WANT TO DISCOVER MORE?

SEARCH

WANT TO DISCOVER MORE?

SEARCH

ig 4 Global Truck Manufacturers with record sales, revenues and profits in 2022

The global truck manufacturers Daimler, Traton, Volvo and Paccar have achieved record sales, revenues and profits in 2022. They have earned cumulated 12.3 bn Euro in 2022 – more than ever before. This equals an average return on sales (RoS) of 8.5%. Main drivers were substantial price increases, excellent after sales revenues as well as favorable exchange rates.

There is a clear benchmark in performance and profitability: U.S. based Paccar group with its subsidiary DAF in Europe. The German players Daimler and Traton are well above pre-crisis level, but still far less profitable than their peers. While Daimler suffers from below average profitability of their Asian business, Traton still has homework to do regarding the turnaround of MAN.

Market outlook for 2023 is positive, but ongoing industry transformation requires significant cash flow from the operative business. Focus must be on portfolio management of the increasing zero-emission product offering including comprehensive e-mobility services.

Check our FY 2022 Review and reach out to the team for more details.

Curious? Download the full article now!

Steffen Stumpp

Steffen Stumpp (1970) joined the Berylls Group in October 2020 as Head of Business Unit Commercial Vehicles. At this point, he already looked back on extensive professional and leadership experience in the commercial vehicle industry. Stumpp started his career in an OEM and went through different roles in research, marketing, product planning and after-sales service. When he switched to the automotive supplier industry, he took over the responsibility for worldwide sales and marketing of a medium-sized tier 1 supplier. After another step as head of sales he decided to join Berylls, where he is now responsible for the commercial vehicle business.

Stumpp is a graduate engineer and has studied industrial engineering at the KIT in Karlsruhe and the Technical University of Berlin with focus on logistics.

he time in which electric cars had been a phenomenon limited to the west coast tech community is over – in a market where a V8-powered pickup truck has long epitomized people’s perception of a car, electric vehicles (or EVs) made up 6% of US light vehicle sales in 2022. And more than 30 million EVs will have been sold cumulatively in the US by 2030 , when the country will likely be the biggest single EV market after China.

TOP 3 CUSTOMER PURCHASE CRITERIA

(by country, general customer)

Source: Ipsos 2022 Mobility Navigator Module 1, Berylls

Incumbents and new entrants face a US EV customer that is significantly different from its European and Chinese counterparts. An international survey of customers shows that while US customers only cite ‘economic’ reasons as their top three purchase criteria, Chinese customers also place a premium on safety and sustainability while German customers love the thrill of driving. While US customers generally have an affinity for digital channels during the research and vehicle configuration stages of the customer journey, they still have a stronger preference for dealership visits when interacting with salespeople and completing the purchase or leasing of a vehicle; Only 58% of US customers are interested in contacting salespeople online2.

TOP 3 CUSTOMER PURCHASE CRITERIA

(by US customer persona compared to US general customer)

Source: Ipsos 2022 Mobility Navigator Module 1, Berylls

Beyond international differences, there are also three distinct attitudinal groups among US car buyers. Early EV adopters (current EV owners), EV considerers (those strongly considering EVs as the next purchase) and EV skeptics (currently not considering an EV) differ significantly in terms of their socio-demographics and top three purchase criteria. While EV adopters care about CO2 emissions and environmental sustainability, EV skeptics and EV considerers put a stronger weight on functional and economic aspects when evaluating EVs.

Yet, US buyers (especially skeptics) are contradictory. In the Ipsos 2022 Mobility Navigator EV survey, US buyers cited good fuel economy, maximizing residual value, and low total cost of ownership (TCO) as their top three vehicle features. However, in reality the F-150 – the top-selling vehicle in the US – is among the lowest of any car sold in the US3 in terms of fuel efficiency (range of EPA-estimated combined fuel efficiency of 12-25 MPG depending on trim)4. It becomes clear that beyond economic factors the size and versatility of vehicles are clear purchase drivers for the US population. Fortunately, it is not an absolute necessity to convince the skeptics in the next few years – the segment of considerers is large enough to fuel the EV growth until 2030 and will certainly expand as EV technology shifts toward mainstream prominence.

Today, even EV considerers see a gap between their willingness to pay and current EV prices. 36% of US customers said vehicle sticker price is a top three purchase factor, and 48% of customers say they are not willing to pay a premium for an EV2. Yet the December 2022 average transaction price of an EV was $12,0005 more than an ICE vehicle6. While Tesla and Ford (among others) have recently cut MSRPs on the Model Y (up to 20%)7 and the Mach-e (up to 9%)8 respectively, the ‘price-willingness to pay delta’ coupled with slim profit margins will require OEMs to move beyond the tactical (pricing) level. A sustainable EV business model will benefit from significant advances in OEMs’ supply chain and production (e.g., EV vs. ICE price competitiveness is expected when battery cost falls below $100/ kWh9) and smart exploitation of purchase and production incentives (see the second part of our series for further details).

