEISTUNGEN

Software & architecture, Transformation, Konnektivität, Daten

CASE STUDIES

Strategie für mobile Anwendungen

Herausforderung

Lösung

Ergebnis

Metaverse

Herausforderung

Lösung

Ergebnis

IT-Standortstrategie

Herausforderung

Lösung

Ergebnis

Gezielte Digitalisierung des Kundenerlebnisses einer Luxusautomarke der Oberklasse

Herausforderung

Lösung

Ergebnis

Modellierung der Software-Marktgröße

Herausforderung

Lösung

Ergebnis

Aktualisierung und Umsetzung der Strategie

Herausforderung

Lösung

Ergebnis

Neugestaltung der digitalen Wertschöpfungskette

Herausforderung

Lösung

Ergebnis

SW-Produktstrategie

Herausforderung

Lösung

Ergebnis

Kommerzielle Due-Diligence-Prüfung SW-Testing-Tool-Unternehmen

Herausforderung

Lösung

Ergebnis

07 Mobilitätsnutzung

Neue Anbieter und Start-ups im Mobilitätsbereich unterstützen wir in der Anfangsphase, von der Entwicklung ihres Zielbildes und Betreibermodells über Preisstrategien und die Auswahl der Zulieferer bis hin zu der ersten Produktversion und der Markteinführung.

DIENSTLEISTUNGEN

Portfolio strategy, Software & Architektur, Mobilitätsdienste, Konnektivität

CASE STUDIES

AD-Strategie für die Markteinführung

Herausforderung

Lösung

Ergebnis

Firmengebäude des Pooling-Dienstleisters

Herausforderung

Lösung

Ergebnis

Unterstützung bei Geschäftsaufbau und Skalierung

Herausforderung

Lösung

Ergebnis

Entwicklung einer Mobilitätsstrategie und Ausgliederung der Mobilitätseinheit

Herausforderung

Lösung

Ergebnis

Zielbild Mobilität

Herausforderung

Lösung

Ergebnis

Überprüfung der Mobilitätsstrategie

Herausforderung

Lösung

Ergebnis

Überprüfung des Portfolios der Mobilitätsdienste

Herausforderung

Lösung

Ergebnis

Entwicklung eines Robo-Taxi-Fernverkehrsdienstes

Herausforderung

Lösung

Ergebnis

Strategie und Marktmodell der Mikromobilität

Herausforderung

Lösung

Ergebnis

Ride-hailing CDD

Herausforderung

Lösung

Ergebnis

Unterstützung bei der Markteinführung des autonomen Fahrdienstes

Herausforderung

Lösung

Ergebnis

Modulare Architekturstrategie für einen Anbieter von Mobilitätslösungen

Herausforderung

Lösung

Ergebnis

Identifizierung künftiger Geschäftsmöglichkeiten im Bereich der Mobilität und Entwicklung entsprechender Geschäftsmodelle

Herausforderung

Lösung

Ergebnis

08 Laden & Tanken

Wir helfen Kunden, Strategien, Geschäftsmodelle und Komplettlösungen rund um den Ladevorgang zu entwickeln.

DIENSTLEISTUNGEN

Nachhaltigkeit, Software & Architektur, Mobilitätsdienste, Konnektivität, Daten

CASE STUDIES

Übergang des Geschäftsmodells vom "Tanken" zum "Laden"

Herausforderung

Lösung

Ergebnis

Kundenreise "Laden"

Herausforderung

Lösung

Ergebnis

Ladestrategie 2030

Herausforderung

Lösung

Ergebnis

Ladestrategie 2030

Herausforderung

Lösung

Ergebnis

Identifikation von Wertschöpfungspotenzialen entlang der Wertschöpfungskette von Elektrofahrzeugen

Herausforderung

Lösung

Ergebnis

Untersuchung von Geschäftsmöglichkeiten und potenziellen Geschäftsmodellen im Bereich der Wasserstoffmobilität

Herausforderung

Lösung

Ergebnis

Gestaltung einer kostenpflichtigen Customer Journey durch den gesamten Kundenlebenszyklus

Herausforderung

Lösung

Ergebnis

09 Wartung & Wiederverwendung

Wir unterstützen Klienten im Bereich Service und Kundendienst dabei, Produkte, Betriebsmodelle und Kundenerlebnisse aufzusetzen. Dabei decken wir auch mehrzyklische Vertriebs- und Ertragsvarianten ab und berücksichtigen Governance-Anforderungen, Bewertungskennzahlen sowie Matching- und Verteilungsalgorithmen.

DIENSTLEISTUNGEN

Portfolio Strategie, Future sales

CASE STUDIES

Multi-Cycle-Verkaufsmodell zur Maximierung des Vehicle Lifetime Value (VLV)

Herausforderung

Lösung

Ergebnis

Transformation des physischen Einzelhandels für einen Premium-OEM

Herausforderung

Lösung

Ergebnis

Entwicklung einer Gebrauchtwagenstrategie für einen großen Premium-Autohändler

Herausforderung

Lösung

Ergebnis

Bewertung des Geschäftsmodells eines nachhaltigen Ersatzteilunternehmens

Herausforderung

Lösung

Ergebnis

10 Wiederaufbereitung & Recycling

Wir helfen Kunden, den Ansatz der Kreislaufwirtschaft bereits bei der Produktentwicklung zu berücksichtigen, entwerfen Strategien für Wiederverwendung, Wiederaufbereitung und Recycling und entwickeln Second-Life-Lösungen für den Einsatz ausgedienter Autobatterien.

DIENSTLEISTUNGEN

CASE STUDIES

Bewertung des Geschäftsmodells eines nachhaltigen Ersatzteilunternehmens

Herausforderung

Lösung

Ergebnis

Strategische Optionen und Zielbildentwicklung im Recycling

Herausforderung

Lösung

Ergebnis

Unser Leistungsspektrum

Mit 9 SERVICEGRUPPEN und 5 VERTICALS decken wir sämtliche Facetten in der Wertschöpfungskette der Automobilität ab. Diese Struktur ermöglicht uns, Themen bis zum Ziel zu begleiten und sogar unsere eigenen Produkte zu entwickeln.

Services: Unsere Fähigkeiten reichen von innovativen Ansätzen Nachhaltigkeit ganzheitlich zu denken bis hin zur Umsetzung von Kundenbedürfnissen in konkrete Produkte. Dabei sind wir, dank unserer 9 SERVICEGRUPPEN, in der Lage, Projekte von der Idee bis zur Umsetzung voranzubringen und die gesamte Wertschöpfungskette abzudecken.

Nachhaltigkeit und Elektromobilität sind die Zukunftsthemen der Automobilität. Ein Geschäftsmodell, das unternehmerische Ziele nicht mit Umweltschutz und sozialen Aspekten verbindet, ist heute wirtschaftlich nicht mehr tragfähig. Berylls hat langjährige Erfahrung darin, Nachhaltigkeitskonzepte sowohl für Kunden als auch für eigene unternehmerische Ideen zu entwerfen und erfolgreich umzusetzen. WALL-E als erste Infrastrukturinitiative für Elektromobilität ist dafür nur ein Beispiel.