Considering the high share of vehicles financed or leased in the US (above 80% over the last three years)10, monthly payments may play an even stronger role than list prices. Narrowing the current delta between gasoline and EV leases ($337) and loans ($210)7 requires OEMs to increase residual values of vehicles – e.g., through advancements in battery durability, parts quality and vehicle certification. In addition, creative expansion of their businesses along the vehicle’s life will further contribute to attractive BEV economics.

MINIMUM ACCEPTABLE RANGE

(% of respondents, by US consumer persona)

Source: Ipsos 2022 Mobility Navigator Module 1, Berylls

While price deltas between ICE and EV are (still) factual, other differences are (only) perceived by customers – particularly in terms of driving range and cost benefits. Customers’ minimum range requirements differ by persona. Unsurprisingly, BEV skeptics have the highest range requirement while BEV considerers have the lowest. Most early adopters state a requirement of under 300 miles. As so often in car buying, buyers’ stated requirements are based on the exceptional use, considering the average daily driving distance in the US is only 25 miles2. While the evolution of battery technology (and thus increase of range and reduced charging time) may narrow parts of this gap, customer education and practical experience will be paramount in addressing customers’ greatest EV concerns around range and charging anxiety, affordability and product availability to turn skeptics into adopters. While OEMs have to carry customers to the brink of consideration, dealers will be key in familiarizing customers with the practicalities of EV infrastructure and pros and cons against their gasoline counterparts. Federal and state governments can play a supporting role reassuring customers around EV incentives and infrastructure.

Communication to customers will similarly help to underline EVs (potential) TCO advantages. 40% of BEV skeptics say that a concern about owning an EV is higher TCO. Yet, for two models of similar segment and size, an ICE vehicle can be more than 20% more expensive to run depending on the length of ownership11.

The gaps in perceptions and buying preferences are narrowing fast in the US. Over the last three years, the proportion of US buyers contemplating an EV for their next purchase is up to 49% (up 19 points) compared to both Chinese buyers (72%, up 7 points) and German buyers (37%, up 14 points)2. The race is on.

EV SALES FORECAST BY COUNTRY (US, CHINA, EU5)

(2021-2030, in thousands of units)

Source: Berylls Strategy Advisors analysis and extrapolation including (among others) sales data from S&P Global Mobility Light Vehicle Sales April 2022 as well as production nameplate and propulsion system design data from S&P Global Mobility Automotive Light Vehicle Transmission + Engine Forecast, April 2022

While the current US EV share cannot compete with Europe, the US will battle the EU5 for the runner up position behind China in volume terms – with both regions forecasted to show annual EV sales above 6mn units by 2030. With the Inflation Reduction Act aiming to provide an answer to China’s Made in China 2025 initiative and the Detroit Three announcing investments of more than $115bn in electrification by 202612, the US is positioning itself to move from EV niche to necessity. EVs are forecasted to grow quicker in the USA than in any other market (34% CAGR 2021-2030) vs. China (22%) and EU5 (33%)1. Considering this growth and the substantial size of the US EV opportunity combined with US customers’ explicit and implicit product requirements, OEMs can no longer treat the States as another platform to sell their Europe/China-centric vehicles – a dedicated (product) strategy is required.

US EV VS. ICE SALES BY SUB-SEGMENT

(2021 vs. 2030, in thousands of units)

Source: Berylls Strategy Advisors analysis and extrapolation including (among others) sales data from S&P Global Mobility Light Vehicle Sales April 2022 as well as production nameplate and propulsion system design data from S&P Global Mobility Automotive Light Vehicle Transmission + Engine Forecast, April 2022

By the end of the decade, EVs will have taken around a third of the US market. That also means that the US market for internal combustion engine (ICE) vehicles is set to shrink, and fast. In parallel a substantial part of the EV capacity will come from newly constructed EV plants – Tesla, Polestar, Lucid and VW, among others, have all announced or begun large capacity EV projects in America. Legacy ICE capabilities across the value chain therefore face a tremendous transformation challenge; the majority of automotive CEOs are concerned about capability gaps in their organization13. Upstream EVs will require new chassis, body-in-white, E/E and e-drive capabilities (among others). The ramp-up and holistic industrialization of these capabilities will be the deciding factor: From the shopfloor to the board room and back again.

SALES FORECAST BY POWERTRAINS

(2021-2030, in thousands of units)

Source: Berylls Strategy Advisors analysis and extrapolation including (among others) sales data from S&P Global Mobility Light Vehicle Sales April 2022 as well as production nameplate and propulsion system design data from S&P Global Mobility Automotive Light Vehicle Transmission + Engine Forecast, April 2022

Also, downstream the impact is already visible: the reactions by dealers range from going all into electric to leaving the party (e.g., GM). OEMs have begun dealer EV certification levels (e.g., Ford) and more fundamental (online) shifts to the sales process (e.g., Acura).

The question for OEMs, suppliers, dealers and other automobility players is not if and when, but how to participate in the US EV market now. The US will become the second biggest single EV market by 2030 and will be growing faster than any other region1. The specific demands of US customers will necessitate a US-centric product strategy, which goes beyond derivatives of Europe/Asia-focused platforms. New entrants and niche manufacturers face the additional complexity of having to realize sufficient volumes of such local products for scale economies, while keeping the costs of ramping-up the supporting sales/after-sales footprint to a minimum.

Look forward to part two of our US EV study: We will discuss various market factors that OEMs will need to pay attention to in the race to electrification including competition, policy, infrastructure, funding, and dealership laws.

Sources:

1 Berylls Strategy Advisors analysis and extrapolation including (among others) sales data from S&P Global Mobility Light Vehicle Sales April 2022 as well as production nameplate and propulsion system design data from S&P Global Mobility Automotive Light Vehicle Transmission + Engine Forecast, April 2022.

2 Ipsos. (2022, June 2). Ipsos Mobility Navigator Module 1: Electrification. Ipsos.

3 Oak Ridge National Laboratory for the U.S. Department of Energy and the U.S. Environmental Protection Agency. (2023, 03 17). 2023 Best and Worst Fuel Economy Vehicles. Retrieved from www.fueleconomy.gov: https://www.fueleconomy.gov/feg/best-worst.shtml. Retrieved from U.S. Department of Energy, Office of Energy Efficiency & Renewable Energy.

4 Oak Ridge National Laboratory for the U.S. Department of Energy and the U.S. Environmental Protection Agency. (2023). 2023 Ford F150. Retrieved from U.S. Department of Energy, Office of Energy Efficiency & Renewable Energy: https://www.fueleconomy.gov/feg/bymodel/2023_Ford_F150.shtml.

5 As of July 2022.

6 Experian Information Solutions, Inc. (2023). Auto Finance Year-in-Review Electric Vehicles & Affordability.

7 Reuters. (2023, March 6). Tesla cuts U.S. Model S and Model X prices between 4% and 9%. Retrieved from Reuters: https://www.reuters.com/business/autos-transportation/tesla-cuts-prices-model-y-model-x-variants-us-website-2023-03-06/.

8 Eckert, N., & Feuer, W. (2023, January 30). Ford Cuts Prices of EV Mustang Mach-E. Retrieved from The Wall Street Journal: https://www.wsj.com/articles/ford-cuts-prices-of-ev-mustang-mach-e-11675090387.

9 Baker, D. R. (2022, December 6). EV Transition Threatened as Battery Prices Rise for First Time. Bloomberg.

10 Experian Information Solutions, Inc. (2022). State of the Automotive Finance Market Report.

11 Burnham, A., Gohlke, D., Rush, L., Stephens, T., Zhou, Y., Delucchi, M. A., . . . Boloor, M. (2021). Comprehensive Total Cost of Ownership Quantification for Vehicles with Different Size Classes and Powertrains. USDOE Office of Energy Efficiency and Renewable Energy, Argonne National Lab.

12 GM, Stellantis, Ford.

13 Heines, D. F. (2022, December). Digital Capability Building: Solving the key Transformation Bottleneck. Berylls Strategy Advisors. Munich, Germany.

Henning Ludes

Henning joined Berylls in 2018, is an Associate Partner at the Berylls Group and is currently completing a regional assignment in Detroit to further expand our local footprint. Henning particularly focuses on topics at the interface of new business development, go-to-market strategies, sales as well as organizational transformation. He has advised automotive manufacturers, suppliers and investors on a global scale.

As an MSc. Management graduate, Henning has completed his education at WHU – Otto Beisheim School of Management (Germany), Kellogg School of Management, Northwestern University (United States) and Warwick Business School (United Kingdom).

Cameron Gormley

Cameron Gormley joined Berylls Strategy Advisors US in July 2022 as a Senior Consultant. Cameron has deep knowledge of the US electric vehicle (EV) infrastructure, policy, and regulatory landscape and its role as a key driver of EV penetration. He advises clients on topics of electrification strategy and business model development across all vehicle segments. Other areas of expertise include market analysis, go-to-market strategy, strategic planning, customer strategy, and PMO.

Cameron received a Bachelor of Science in Mechanical Engineering at Western New England University (2015) and holds a Project Management Professional (PMP) certification (2021).

Martin French

Martin French has over 25 years of experience in automotive OEM, Tier 1 suppliers & mobility startups with various high-profile international leadership, product development, operational, program management, strategic & business development roles. In 2012, after holding various senior management positions, he was appointed Global Vice President Customer Group at Webasto where he led the global business transformation for their US based customers with over $1bn in revenue.

Martin joined Berylls by AlixPartners (formerly Berylls Strategy Advisors) as Managing Director in 2019 and leads the Berylls office in Metro Detroit, USA. His consulting focus is Automotive Suppliers & OEMs, Corporate Strategy & Business models, M&A, Restructuring & New Business Development & Go to Market.

Martin studied Production & Mechanical Engineering at Oxford Brookes University. He has lived in Michigan, USA, since 2012.

he transformation of trucking in Europe towards zero-emission vehicles is accelerating and must be accomplished within two decades.