Um auf die Herausforderungen von Digitalisierung, Konnektivität, Mobilitätsdiensten und Elektromobilität zu reagieren, überarbeiten OEMs, Zulieferer, Start-ups und Dienstleister ihr Produktangebot grundlegend. Nirgendwo sonst wird das so deutlich wie beim Fahrzeug selbst. Berylls hat Automobilunternehmen dabei unterstützt, neue Produkteigenschaften mit Softwaremerkmalen, neuen Eigentumsmodellen und digitalen Angeboten zu kombinieren. Gemeinsam erstellen wir maßgeschneiderte Lösungen, die physische und digitale Produkte zusammenführen.

Um kommerziell ein Erfolg zu werden, muss ein Produktportfolio auf Plattformen, Module, Komponenten, Fertigungstechniken und Dienstleistungsangebote heruntergebrochen werden. Hierbei ist es unerlässlich, dass man mit Hilfe anwendungsspezifischer Software diese einzelnen Portfoliosegmente zusammenhält. Berylls hilft seinen Kunden, Produkte für eine radikal andere Zukunft zu entwerfen und dabei sicherzustellen, dass der Übergang von der Hardware von heute zu den Softwareprodukten von morgen gelingt.

Kein Produkt findet seine Zielgruppe, wenn Zeitpunkt, Qualität und Kosten von Entwicklung und Fertigung nicht stimmen. Berylls hat Kunden erfolgreich dabei unterstützt, neue Produkte, Technologien und Anwendungen auf den Markt zu bringen, die entsprechenden Werke und Fertigungsstraßen aufzubauen sowie Lieferengpässe, Qualitätsmängel und Anlaufverzögerungen mit Hilfe unserer Taskforce-Teams zu lösen. Wir begleiten unsere Kunden von der Idee bis zur Umsetzung und von der Führungsebene bis in die Fertigung.

Bisher drehte sich der Autohandel um den Verkauf, die Finanzierung und den Service von Autos über ein Netz von Händlern. Jetzt verlangen Direktverkauf, neue digitale Angebote und Drittanbieter nach neuen Ansätzen. Heute kann sich kein OEM seines Erfolgs sicher sein, ohne ein schlagkräftiges Online-Angebot vorzuweisen, das nahtlos digitale und physische Produkte integriert. Wer im Luxus-Segment mitspielt, für den gewinnt dagegen das reale Händlernetz weiter an Bedeutung. Wir haben OEMs darin unterstützt, Full-Service-Angebote einschließlich Online- und Offline-Handel aufzubauen und dabei über die gesamte Lebensdauer eines Fahrzeugs Ihren Umsatzanteil zu erhöhen.

Fusionen, Übernahmen und strategische Partnerschaften können wesentliche Voraussetzungen schaffen, um neue Kompetenzfelder, Märkte und Kunden zu erschließen – oder einfach zu wachsen. Sie helfen Unternehmen, wettbewerbsfähig zu bleiben oder ihr Geschäft auf bevorstehende Veränderungen vorzubereiten. Berylls kann hier eine beachtliche Erfolgsbilanz vorweisen – ob es um die Suche nach geeigneten Partnern oder die Umsetzung von Übernahmezielen geht, die Durchführung von Due Diligences oder die Integration nach einer Fusion. Berylls hat viele Kunden dabei unterstützt, mit Hilfe strategischer Partnerschaften oder durch Beteiligungen und Übernahmen ihren Unternehmenswert zu steigern.

Der Aufbau von Software-basierten Kompetenzen und Geschäftsmodellen berührt den Kern dessen, was ein Unternehmen ausmacht. Einen solchen Umbau erfolgreich zu gestalten, in entscheidend für die Zukunft eines jeden Unternehmens. Berylls hat viele Kunden dabei unterstützt, agile, effiziente Strukturen zu schaffen, die zu ihrer Strategie passen: mit der richtigen Mischung aus Kultur und Fähigkeiten, die notwendig sind, um die zunehmende Komplexität der Automobilität beherrschbar zu machen.

Die erheblichen Investitionen, die für neue Produkte und Technologien nötig werden, können nur wenige Autokonzerne aus dem operativen Cashflow stemmen. Zugang zu frischem Kapital ist daher entscheidend. Einige OEMs sind bei der Kapitalbeschaffung eingeschränkt, da sie unterbewertet sind. Andere finden zwar Investoren, tun sich aber schwer damit, deren Erwartungen zu erfüllen. Um diese Herausforderungen anzugehen, ist ein tiefgehendes Verständnis der Kapitalmärkte nötig, das deutlich über die Grundlagen von Ertrag, Profitabilität und Rendite hinausgeht. Bei Berylls haben wir daher unseren eigenen Automobilitätsindex entwickelt. Der Index bietet mehr als Finanzkennzahlen-basierte Analysen: Er umfasst die Bewertung der Strategie, Wertschöpfung und Börsenstimmung. Mit Hilfe des Index unterstützt Berylls seine Kunden dabei, die Erwartungen von Investoren besser zu verstehen und das eigene Unternehmen so darzustellen, dass es für die Kapitalmärkte attraktiv wird.

Mit zunehmender Innovationsgeschwindigkeit entstehen neue Trends in immer kürzeren Abständen. Mit Big Data, Konnektivität und der Blockchain sind einige Entwicklungen der vergangenen Jahre längst im automobilen Alltag angekommen. Chatbots, die mit Hilfe von Künstlicher Intelligenz kommunizieren, oder das Metaverse stehen hingegen noch am Anfang. Egal, ob es um bereits Etabliertes oder noch Entstehendes geht: Berylls zeigt Unternehmen erfolgreich auf, wie man aus Trends neue Produkte lanciert. Wir übersetzen Konzepte in Anforderungen und entwickeln daraus mit unseren Kunden marktfähige Produkte. Wenn nötig, greifen wir auch auf eigene Mittel zurück, um im Zuge von Megatrends Produkte zu entwickeln, zu finanzieren und zu launchen.

Einige Themen sind so entscheidend, dass sie besondere Aufmerksamkeit verdienen. In unseren 5 VERTICALS entwickeln wir Expertise für die drängenden Themen der Automobilität.

Kaum eine Technologie scheint so vorhersehbar und ist durch so viele Unbekannte gekennzeichnet wie die Elektromobilität. Doch auch wenn viele Fragen offen sind: Auf Entwürfe von Gesetzgebern und Regierungen zu warten ist keine Lösung.

Vernetzte Fahrzeuge bieten ein besonderes Kundenerlebnis, schaffen zusätzliche Geschäftschancen und verbessern das Produkt und die damit verbundenen Prozesse. Aber viele Anbieter automobiler Systeme schöpfen bis heute längst nicht alle Möglichkeiten aus, die Konnektivität in puncto Dienstleistungen rund um das Fahrzeug bietet.

Der Bereich des autonomen Fahrens ist gekennzeichnet durch immer neue technologische Fortschritte und neue Geschäftschancen. Doch die Unternehmen stehen hier unter erheblichem Druck, die Technologie zuverlässig und sicher zu gestalten und profitable Geschäftsmodelle zu entwickeln.

Eine regelrechte Berg- und Talfahrt haben Mobilitätsdienste im vergangenen Jahrzehnt durchgemacht. In den kommenden Jahren wird sich zeigen, ob der Umbau zu einem komfortablen und effizienten Transportsystem weiterhin nur schleppend vorangeht oder ob er den dringend nötigen Schwung wieder aufnehmen kann.

Innovative, datengetriebene Geschäftsmodelle ermöglichen ganz neue Einblicke in die Erwartungen der Kunden. Das Potenzial ist riesig, doch viele Autokonzerne tun sich schwer damit, die verfügbaren Informationen in einen Wettbewerbsvorteil zu verwandeln.