Never since the switch from horse-drawn carriages to Diesel-powered trucks, has there been such fundamental change for the industry. Technologies are being replaced and value pools are being reallocated. But also, the daily use of trucks by their operators is changing: battery charging and range limitations heavily affect the usage and scheduling of electric vehicle fleets.

Batteries replace Diesel engines as being the most valuable single component of a truck. On a long-haul tractor with 600 kWh battery capacity, the energy storage

accounts for 60% of the total product costs. Even though this share will gradually

decrease because of improving economies of scale and evolving battery technology, batteries have a massive influence on the value of electric trucks throughout their life cycle. And here another difference to Diesel trucks comes into play: lifespans of vehicles and major components like the battery will increasingly be out of sync.

Curious? Download the full article now!

Steffen Stumpp

Steffen Stumpp (1970) joined the Berylls Group in October 2020 as Head of Business Unit Commercial Vehicles. At this point, he already looked back on extensive professional and leadership experience in the commercial vehicle industry. Stumpp started his career in an OEM and went through different roles in research, marketing, product planning and after-sales service. When he switched to the automotive supplier industry, he took over the responsibility for worldwide sales and marketing of a medium-sized tier 1 supplier. After another step as head of sales he decided to join Berylls, where he is now responsible for the commercial vehicle business.

Stumpp is a graduate engineer and has studied industrial engineering at the KIT in Karlsruhe and the Technical University of Berlin with focus on logistics.

EMs face increasing pressure to cut their environmental impact.

This means reducing their carbon footprint, but also their raw material and resources consumption, and making their operations and business model more sustainable (not focused solely on selling more and more cars). In response, OEMs are starting to put in place Refurbish, Remanufacture, Reuse, and Recycle (R4 or the “4Rs”) strategies to maximize their reuse of valuable materials.

Source: Berylls Strategy Advisors

However, their strategies are at the moment neither comprehensive nor consistent. On the one hand, they usually focus on end-of-life applications, such as recycling and reuse of vehicles and battery modules. Recycling and reuse are the “2Rs” that appear to be the most profitable at present (if you want to learn more, please also have a look on Berylls’ Battery Re-X study. On the other hand they tend not to consider an important prerequisite for their strategies: Being the legal owner of the vehicle throughout and particularly at the end of its lifetime (around 8-10 years).

During the 8-10 year period, OEMs will need to redeploy the car to different end customers for different types of contract, as part of a multi-cycle Vehicle-as-a-Service (VaaS) sales model, rather than selling the car outright when it is new (if you want to learn more about the Berylls point-of-view on VaaS, please have a look on our dedicated website.

This multi-cycle sales model will put vehicle condition in the spotlight, as it will be essential to maintain a certain standard of quality so the car is available for as many types of business models as possible.

Source: Berylls Strategy Advisors

Efficient refurbishment operations to maintain the quality of vehicles between different use cycles will therefore become a strategic enabler for both multi-cycle sales models and for OEMs’ holistic 4R strategies.

We believe that taking a lifetime view of vehicles and components has significant strategic and commercial benefits

Source: Berylls Strategy Advisors

THE IMPORTANCE OF 4R STRATEGIES in the context of business model and sustainability transformation is increasing rapidly and only few players are starting to get prepared. Now is the time to decide whether to bea pioneer or a laggard in two of the most relevant future fields of action!

Curious? Download the full article now!

Christopher Ley

Christopher Ley joined Berylls by AlixPartners (formerly Berylls Strategy Advisors) in October 2021 as Partner. He has over 14 years of top management consulting experience with focus on new business models and market expansions within the automotive & mobility industry. He is an expert around Vehicle-as-a-Service, comprising vehicle finance & leasing, fleet management and mobility services. Christopher Ley is advising OEMs, Captives, Financial Services Companies, PE & VC Investors, Leasing & Rental Companies, Fleet Managers and Mobility Startups around the transformation from one-time sales towards use-based multi-cycle business models on a global level.

Prior to joining Berylls, Christopher Ley has been working for other international management consulting firms, amongst others Monitor Deloitte and Alvarez & Marsal. He holds a diploma degree in business administration from Johannes Gutenberg-Universität in Mainz and an MBA from Colorado State University.

Heiko Weber

Heiko Weber (1972), Partner at Berylls by AlixPartners (formerly Berylls Strategy Advisors), is an automotive expert in operations.

He started his career at the former DaimlerChrysler AG, where he worked for seven years and was most recently responsible for quality assurance and production of an engine line. Since moving to Management Engineers in 2006, he has been contributing his experience and expertise to projects for automotive manufacturers as well as suppliers in development, purchasing, production and supply chain. Heiko Weber has extensive experience in the development of functional strategies in these areas and also possesses the operational management expertise to promptly catch critical situations in the supply chain through task force operations or to prevent them from occurring in the first place.

As a partner of Management Engineers, he accompanied the firm’s integration first into Booz & Co. and later into PwC Strategy&, where he was most recently responsible for the European automotive business until 2020.