Unternehmenseinheiten: Da unterschiedliche Kompetenzen eine gewisse Unabhängigkeit erfordern, um die richtigen Leute anzuziehen, umfasst Berylls by AlixPartners eine UNTERNEHMENSEINHEITEN.

Berylls Strategy Advisors konzentriert sich als Managementberatung ausschließlich auf die Automobilitätsbranche. Wir decken die gesamte Wertschöpfungskette der Automobilindustrie ab – von langfristiger Strategieentwicklung bis zu operativer Ergebnisverbesserung. Unsere Kunden schätzen uns als Vordenker unserer Branche mit Unternehmergeist, die sich nicht mit Standardlösungen zufriedengeben.

Services: Unsere Fähigkeiten reichen von innovativen Ansätzen Nachhaltigkeit ganzheitlich zu denken bis hin zur Umsetzung von Kundenbedürfnissen in konkrete Produkte. Dabei sind wir, dank unserer 9 SERVICEGRUPPEN, in der Lage, Projekte von der Idee bis zur Umsetzung voranzubringen und die gesamte Wertschöpfungskette abzudecken.

Nachhaltigkeit und Elektromobilität sind die Zukunftsthemen der Automobilität. Ein Geschäftsmodell, das unternehmerische Ziele nicht mit Umweltschutz und sozialen Aspekten verbindet, ist heute wirtschaftlich nicht mehr tragfähig. Berylls hat langjährige Erfahrung darin, Nachhaltigkeitskonzepte sowohl für Kunden als auch für eigene unternehmerische Ideen zu entwerfen und erfolgreich umzusetzen. WALL-E als erste Infrastrukturinitiative für Elektromobilität ist dafür nur ein Beispiel.

Um auf die Herausforderungen von Digitalisierung, Konnektivität, Mobilitätsdiensten und Elektromobilität zu reagieren, überarbeiten OEMs, Zulieferer, Start-ups und Dienstleister ihr Produktangebot grundlegend. Nirgendwo sonst wird das so deutlich wie beim Fahrzeug selbst. Berylls hat Automobilunternehmen dabei unterstützt, neue Produkteigenschaften mit Softwaremerkmalen, neuen Eigentumsmodellen und digitalen Angeboten zu kombinieren. Gemeinsam erstellen wir maßgeschneiderte Lösungen, die physische und digitale Produkte zusammenführen.

Um kommerziell ein Erfolg zu werden, muss ein Produktportfolio auf Plattformen, Module, Komponenten, Fertigungstechniken und Dienstleistungsangebote heruntergebrochen werden. Hierbei ist es unerlässlich, dass man mit Hilfe anwendungsspezifischer Software diese einzelnen Portfoliosegmente zusammenhält. Berylls hilft seinen Kunden, Produkte für eine radikal andere Zukunft zu entwerfen und dabei sicherzustellen, dass der Übergang von der Hardware von heute zu den Softwareprodukten von morgen gelingt.

Kein Produkt findet seine Zielgruppe, wenn Zeitpunkt, Qualität und Kosten von Entwicklung und Fertigung nicht stimmen. Berylls hat Kunden erfolgreich dabei unterstützt, neue Produkte, Technologien und Anwendungen auf den Markt zu bringen, die entsprechenden Werke und Fertigungsstraßen aufzubauen sowie Lieferengpässe, Qualitätsmängel und Anlaufverzögerungen mit Hilfe unserer Taskforce-Teams zu lösen. Wir begleiten unsere Kunden von der Idee bis zur Umsetzung und von der Führungsebene bis in die Fertigung.

Bisher drehte sich der Autohandel um den Verkauf, die Finanzierung und den Service von Autos über ein Netz von Händlern. Jetzt verlangen Direktverkauf, neue digitale Angebote und Drittanbieter nach neuen Ansätzen. Heute kann sich kein OEM seines Erfolgs sicher sein, ohne ein schlagkräftiges Online-Angebot vorzuweisen, das nahtlos digitale und physische Produkte integriert. Wer im Luxus-Segment mitspielt, für den gewinnt dagegen das reale Händlernetz weiter an Bedeutung. Wir haben OEMs darin unterstützt, Full-Service-Angebote einschließlich Online- und Offline-Handel aufzubauen und dabei über die gesamte Lebensdauer eines Fahrzeugs Ihren Umsatzanteil zu erhöhen.

Fusionen, Übernahmen und strategische Partnerschaften können wesentliche Voraussetzungen schaffen, um neue Kompetenzfelder, Märkte und Kunden zu erschließen – oder einfach zu wachsen. Sie helfen Unternehmen, wettbewerbsfähig zu bleiben oder ihr Geschäft auf bevorstehende Veränderungen vorzubereiten. Berylls kann hier eine beachtliche Erfolgsbilanz vorweisen – ob es um die Suche nach geeigneten Partnern oder die Umsetzung von Übernahmezielen geht, die Durchführung von Due Diligences oder die Integration nach einer Fusion. Berylls hat viele Kunden dabei unterstützt, mit Hilfe strategischer Partnerschaften oder durch Beteiligungen und Übernahmen ihren Unternehmenswert zu steigern.

Der Aufbau von Software-basierten Kompetenzen und Geschäftsmodellen berührt den Kern dessen, was ein Unternehmen ausmacht. Einen solchen Umbau erfolgreich zu gestalten, in entscheidend für die Zukunft eines jeden Unternehmens. Berylls hat viele Kunden dabei unterstützt, agile, effiziente Strukturen zu schaffen, die zu ihrer Strategie passen: mit der richtigen Mischung aus Kultur und Fähigkeiten, die notwendig sind, um die zunehmende Komplexität der Automobilität beherrschbar zu machen.

Die erheblichen Investitionen, die für neue Produkte und Technologien nötig werden, können nur wenige Autokonzerne aus dem operativen Cashflow stemmen. Zugang zu frischem Kapital ist daher entscheidend. Einige OEMs sind bei der Kapitalbeschaffung eingeschränkt, da sie unterbewertet sind. Andere finden zwar Investoren, tun sich aber schwer damit, deren Erwartungen zu erfüllen. Um diese Herausforderungen anzugehen, ist ein tiefgehendes Verständnis der Kapitalmärkte nötig, das deutlich über die Grundlagen von Ertrag, Profitabilität und Rendite hinausgeht. Bei Berylls haben wir daher unseren eigenen Automobilitätsindex entwickelt. Der Index bietet mehr als Finanzkennzahlen-basierte Analysen: Er umfasst die Bewertung der Strategie, Wertschöpfung und Börsenstimmung. Mit Hilfe des Index unterstützt Berylls seine Kunden dabei, die Erwartungen von Investoren besser zu verstehen und das eigene Unternehmen so darzustellen, dass es für die Kapitalmärkte attraktiv wird.

Mit zunehmender Innovationsgeschwindigkeit entstehen neue Trends in immer kürzeren Abständen. Mit Big Data, Konnektivität und der Blockchain sind einige Entwicklungen der vergangenen Jahre längst im automobilen Alltag angekommen. Chatbots, die mit Hilfe von Künstlicher Intelligenz kommunizieren, oder das Metaverse stehen hingegen noch am Anfang. Egal, ob es um bereits Etabliertes oder noch Entstehendes geht: Berylls zeigt Unternehmen erfolgreich auf, wie man aus Trends neue Produkte lanciert. Wir übersetzen Konzepte in Anforderungen und entwickeln daraus mit unseren Kunden marktfähige Produkte. Wenn nötig, greifen wir auch auf eigene Mittel zurück, um im Zuge von Megatrends Produkte zu entwickeln, zu finanzieren und zu launchen.

Einige Themen sind so entscheidend, dass sie besondere Aufmerksamkeit verdienen. In unseren 5 VERTICALS entwickeln wir Expertise für die drängenden Themen der Automobilität.

Kaum eine Technologie scheint so vorhersehbar und ist durch so viele Unbekannte gekennzeichnet wie die Elektromobilität. Doch auch wenn viele Fragen offen sind: Auf Entwürfe von Gesetzgebern und Regierungen zu warten ist keine Lösung.

Vernetzte Fahrzeuge bieten ein besonderes Kundenerlebnis, schaffen zusätzliche Geschäftschancen und verbessern das Produkt und die damit verbundenen Prozesse. Aber viele Anbieter automobiler Systeme schöpfen bis heute längst nicht alle Möglichkeiten aus, die Konnektivität in puncto Dienstleistungen rund um das Fahrzeug bietet.

Der Bereich des autonomen Fahrens ist gekennzeichnet durch immer neue technologische Fortschritte und neue Geschäftschancen. Doch die Unternehmen stehen hier unter erheblichem Druck, die Technologie zuverlässig und sicher zu gestalten und profitable Geschäftsmodelle zu entwickeln.

Eine regelrechte Berg- und Talfahrt haben Mobilitätsdienste im vergangenen Jahrzehnt durchgemacht. In den kommenden Jahren wird sich zeigen, ob der Umbau zu einem komfortablen und effizienten Transportsystem weiterhin nur schleppend vorangeht oder ob er den dringend nötigen Schwung wieder aufnehmen kann.

Innovative, datengetriebene Geschäftsmodelle ermöglichen ganz neue Einblicke in die Erwartungen der Kunden. Das Potenzial ist riesig, doch viele Autokonzerne tun sich schwer damit, die verfügbaren Informationen in einen Wettbewerbsvorteil zu verwandeln.

Unternehmenseinheiten: Da unterschiedliche Kompetenzen eine gewisse Unabhängigkeit erfordern, um die richtigen Leute anzuziehen, umfasst Berylls by AlixPartners eine UNTERNEHMENSEINHEITEN.

Berylls Strategy Advisors konzentriert sich als Managementberatung ausschließlich auf die Automobilitätsbranche. Wir decken die gesamte Wertschöpfungskette der Automobilindustrie ab – von langfristiger Strategieentwicklung bis zu operativer Ergebnisverbesserung. Unsere Kunden schätzen uns als Vordenker unserer Branche mit Unternehmergeist, die sich nicht mit Standardlösungen zufriedengeben.

Services: Unsere Fähigkeiten reichen von innovativen Ansätzen Nachhaltigkeit ganzheitlich zu denken bis hin zur Umsetzung von Kundenbedürfnissen in konkrete Produkte. Dabei sind wir, dank unserer 9 SERVICEGRUPPEN, in der Lage, Projekte von der Idee bis zur Umsetzung voranzubringen und die gesamte Wertschöpfungskette abzudecken.

Nachhaltigkeit und Elektromobilität sind die Zukunftsthemen der Automobilität. Ein Geschäftsmodell, das unternehmerische Ziele nicht mit Umweltschutz und sozialen Aspekten verbindet, ist heute wirtschaftlich nicht mehr tragfähig. Berylls hat langjährige Erfahrung darin, Nachhaltigkeitskonzepte sowohl für Kunden als auch für eigene unternehmerische Ideen zu entwerfen und erfolgreich umzusetzen. WALL-E als erste Infrastrukturinitiative für Elektromobilität ist dafür nur ein Beispiel.

Um auf die Herausforderungen von Digitalisierung, Konnektivität, Mobilitätsdiensten und Elektromobilität zu reagieren, überarbeiten OEMs, Zulieferer, Start-ups und Dienstleister ihr Produktangebot grundlegend. Nirgendwo sonst wird das so deutlich wie beim Fahrzeug selbst. Berylls hat Automobilunternehmen dabei unterstützt, neue Produkteigenschaften mit Softwaremerkmalen, neuen Eigentumsmodellen und digitalen Angeboten zu kombinieren. Gemeinsam erstellen wir maßgeschneiderte Lösungen, die physische und digitale Produkte zusammenführen.

Um kommerziell ein Erfolg zu werden, muss ein Produktportfolio auf Plattformen, Module, Komponenten, Fertigungstechniken und Dienstleistungsangebote heruntergebrochen werden. Hierbei ist es unerlässlich, dass man mit Hilfe anwendungsspezifischer Software diese einzelnen Portfoliosegmente zusammenhält. Berylls hilft seinen Kunden, Produkte für eine radikal andere Zukunft zu entwerfen und dabei sicherzustellen, dass der Übergang von der Hardware von heute zu den Softwareprodukten von morgen gelingt.

Kein Produkt findet seine Zielgruppe, wenn Zeitpunkt, Qualität und Kosten von Entwicklung und Fertigung nicht stimmen. Berylls hat Kunden erfolgreich dabei unterstützt, neue Produkte, Technologien und Anwendungen auf den Markt zu bringen, die entsprechenden Werke und Fertigungsstraßen aufzubauen sowie Lieferengpässe, Qualitätsmängel und Anlaufverzögerungen mit Hilfe unserer Taskforce-Teams zu lösen. Wir begleiten unsere Kunden von der Idee bis zur Umsetzung und von der Führungsebene bis in die Fertigung.

Bisher drehte sich der Autohandel um den Verkauf, die Finanzierung und den Service von Autos über ein Netz von Händlern. Jetzt verlangen Direktverkauf, neue digitale Angebote und Drittanbieter nach neuen Ansätzen. Heute kann sich kein OEM seines Erfolgs sicher sein, ohne ein schlagkräftiges Online-Angebot vorzuweisen, das nahtlos digitale und physische Produkte integriert. Wer im Luxus-Segment mitspielt, für den gewinnt dagegen das reale Händlernetz weiter an Bedeutung. Wir haben OEMs darin unterstützt, Full-Service-Angebote einschließlich Online- und Offline-Handel aufzubauen und dabei über die gesamte Lebensdauer eines Fahrzeugs Ihren Umsatzanteil zu erhöhen.

Fusionen, Übernahmen und strategische Partnerschaften können wesentliche Voraussetzungen schaffen, um neue Kompetenzfelder, Märkte und Kunden zu erschließen – oder einfach zu wachsen. Sie helfen Unternehmen, wettbewerbsfähig zu bleiben oder ihr Geschäft auf bevorstehende Veränderungen vorzubereiten. Berylls kann hier eine beachtliche Erfolgsbilanz vorweisen – ob es um die Suche nach geeigneten Partnern oder die Umsetzung von Übernahmezielen geht, die Durchführung von Due Diligences oder die Integration nach einer Fusion. Berylls hat viele Kunden dabei unterstützt, mit Hilfe strategischer Partnerschaften oder durch Beteiligungen und Übernahmen ihren Unternehmenswert zu steigern.

Der Aufbau von Software-basierten Kompetenzen und Geschäftsmodellen berührt den Kern dessen, was ein Unternehmen ausmacht. Einen solchen Umbau erfolgreich zu gestalten, in entscheidend für die Zukunft eines jeden Unternehmens. Berylls hat viele Kunden dabei unterstützt, agile, effiziente Strukturen zu schaffen, die zu ihrer Strategie passen: mit der richtigen Mischung aus Kultur und Fähigkeiten, die notwendig sind, um die zunehmende Komplexität der Automobilität beherrschbar zu machen.