Weber holds a degree in industrial engineering from the Technical University of Berlin and completed semesters abroad at Dublin City University in Marketing and Languages.

Florian Tauschek

Florian Tauschek has 8 years of experience in strategy consulting. He focuses on business & sales model strategies for flexible Vehicle-as-a-Service (VaaS) offers.

He is an expert in topics such as customer & vehicle lifetime value optimization, the transformation of the underlying automotive sales model from one-time asset sales towards multicycle models generating recurring revenues as well as market entry strategies for various VaaS products such as operating lease or subscriptions. Furthermore he is the author of several market leading studies around VaaS.

He holds a Master of Science degree in management from HHL – Leipzig Graduate School of Management.

s the transition to electric mobility accelerates, Berylls’ six-point action plan will help OEMs and suppliers ride out the economic headwinds and improve digital customer engagement

This year could see the first inflation-driven global economic crisis for 40 years, as the combined impact of the COVID-19 pandemic and the war in Ukraine continues to disrupt supply chains and force up prices. The hopeful news is that most economists expect inflation rates worldwide to fall during 2023, as bottlenecks ease and energy prices come down. Nonetheless, even if a global recession is avoided, the cost of living will still be far higher for billions of consumers than before the pandemic struck.

Against this background, the automotive industry confronts a series of formidable challenges, all of which are exacerbated by inflation. Manufacturers and suppliers must cope with raw material shortages and price rises as they implement ambitious restructuring programs to keep pace with the transition to electric mobility. At the same time, the massive boost to online shopping triggered by COVID-19 lockdowns has created a new breed of digitally savvy but financially hard-pressed car buyers who are far choosier and less loyal to brands than before the pandemic.

Our report sets out how industry players can turn the current inflationary storm into an opportunity to gain a lead over competitors that cannot navigate the headwinds. The last global financial meltdown in 2008 and its aftermath offered agile, imaginative automotive companies precisely this kind of opening to seize the advantage. Consider, for instance, how Korea’s Hyundai Motor Group increased its North American market share from 5.3 percent in 2008 to 9.1 percent in 2011 by targeting customers who would not have considered buying a Hyundai or a Kia before the US subprime mortgage crisis.

The challenge today is to apply the same creative thinking in a market buffeted by inflation, where both consumer behavior and the automotive industry are evolving at unprecedented speed. After analyzing the industry’s response so far to the current inflation-driven slowdown, we make the following key recommendations for 2023 and beyond:

Curious? Download the full article now!

Michael Bang

Michael Bang (1971) has more than 20 years of management consulting experiences, with 15 years of which dedicated to automotive consulting. His focus is brand/marketing, EV strategies, software defined vehicle and M&As in automotive sector. He joined Berylls by AlixPartners (formerly Berylls Strategy Advisors) in January 2018 and has been leading its office in Seoul, Korea. Among 100+ projects with OEMs and suppliers, he helped a Korean automaker to successfully enter Indian market and to develop its SDV strategies, and a major Korean tier-1 to acquire the market leader in thermal management systems. Prior to business school, he was a suspension system engineer at Mando.

BS/MS in mechanical engineering from Yonsei University, Seoul/Korea, and MBA from MIT Sloan School of Management, Cambridge/USA.

s herrscht ein großer Druck für deutsche Autobauer - auf dem chinesischen Markt und auf unserem heimischen Markt in Deutschland und Europa.

Neben BYD gibt es auch neuere Marken wie NIO, MGmotor, Polestar, die unter Konstrukten wie Geely Global geführt werden. Das sind neuen Konkurrenten besonders im Premium-Segment, denn diese Hersteller haben sich ausschließlich auf den Elektromarkt konzertiert. Wenn Sie sich den europäischen Automarkt anschauen, der rückläufig ist, denn das einzige Segment, das wächst, ist das Thema Elektromobilität.

Jetzt Podcast anhören:

Quelle: Börse hören.

https://www.brn-ag.de/41624

Zum Artikel

Zum Artikel

Zum Artikel

Zum Artikel

Zum Artikel

Dr. Jan Burgard

Dr. Jan Burgard (1973) ist CEO der Berylls Group, einer internationalen und auf die Automobilitätsindustrie spezialisierten Unternehmensgruppe.

Sein Aufgabengebiet umfasst die Transformation von Luxus- und Premiumherstellern, mit besonderen Schwerpunkten auf Digitalisierung, Big Data, Start-ups, Connectivity und künstliche Intelligenz. Dr. Jan Burgard verantwortet bei Berylls außerdem die Umsetzung digitaler Produkte und ist ausgewiesener Spezialist für den Markt China.

Dr. Jan Burgard begann seine Karriere bei der Investmentbank MAN GROUP in New York. Die Leidenschaft für die Automobilitätsindustrie entwickelte er während Zwischenstopps bei einer amerikanischen Beratung und als Manager eines deutschen Premiumherstellers.

Im Oktober 2011 komplettierte er die Gründungspartner von Berylls Strategy Advisors. Die Top-Management-Beratung ist die Basis der heutigen Group und weiterhin der fachliche Nukleus aller Einheiten.