Die erheblichen Investitionen, die für neue Produkte und Technologien nötig werden, können nur wenige Autokonzerne aus dem operativen Cashflow stemmen. Zugang zu frischem Kapital ist daher entscheidend. Einige OEMs sind bei der Kapitalbeschaffung eingeschränkt, da sie unterbewertet sind. Andere finden zwar Investoren, tun sich aber schwer damit, deren Erwartungen zu erfüllen. Um diese Herausforderungen anzugehen, ist ein tiefgehendes Verständnis der Kapitalmärkte nötig, das deutlich über die Grundlagen von Ertrag, Profitabilität und Rendite hinausgeht. Bei Berylls haben wir daher unseren eigenen Automobilitätsindex entwickelt. Der Index bietet mehr als Finanzkennzahlen-basierte Analysen: Er umfasst die Bewertung der Strategie, Wertschöpfung und Börsenstimmung. Mit Hilfe des Index unterstützt Berylls seine Kunden dabei, die Erwartungen von Investoren besser zu verstehen und das eigene Unternehmen so darzustellen, dass es für die Kapitalmärkte attraktiv wird.

Mit zunehmender Innovationsgeschwindigkeit entstehen neue Trends in immer kürzeren Abständen. Mit Big Data, Konnektivität und der Blockchain sind einige Entwicklungen der vergangenen Jahre längst im automobilen Alltag angekommen. Chatbots, die mit Hilfe von Künstlicher Intelligenz kommunizieren, oder das Metaverse stehen hingegen noch am Anfang. Egal, ob es um bereits Etabliertes oder noch Entstehendes geht: Berylls zeigt Unternehmen erfolgreich auf, wie man aus Trends neue Produkte lanciert. Wir übersetzen Konzepte in Anforderungen und entwickeln daraus mit unseren Kunden marktfähige Produkte. Wenn nötig, greifen wir auch auf eigene Mittel zurück, um im Zuge von Megatrends Produkte zu entwickeln, zu finanzieren und zu launchen.

Einige Themen sind so entscheidend, dass sie besondere Aufmerksamkeit verdienen. In unseren 5 VERTICALS entwickeln wir Expertise für die drängenden Themen der Automobilität.

Kaum eine Technologie scheint so vorhersehbar und ist durch so viele Unbekannte gekennzeichnet wie die Elektromobilität. Doch auch wenn viele Fragen offen sind: Auf Entwürfe von Gesetzgebern und Regierungen zu warten ist keine Lösung.

Vernetzte Fahrzeuge bieten ein besonderes Kundenerlebnis, schaffen zusätzliche Geschäftschancen und verbessern das Produkt und die damit verbundenen Prozesse. Aber viele Anbieter automobiler Systeme schöpfen bis heute längst nicht alle Möglichkeiten aus, die Konnektivität in puncto Dienstleistungen rund um das Fahrzeug bietet.

Der Bereich des autonomen Fahrens ist gekennzeichnet durch immer neue technologische Fortschritte und neue Geschäftschancen. Doch die Unternehmen stehen hier unter erheblichem Druck, die Technologie zuverlässig und sicher zu gestalten und profitable Geschäftsmodelle zu entwickeln.

Eine regelrechte Berg- und Talfahrt haben Mobilitätsdienste im vergangenen Jahrzehnt durchgemacht. In den kommenden Jahren wird sich zeigen, ob der Umbau zu einem komfortablen und effizienten Transportsystem weiterhin nur schleppend vorangeht oder ob er den dringend nötigen Schwung wieder aufnehmen kann.

Innovative, datengetriebene Geschäftsmodelle ermöglichen ganz neue Einblicke in die Erwartungen der Kunden. Das Potenzial ist riesig, doch viele Autokonzerne tun sich schwer damit, die verfügbaren Informationen in einen Wettbewerbsvorteil zu verwandeln.

Unternehmenseinheiten: Da unterschiedliche Kompetenzen eine gewisse Unabhängigkeit erfordern, um die richtigen Leute anzuziehen, umfasst Berylls by AlixPartners eine UNTERNEHMENSEINHEITEN.

Berylls Strategy Advisors konzentriert sich als Managementberatung ausschließlich auf die Automobilitätsbranche. Wir decken die gesamte Wertschöpfungskette der Automobilindustrie ab – von langfristiger Strategieentwicklung bis zu operativer Ergebnisverbesserung. Unsere Kunden schätzen uns als Vordenker unserer Branche mit Unternehmergeist, die sich nicht mit Standardlösungen zufriedengeben.

Services: Unsere Fähigkeiten reichen von innovativen Ansätzen Nachhaltigkeit ganzheitlich zu denken bis hin zur Umsetzung von Kundenbedürfnissen in konkrete Produkte. Dabei sind wir, dank unserer 9 SERVICEGRUPPEN, in der Lage, Projekte von der Idee bis zur Umsetzung voranzubringen und die gesamte Wertschöpfungskette abzudecken.

Nachhaltigkeit und Elektromobilität sind die Zukunftsthemen der Automobilität. Ein Geschäftsmodell, das unternehmerische Ziele nicht mit Umweltschutz und sozialen Aspekten verbindet, ist heute wirtschaftlich nicht mehr tragfähig. Berylls hat langjährige Erfahrung darin, Nachhaltigkeitskonzepte sowohl für Kunden als auch für eigene unternehmerische Ideen zu entwerfen und erfolgreich umzusetzen. WALL-E als erste Infrastrukturinitiative für Elektromobilität ist dafür nur ein Beispiel.

Um auf die Herausforderungen von Digitalisierung, Konnektivität, Mobilitätsdiensten und Elektromobilität zu reagieren, überarbeiten OEMs, Zulieferer, Start-ups und Dienstleister ihr Produktangebot grundlegend. Nirgendwo sonst wird das so deutlich wie beim Fahrzeug selbst. Berylls hat Automobilunternehmen dabei unterstützt, neue Produkteigenschaften mit Softwaremerkmalen, neuen Eigentumsmodellen und digitalen Angeboten zu kombinieren. Gemeinsam erstellen wir maßgeschneiderte Lösungen, die physische und digitale Produkte zusammenführen.

Um kommerziell ein Erfolg zu werden, muss ein Produktportfolio auf Plattformen, Module, Komponenten, Fertigungstechniken und Dienstleistungsangebote heruntergebrochen werden. Hierbei ist es unerlässlich, dass man mit Hilfe anwendungsspezifischer Software diese einzelnen Portfoliosegmente zusammenhält. Berylls hilft seinen Kunden, Produkte für eine radikal andere Zukunft zu entwerfen und dabei sicherzustellen, dass der Übergang von der Hardware von heute zu den Softwareprodukten von morgen gelingt.

Kein Produkt findet seine Zielgruppe, wenn Zeitpunkt, Qualität und Kosten von Entwicklung und Fertigung nicht stimmen. Berylls hat Kunden erfolgreich dabei unterstützt, neue Produkte, Technologien und Anwendungen auf den Markt zu bringen, die entsprechenden Werke und Fertigungsstraßen aufzubauen sowie Lieferengpässe, Qualitätsmängel und Anlaufverzögerungen mit Hilfe unserer Taskforce-Teams zu lösen. Wir begleiten unsere Kunden von der Idee bis zur Umsetzung und von der Führungsebene bis in die Fertigung.

Bisher drehte sich der Autohandel um den Verkauf, die Finanzierung und den Service von Autos über ein Netz von Händlern. Jetzt verlangen Direktverkauf, neue digitale Angebote und Drittanbieter nach neuen Ansätzen. Heute kann sich kein OEM seines Erfolgs sicher sein, ohne ein schlagkräftiges Online-Angebot vorzuweisen, das nahtlos digitale und physische Produkte integriert. Wer im Luxus-Segment mitspielt, für den gewinnt dagegen das reale Händlernetz weiter an Bedeutung. Wir haben OEMs darin unterstützt, Full-Service-Angebote einschließlich Online- und Offline-Handel aufzubauen und dabei über die gesamte Lebensdauer eines Fahrzeugs Ihren Umsatzanteil zu erhöhen.

Fusionen, Übernahmen und strategische Partnerschaften können wesentliche Voraussetzungen schaffen, um neue Kompetenzfelder, Märkte und Kunden zu erschließen – oder einfach zu wachsen. Sie helfen Unternehmen, wettbewerbsfähig zu bleiben oder ihr Geschäft auf bevorstehende Veränderungen vorzubereiten. Berylls kann hier eine beachtliche Erfolgsbilanz vorweisen – ob es um die Suche nach geeigneten Partnern oder die Umsetzung von Übernahmezielen geht, die Durchführung von Due Diligences oder die Integration nach einer Fusion. Berylls hat viele Kunden dabei unterstützt, mit Hilfe strategischer Partnerschaften oder durch Beteiligungen und Übernahmen ihren Unternehmenswert zu steigern.

Der Aufbau von Software-basierten Kompetenzen und Geschäftsmodellen berührt den Kern dessen, was ein Unternehmen ausmacht. Einen solchen Umbau erfolgreich zu gestalten, in entscheidend für die Zukunft eines jeden Unternehmens. Berylls hat viele Kunden dabei unterstützt, agile, effiziente Strukturen zu schaffen, die zu ihrer Strategie passen: mit der richtigen Mischung aus Kultur und Fähigkeiten, die notwendig sind, um die zunehmende Komplexität der Automobilität beherrschbar zu machen.

Die erheblichen Investitionen, die für neue Produkte und Technologien nötig werden, können nur wenige Autokonzerne aus dem operativen Cashflow stemmen. Zugang zu frischem Kapital ist daher entscheidend. Einige OEMs sind bei der Kapitalbeschaffung eingeschränkt, da sie unterbewertet sind. Andere finden zwar Investoren, tun sich aber schwer damit, deren Erwartungen zu erfüllen. Um diese Herausforderungen anzugehen, ist ein tiefgehendes Verständnis der Kapitalmärkte nötig, das deutlich über die Grundlagen von Ertrag, Profitabilität und Rendite hinausgeht. Bei Berylls haben wir daher unseren eigenen Automobilitätsindex entwickelt. Der Index bietet mehr als Finanzkennzahlen-basierte Analysen: Er umfasst die Bewertung der Strategie, Wertschöpfung und Börsenstimmung. Mit Hilfe des Index unterstützt Berylls seine Kunden dabei, die Erwartungen von Investoren besser zu verstehen und das eigene Unternehmen so darzustellen, dass es für die Kapitalmärkte attraktiv wird.

Mit zunehmender Innovationsgeschwindigkeit entstehen neue Trends in immer kürzeren Abständen. Mit Big Data, Konnektivität und der Blockchain sind einige Entwicklungen der vergangenen Jahre längst im automobilen Alltag angekommen. Chatbots, die mit Hilfe von Künstlicher Intelligenz kommunizieren, oder das Metaverse stehen hingegen noch am Anfang. Egal, ob es um bereits Etabliertes oder noch Entstehendes geht: Berylls zeigt Unternehmen erfolgreich auf, wie man aus Trends neue Produkte lanciert. Wir übersetzen Konzepte in Anforderungen und entwickeln daraus mit unseren Kunden marktfähige Produkte. Wenn nötig, greifen wir auch auf eigene Mittel zurück, um im Zuge von Megatrends Produkte zu entwickeln, zu finanzieren und zu launchen.

Einige Themen sind so entscheidend, dass sie besondere Aufmerksamkeit verdienen. In unseren 5 VERTICALS entwickeln wir Expertise für die drängenden Themen der Automobilität.

Kaum eine Technologie scheint so vorhersehbar und ist durch so viele Unbekannte gekennzeichnet wie die Elektromobilität. Doch auch wenn viele Fragen offen sind: Auf Entwürfe von Gesetzgebern und Regierungen zu warten ist keine Lösung.

Vernetzte Fahrzeuge bieten ein besonderes Kundenerlebnis, schaffen zusätzliche Geschäftschancen und verbessern das Produkt und die damit verbundenen Prozesse. Aber viele Anbieter automobiler Systeme schöpfen bis heute längst nicht alle Möglichkeiten aus, die Konnektivität in puncto Dienstleistungen rund um das Fahrzeug bietet.

Der Bereich des autonomen Fahrens ist gekennzeichnet durch immer neue technologische Fortschritte und neue Geschäftschancen. Doch die Unternehmen stehen hier unter erheblichem Druck, die Technologie zuverlässig und sicher zu gestalten und profitable Geschäftsmodelle zu entwickeln.

Eine regelrechte Berg- und Talfahrt haben Mobilitätsdienste im vergangenen Jahrzehnt durchgemacht. In den kommenden Jahren wird sich zeigen, ob der Umbau zu einem komfortablen und effizienten Transportsystem weiterhin nur schleppend vorangeht oder ob er den dringend nötigen Schwung wieder aufnehmen kann.

Innovative, datengetriebene Geschäftsmodelle ermöglichen ganz neue Einblicke in die Erwartungen der Kunden. Das Potenzial ist riesig, doch viele Autokonzerne tun sich schwer damit, die verfügbaren Informationen in einen Wettbewerbsvorteil zu verwandeln.

Unternehmenseinheiten: Da unterschiedliche Kompetenzen eine gewisse Unabhängigkeit erfordern, um die richtigen Leute anzuziehen, umfasst Berylls by AlixPartners eine UNTERNEHMENSEINHEITEN.

Berylls Strategy Advisors konzentriert sich als Managementberatung ausschließlich auf die Automobilitätsbranche. Wir decken die gesamte Wertschöpfungskette der Automobilindustrie ab – von langfristiger Strategieentwicklung bis zu operativer Ergebnisverbesserung. Unsere Kunden schätzen uns als Vordenker unserer Branche mit Unternehmergeist, die sich nicht mit Standardlösungen zufriedengeben.

Services: Unsere Fähigkeiten reichen von innovativen Ansätzen Nachhaltigkeit ganzheitlich zu denken bis hin zur Umsetzung von Kundenbedürfnissen in konkrete Produkte. Dabei sind wir, dank unserer 9 SERVICEGRUPPEN, in der Lage, Projekte von der Idee bis zur Umsetzung voranzubringen und die gesamte Wertschöpfungskette abzudecken.