An das Studium der Betriebs- und Volkswirtschaftslehre, schloss sich die Promotion über virtuelle Produktentwicklung in der Automobilindustrie an.

hina’s automotive market once again displayed great resilience in 2022, despite severe challenges.

In total, 23.6 million passenger cars were sold, a year-on-year increase of 9.5 percent. This included the record-breaking figure of 6.5 million new energy vehicles (NEVs), a year-on-year rise of 94.3 percent, reinforcing China’s critical role in the worldwide shift to electric mobility.

Repeating their success in 2021, Chinese players proved the big winners in the NEV market, accounting for more than 80 percent of total NEV sales. Meanwhile, established foreign OEMs lagged behind. Even premium brands which in the past could depend on success in China struggled to cope with intensifying competition from domestic manufacturers as the transition to e-mobility accelerated.

The next international phase of this battle has now begun in earnest, with Chinese automotive companies taking on major global markets, focusing especially on western Europe. In 2022, China’s total vehicle exports reached another record high of 2.5 million passenger cars, a year-on-year increase of 56.7 percent.

Looking forward, market conditions in China will remain challenging for foreign OEMs, as more new Chinese players ramp up production and sales amid rapidly changing customer tastes and shifting government priorities. Nonetheless, there are still areas such as sustainability and the metaverse where foreign players can gain a competitive advantage, as we explain in this report.

During 2022, China’s economy continued to be affected by restrictive COVID-19 suppression measures while in October, the 20th National Congress of the Chinese Communist Party (CCP) set the country’s direction for the next five years. In addition, Chinese manufacturers, like their international peers, were severely affected by the global chip shortage and rising raw material prices. Against this background, China’s automotive industry experienced a turbulent twelve months.

Curious? Download the full insight now!

Dr. Jan Burgard

Dr. Jan Burgard (1973) is CEO of Berylls Group, an international group of companies providing professional services to the automotive industry.

His responsibilities include accelerating the transformation of luxury and premium OEMs, with a particular focus on digitalization, big data, connectivity and artificial intelligence. Dr. Jan Burgard is also responsible for the implementation of digital products at Berylls and is a proven expert for the Chinese market.

Dr. Jan Burgard started his career at the investment bank MAN GROUP in New York. He developed a passion for the automotive industry during stopovers at an American consultancy and as manager at a German premium manufacturer. In October 2011, he became a founding partner of Berylls Strategy Advisors. The top management consultancy was the origin of today’s Group and continues to be the professional nucleus of the Group.

After studying business administration and economics, he earned his doctorate with a thesis on virtual product development in the automotive industry.

Willy Wang

Willy Lu Wang (1981) joined Berylls Strategy Advisors in 2017. He started his career participating in the graduate program of Audi focusing on production planning. After stations at another strategy consultancy as well as being the strategy director for a German Tier-1 supplier, he is now responsible for the China business at Berylls.

He has a broad consulting focus working for all clients in China, whether they are JVs, WOFEs or pure local players. He is also responsible for the development of AI and Big Data products dedicated towards the Chinese market further strengthening the Berylls End-to-End strategy and product development capabilities.

Wang studied Electronics & Information Technology with focus on Systems and Software Engineering and Control Theory at Karlsruhe Institute of Technology.

Hongtao Wei

Hongtao Wei (1988), Associate Partner, joined Berylls Strategy Advisors in 2015, an international strategy consultancy specializing in the automotive industry, where he focuses on all issues related to the Chinese automotive market. In addition to Western manufacturers in China, his clients also include Chinese OEMs, investors, provincial governments, and state-owned enterprises.

He has profound expert knowledge in the areas of sales and aftersales. His other areas of expertise include digitalization, connectivity, and turnaround management.

He studied Sinology, Economics and Statistics at the Ludwig-Maximilians-Universität in Munich.

Soleiman Mansouri

Soleiman joined the Berylls Group in March 2022. He has set his focus on customer-centrist solutions, gaining experience in Product- and Corporate Strategy, Consulting with the focus on the OEM business. His Automotive career started with digitalization of the Aftersales of an US OEM in Europe and took him to China to the leading German OEM group, heading the Product and Portfolio department. He gained intensive consulting experience with one of the top management consulting firms and as a freelance consultant. Before joining Berylls, he was the Director Go-to-Market of one of the top Chinese OEMs supporting their entrance into the EU market. Soleiman is a graduated M.A./MBA in International Business from the University of Hamburg and ECUST/Shanghai.

Soleiman joined the Berylls Group in March 2022 and is part of the Asia-team, responsible for supporting all players in a successful market entrance. Also, provides profound expertise of customer-centric Product Marketing and Portfolio Strategy approaches to our clients.

Soleiman is expert in customer-centric Product-/Portfolio Strategy, Go-To-Market, Corporate Strategy and Entrepreneurship.