Nachhaltigkeit und Elektromobilität sind die Zukunftsthemen der Automobilität. Ein Geschäftsmodell, das unternehmerische Ziele nicht mit Umweltschutz und sozialen Aspekten verbindet, ist heute wirtschaftlich nicht mehr tragfähig. Berylls hat langjährige Erfahrung darin, Nachhaltigkeitskonzepte sowohl für Kunden als auch für eigene unternehmerische Ideen zu entwerfen und erfolgreich umzusetzen. WALL-E als erste Infrastrukturinitiative für Elektromobilität ist dafür nur ein Beispiel.

Um auf die Herausforderungen von Digitalisierung, Konnektivität, Mobilitätsdiensten und Elektromobilität zu reagieren, überarbeiten OEMs, Zulieferer, Start-ups und Dienstleister ihr Produktangebot grundlegend. Nirgendwo sonst wird das so deutlich wie beim Fahrzeug selbst. Berylls hat Automobilunternehmen dabei unterstützt, neue Produkteigenschaften mit Softwaremerkmalen, neuen Eigentumsmodellen und digitalen Angeboten zu kombinieren. Gemeinsam erstellen wir maßgeschneiderte Lösungen, die physische und digitale Produkte zusammenführen.

Um kommerziell ein Erfolg zu werden, muss ein Produktportfolio auf Plattformen, Module, Komponenten, Fertigungstechniken und Dienstleistungsangebote heruntergebrochen werden. Hierbei ist es unerlässlich, dass man mit Hilfe anwendungsspezifischer Software diese einzelnen Portfoliosegmente zusammenhält. Berylls hilft seinen Kunden, Produkte für eine radikal andere Zukunft zu entwerfen und dabei sicherzustellen, dass der Übergang von der Hardware von heute zu den Softwareprodukten von morgen gelingt.

Kein Produkt findet seine Zielgruppe, wenn Zeitpunkt, Qualität und Kosten von Entwicklung und Fertigung nicht stimmen. Berylls hat Kunden erfolgreich dabei unterstützt, neue Produkte, Technologien und Anwendungen auf den Markt zu bringen, die entsprechenden Werke und Fertigungsstraßen aufzubauen sowie Lieferengpässe, Qualitätsmängel und Anlaufverzögerungen mit Hilfe unserer Taskforce-Teams zu lösen. Wir begleiten unsere Kunden von der Idee bis zur Umsetzung und von der Führungsebene bis in die Fertigung.

Bisher drehte sich der Autohandel um den Verkauf, die Finanzierung und den Service von Autos über ein Netz von Händlern. Jetzt verlangen Direktverkauf, neue digitale Angebote und Drittanbieter nach neuen Ansätzen. Heute kann sich kein OEM seines Erfolgs sicher sein, ohne ein schlagkräftiges Online-Angebot vorzuweisen, das nahtlos digitale und physische Produkte integriert. Wer im Luxus-Segment mitspielt, für den gewinnt dagegen das reale Händlernetz weiter an Bedeutung. Wir haben OEMs darin unterstützt, Full-Service-Angebote einschließlich Online- und Offline-Handel aufzubauen und dabei über die gesamte Lebensdauer eines Fahrzeugs Ihren Umsatzanteil zu erhöhen.

Fusionen, Übernahmen und strategische Partnerschaften können wesentliche Voraussetzungen schaffen, um neue Kompetenzfelder, Märkte und Kunden zu erschließen – oder einfach zu wachsen. Sie helfen Unternehmen, wettbewerbsfähig zu bleiben oder ihr Geschäft auf bevorstehende Veränderungen vorzubereiten. Berylls kann hier eine beachtliche Erfolgsbilanz vorweisen – ob es um die Suche nach geeigneten Partnern oder die Umsetzung von Übernahmezielen geht, die Durchführung von Due Diligences oder die Integration nach einer Fusion. Berylls hat viele Kunden dabei unterstützt, mit Hilfe strategischer Partnerschaften oder durch Beteiligungen und Übernahmen ihren Unternehmenswert zu steigern.

Der Aufbau von Software-basierten Kompetenzen und Geschäftsmodellen berührt den Kern dessen, was ein Unternehmen ausmacht. Einen solchen Umbau erfolgreich zu gestalten, in entscheidend für die Zukunft eines jeden Unternehmens. Berylls hat viele Kunden dabei unterstützt, agile, effiziente Strukturen zu schaffen, die zu ihrer Strategie passen: mit der richtigen Mischung aus Kultur und Fähigkeiten, die notwendig sind, um die zunehmende Komplexität der Automobilität beherrschbar zu machen.

Die erheblichen Investitionen, die für neue Produkte und Technologien nötig werden, können nur wenige Autokonzerne aus dem operativen Cashflow stemmen. Zugang zu frischem Kapital ist daher entscheidend. Einige OEMs sind bei der Kapitalbeschaffung eingeschränkt, da sie unterbewertet sind. Andere finden zwar Investoren, tun sich aber schwer damit, deren Erwartungen zu erfüllen. Um diese Herausforderungen anzugehen, ist ein tiefgehendes Verständnis der Kapitalmärkte nötig, das deutlich über die Grundlagen von Ertrag, Profitabilität und Rendite hinausgeht. Bei Berylls haben wir daher unseren eigenen Automobilitätsindex entwickelt. Der Index bietet mehr als Finanzkennzahlen-basierte Analysen: Er umfasst die Bewertung der Strategie, Wertschöpfung und Börsenstimmung. Mit Hilfe des Index unterstützt Berylls seine Kunden dabei, die Erwartungen von Investoren besser zu verstehen und das eigene Unternehmen so darzustellen, dass es für die Kapitalmärkte attraktiv wird.

Mit zunehmender Innovationsgeschwindigkeit entstehen neue Trends in immer kürzeren Abständen. Mit Big Data, Konnektivität und der Blockchain sind einige Entwicklungen der vergangenen Jahre längst im automobilen Alltag angekommen. Chatbots, die mit Hilfe von Künstlicher Intelligenz kommunizieren, oder das Metaverse stehen hingegen noch am Anfang. Egal, ob es um bereits Etabliertes oder noch Entstehendes geht: Berylls zeigt Unternehmen erfolgreich auf, wie man aus Trends neue Produkte lanciert. Wir übersetzen Konzepte in Anforderungen und entwickeln daraus mit unseren Kunden marktfähige Produkte. Wenn nötig, greifen wir auch auf eigene Mittel zurück, um im Zuge von Megatrends Produkte zu entwickeln, zu finanzieren und zu launchen.

Einige Themen sind so entscheidend, dass sie besondere Aufmerksamkeit verdienen. In unseren 5 VERTICALS entwickeln wir Expertise für die drängenden Themen der Automobilität.

Kaum eine Technologie scheint so vorhersehbar und ist durch so viele Unbekannte gekennzeichnet wie die Elektromobilität. Doch auch wenn viele Fragen offen sind: Auf Entwürfe von Gesetzgebern und Regierungen zu warten ist keine Lösung.

Vernetzte Fahrzeuge bieten ein besonderes Kundenerlebnis, schaffen zusätzliche Geschäftschancen und verbessern das Produkt und die damit verbundenen Prozesse. Aber viele Anbieter automobiler Systeme schöpfen bis heute längst nicht alle Möglichkeiten aus, die Konnektivität in puncto Dienstleistungen rund um das Fahrzeug bietet.

Der Bereich des autonomen Fahrens ist gekennzeichnet durch immer neue technologische Fortschritte und neue Geschäftschancen. Doch die Unternehmen stehen hier unter erheblichem Druck, die Technologie zuverlässig und sicher zu gestalten und profitable Geschäftsmodelle zu entwickeln.