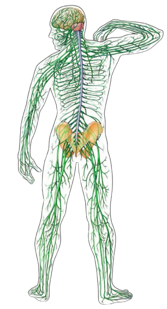

he Viable System Model (VSM) can help automotive companies steer a path to sustainable profitability while managing their increasing organizational complexity

75 percent of companies are unable to grow profitably over the long term., according to Sebastian Raisch, Gilbert Probst and Peter Gomez, authors of Wege zum Wachstum. One of the main reasons for this, is called the “growth paradox”, which describes companies chasing growth in a way that creates complexity, which actually inhibits growth.

Many executives say that it is not the complexity of external market conditions that causes them problems but the control of complexity within their own organization. Internal processes and administrative structures build up as the company grows, making it difficult for executives to maintain direct contact with their business and customers. As a result, they lose the essential focus on developing the potential for success.

This is where the Viable System Model (VSM) developed by the cybernetician Stafford Beer can help organizations make their complexity controllable and embed the important principle of self-organization.

The goal of many reorganizations is to “manage” corporate complexity. However, Berylls’ research and feedback from our clients suggests that most such exercises in the automotive industry only achieve limited success. Martin Pfiffner, author of The Neurology of Business: Implementing the Viable System Model, has identified the following cardinal errors that mean reorganizations often fail to have the desired impact:

The VSM offers executives a framework for avoiding these errors and shows how they can solve the problems created by complexity. Its primary focus is not to define structures such as divisions and departments within a successful organization, but to define the relationships between them.

A fundamental principle of the VSM is that the operational units of a company must be organized as viable systems according to the same model. This principle, called “recursivity”, enables problem-solving strategies for dealing with complexity and creating order out of chaos across the organization.

Box: How the Viable System Model was created

Why VSM is especially relevant to automotive companies

Many major OEMs and suppliers are undertaking or considering hugely ambitious reorganization programs to keep pace with the industry’s accelerating transformation. The VSM, correctly applied, is a critical approach for managing these organizations’ increasing complexity while maintaining growth and staying ahead of competitors.

To manage the increasing complexity within automotive organizations, the VSM provides five key control functions:

Figure 1: Viable System Model in an automotive company

Source: Berylls Strategy Advisors, following Pfiffner (2020) - Die dritte Dimension der Organisierens

Berylls’ research and our work with clients globally confirm that the VSM has repeatedly delivered rapid, effective solutions. Here are our key insights about how the VSM can be applied to achieve the only success that counts – satisfying customers to generate sustainable, long-term profitability:

Putting the customer first

It is crucial to design the organization’s dominant control dimension correctly to ensure that the business is structured in such a way that it focuses on the customer’s purchasing criteria and can implement the defined strategy effectively. Potential control dimensions include products, technologies, customer groups, applications, or regions.

Examples:

Premium OEMs: Cars, Vans, Service & Parts, Digital Services, Financial Services

Automotive Software Suppliers: Car Operating System, Omni Channel Commerce, After Sales, Production Automation, Enabler Technologies

Determining how far to decentralize:

Within operating business units, it is important to ensure that managers are responsible for the competencies and resources that determine success (System 1, see Figure 1). This autonomy should cover all functions that have a direct influence on the criteria that determine purchasing, such as product development.

At the same time, responsibility for organization-wide functions such as IT cannot be delegated, while central management may need to maintain control of plants or production capacities shared by operating units to achieve synergies between them (System 2).

The right degree of centralization can be calculated by asking the following questions:

Firstly, can we afford decentralization?

If the answer is yes, will decentralizing a task influence one or more key customer purchasing criteria?

If the answer is no, can a synergy be achieved by continuing to centralize the task?

If the answer is again no, the task should be assigned to the relevant unit because of the principle of subsidiarity.

Flattening further than conventional wisdom suggests

“How many direct reports can be managed?” is the wrong question. In our experience the traditional rule that there should be a maximum of seven “direct reports” fails in most cases. The correct approach is to look at horizontal and vertical complexity and consider how much autonomy operational units need to perform at their best and whether they need more or less support from senior management (horizontal complexity). In addition, reorganization programs should address whether senior management has sufficient scope for intervention to limit the autonomy of operating units in the interests of the whole company (vertical complexity).

At one automotive supplier, a VSM diagnosis showed that the organization could be flattened from five to four management levels by dissolving three business units and converting ten new product units into fully-fledged operational units. This flattening was possible because the product divisions were different and to a large extent able to manage their complexity independently. Furthermore, senior management had significant vertical complexity control to ensure overall optimization of the product areas (System 3).

Navigating into the unknown

In the automotive industry, navigating a rapidly changing environment must also be organized, with senior management taking the lead (System 4). Senior executives and senior operation leader (System 4 and 3) must balance what is right for today’s business with what is important for the future, while identifying external opportunities and threats. The last function to be designed is normative management (System 5) which defines the business mission and formulates governance policies which establish the guard rails within which strategic and operational management can function. This interplay of operational, strategic and normative management is of utmost importance to a successful transformation.