Eine regelrechte Berg- und Talfahrt haben Mobilitätsdienste im vergangenen Jahrzehnt durchgemacht. In den kommenden Jahren wird sich zeigen, ob der Umbau zu einem komfortablen und effizienten Transportsystem weiterhin nur schleppend vorangeht oder ob er den dringend nötigen Schwung wieder aufnehmen kann.

Innovative, datengetriebene Geschäftsmodelle ermöglichen ganz neue Einblicke in die Erwartungen der Kunden. Das Potenzial ist riesig, doch viele Autokonzerne tun sich schwer damit, die verfügbaren Informationen in einen Wettbewerbsvorteil zu verwandeln.

Unternehmenseinheiten: Da unterschiedliche Kompetenzen eine gewisse Unabhängigkeit erfordern, um die richtigen Leute anzuziehen, umfasst Berylls by AlixPartners eine UNTERNEHMENSEINHEITEN.

Berylls Strategy Advisors konzentriert sich als Managementberatung ausschließlich auf die Automobilitätsbranche. Wir decken die gesamte Wertschöpfungskette der Automobilindustrie ab – von langfristiger Strategieentwicklung bis zu operativer Ergebnisverbesserung. Unsere Kunden schätzen uns als Vordenker unserer Branche mit Unternehmergeist, die sich nicht mit Standardlösungen zufriedengeben.

Services: Unsere Fähigkeiten reichen von innovativen Ansätzen Nachhaltigkeit ganzheitlich zu denken bis hin zur Umsetzung von Kundenbedürfnissen in konkrete Produkte. Dabei sind wir, dank unserer 9 SERVICEGRUPPEN, in der Lage, Projekte von der Idee bis zur Umsetzung voranzubringen und die gesamte Wertschöpfungskette abzudecken.

Nachhaltigkeit und Elektromobilität sind die Zukunftsthemen der Automobilität. Ein Geschäftsmodell, das unternehmerische Ziele nicht mit Umweltschutz und sozialen Aspekten verbindet, ist heute wirtschaftlich nicht mehr tragfähig. Berylls hat langjährige Erfahrung darin, Nachhaltigkeitskonzepte sowohl für Kunden als auch für eigene unternehmerische Ideen zu entwerfen und erfolgreich umzusetzen. WALL-E als erste Infrastrukturinitiative für Elektromobilität ist dafür nur ein Beispiel.

Um auf die Herausforderungen von Digitalisierung, Konnektivität, Mobilitätsdiensten und Elektromobilität zu reagieren, überarbeiten OEMs, Zulieferer, Start-ups und Dienstleister ihr Produktangebot grundlegend. Nirgendwo sonst wird das so deutlich wie beim Fahrzeug selbst. Berylls hat Automobilunternehmen dabei unterstützt, neue Produkteigenschaften mit Softwaremerkmalen, neuen Eigentumsmodellen und digitalen Angeboten zu kombinieren. Gemeinsam erstellen wir maßgeschneiderte Lösungen, die physische und digitale Produkte zusammenführen.

Um kommerziell ein Erfolg zu werden, muss ein Produktportfolio auf Plattformen, Module, Komponenten, Fertigungstechniken und Dienstleistungsangebote heruntergebrochen werden. Hierbei ist es unerlässlich, dass man mit Hilfe anwendungsspezifischer Software diese einzelnen Portfoliosegmente zusammenhält. Berylls hilft seinen Kunden, Produkte für eine radikal andere Zukunft zu entwerfen und dabei sicherzustellen, dass der Übergang von der Hardware von heute zu den Softwareprodukten von morgen gelingt.

Kein Produkt findet seine Zielgruppe, wenn Zeitpunkt, Qualität und Kosten von Entwicklung und Fertigung nicht stimmen. Berylls hat Kunden erfolgreich dabei unterstützt, neue Produkte, Technologien und Anwendungen auf den Markt zu bringen, die entsprechenden Werke und Fertigungsstraßen aufzubauen sowie Lieferengpässe, Qualitätsmängel und Anlaufverzögerungen mit Hilfe unserer Taskforce-Teams zu lösen. Wir begleiten unsere Kunden von der Idee bis zur Umsetzung und von der Führungsebene bis in die Fertigung.

Bisher drehte sich der Autohandel um den Verkauf, die Finanzierung und den Service von Autos über ein Netz von Händlern. Jetzt verlangen Direktverkauf, neue digitale Angebote und Drittanbieter nach neuen Ansätzen. Heute kann sich kein OEM seines Erfolgs sicher sein, ohne ein schlagkräftiges Online-Angebot vorzuweisen, das nahtlos digitale und physische Produkte integriert. Wer im Luxus-Segment mitspielt, für den gewinnt dagegen das reale Händlernetz weiter an Bedeutung. Wir haben OEMs darin unterstützt, Full-Service-Angebote einschließlich Online- und Offline-Handel aufzubauen und dabei über die gesamte Lebensdauer eines Fahrzeugs Ihren Umsatzanteil zu erhöhen.

Fusionen, Übernahmen und strategische Partnerschaften können wesentliche Voraussetzungen schaffen, um neue Kompetenzfelder, Märkte und Kunden zu erschließen – oder einfach zu wachsen. Sie helfen Unternehmen, wettbewerbsfähig zu bleiben oder ihr Geschäft auf bevorstehende Veränderungen vorzubereiten. Berylls kann hier eine beachtliche Erfolgsbilanz vorweisen – ob es um die Suche nach geeigneten Partnern oder die Umsetzung von Übernahmezielen geht, die Durchführung von Due Diligences oder die Integration nach einer Fusion. Berylls hat viele Kunden dabei unterstützt, mit Hilfe strategischer Partnerschaften oder durch Beteiligungen und Übernahmen ihren Unternehmenswert zu steigern.

Der Aufbau von Software-basierten Kompetenzen und Geschäftsmodellen berührt den Kern dessen, was ein Unternehmen ausmacht. Einen solchen Umbau erfolgreich zu gestalten, in entscheidend für die Zukunft eines jeden Unternehmens. Berylls hat viele Kunden dabei unterstützt, agile, effiziente Strukturen zu schaffen, die zu ihrer Strategie passen: mit der richtigen Mischung aus Kultur und Fähigkeiten, die notwendig sind, um die zunehmende Komplexität der Automobilität beherrschbar zu machen.

Die erheblichen Investitionen, die für neue Produkte und Technologien nötig werden, können nur wenige Autokonzerne aus dem operativen Cashflow stemmen. Zugang zu frischem Kapital ist daher entscheidend. Einige OEMs sind bei der Kapitalbeschaffung eingeschränkt, da sie unterbewertet sind. Andere finden zwar Investoren, tun sich aber schwer damit, deren Erwartungen zu erfüllen. Um diese Herausforderungen anzugehen, ist ein tiefgehendes Verständnis der Kapitalmärkte nötig, das deutlich über die Grundlagen von Ertrag, Profitabilität und Rendite hinausgeht. Bei Berylls haben wir daher unseren eigenen Automobilitätsindex entwickelt. Der Index bietet mehr als Finanzkennzahlen-basierte Analysen: Er umfasst die Bewertung der Strategie, Wertschöpfung und Börsenstimmung. Mit Hilfe des Index unterstützt Berylls seine Kunden dabei, die Erwartungen von Investoren besser zu verstehen und das eigene Unternehmen so darzustellen, dass es für die Kapitalmärkte attraktiv wird.