The timely redirection of human and financial capital from the old to the new business is both the most difficult and important task currently confronting the automotive industry. Figure 2 shows this interplay and the shift from the lower S-curve to the upper S-curve. However, too many senior automotive managers lack sufficient time to devote to strategic questions such as how much to invest in electromobility, connectivity or ADAS development because they are mired in operational issues which absorb most of their attention.

Figure 2: Adaptability – When do we change course?

Source: Malik, Berylls Strategy Advisors

By applying the VSM, an increasing number of OEMs and suppliers have executed successful organizational transformations that free up management time while delivering the critical interplay of operational, strategic and normative management. In plain terms, they are at least one step ahead of their competitors in seizing the opportunities created by this period of industry transition and transformation.

Dr. Christopher Brüggemann

Dr. Christopher Brüggemann (1983) is a Project Manager with focus on transforming organizations to improve performance, speed and agility. He is also an expert in strategy deployment, organizational design, and transformational change. Christopher has advised numerous companies through multiyear organizational transformations, often focused on operating model development and putting new ways of working, structures, processes, decision making mechanism in place.

Before joining Berylls, Christopher worked at Sixt SE, several other consultancies, and served as a research associate in cooperation with Deutsche Telekom. He has a PhD in economics and a diploma degree in business administration of Bayreuth University.

Peter Eltze

Peter Eltze (1964) joined Berylls by AlixPartners (formerly Berylls Strategy Advisors) as a Partner in November 2015. He began his career in the medical technology division of an integrated technology corporation, and became a project manager at Malik Management Zentrum St. Gallen in 1996 before being appointed Partner in 2001. From 2003, in his role as member of the executive board, he was in charge of Management Education & Development. Since the end of the 1990s, Peter Eltze has advised companies in the automotive and mechanical engineering industries. At Berylls, his consulting activities focus on integrated organizational development (strategy, structure, culture), transformation management, and executive development.

Education in wholesale and international trade; administrative sciences at the University of Constance, Germany.

Laura Kronen

Laura Kronen (1980) is a partner at Berylls by AlixPartners (formerly Berylls Strategy Advisors) with a focus on transformation. She is passionate about moving people and organizations forward. With over 18 years of industry and consulting experience, her focus is on transformative challenges in the operations context – from executives to individual employees, at manufacturers and suppliers. She helps her clients align strategy, structure, and culture in their respective market environments to build resilience.

Prior to joining Berylls, Laura Kronen worked at PwC Strategy&, Volkswagen AG and Audi. She holds a diploma degree in industrial engineering from the Karlsruhe Institute of Technology (KIT).

Dr. Martin Pfiffner

Dr. Martin Pfiffner (1965) works at Oroborus Fondation. Martin is one of the world’s leading experts on the practical implementation of the Viable System Model and Syntegration. Over the last thirty years, he has advised numerous economic, public, and private entities across the world, helping them get back on track and achieve success. His work centers on “The third dimension of organization,” which he defines as the neurology of an organization. His most recent book is The Neurology of Business: Implementing the Viable System Model (2022)

Martin studied economics at the University of St. Gallen (HSG) and earned his doctorate. At the time, he served as an assistant to professors Peter Gross (sociology, multi-option society) and Fredmund Malik (systems-oriented management theory). Later he studied in Canada and in Wales with Professor Stafford Beer, the pioneer of management-cybernetics.

ine erfolgreiche Transformation ist nur möglich, wenn die Führungskräfte die entsprechenden Qualitäten mitbringen.

Der Begriff der Transformation ist allgegenwärtig und auch in der Automobilindustrie nicht mehr wegzudenken. Es geht darum, dass das Unternehmen sich umorientiert. Dass das Unternehmen Dinge neu erlernen -sowie eingeschlagene Pfade verlassen muss.

Wenn wir von der Transformation sprechen, müssen wir auch über die Transformation der Führungskräfte sprechen.

Jetzt Podcast anhören:

Quelle: Börse hören.

https://www.brn-ag.de/41564

Laura Kronen

Laura Kronen (1980) ist Partner bei Berylls by AlixPartners (ehemals Berylls Strategy Advisors) mit Schwerpunkt Transformation. Menschen zu bewegen und Organisationen voranzubringen begeistert sie. Mit über 18 Jahren Industrie- und Beratungserfahrung liegt ihr Fokus auf transformativen Fragestellungen im Operations Umfeld – vom Executive bis zum einzelnen Mitarbeiter, bei Herstellern und Zulieferern. Sie unterstützt ihre Kunden dabei, Strategie, Struktur und Kultur in ihrem jeweiligen Marktumfeld in Einklang zu bringen und somit ihre Resilienz zu stärken.

Bevor Laura Kronen zu Berylls kam, arbeitete sie bei PwC Strategy&, Volkswagen AG und Audi. Sie hat einen Diplomabschluss in Wirtschaftsingenieurwesen vom Karlsruher Institut für Technologie (KIT).

Peter Eltze

Peter Eltze (1964) ist seit November 2015 als Partner bei Berylls by AlixPartners (ehemals Berylls Strategy Advisors) tätig, einer internationalen und auf die Automobilitätsindustrie spezialisierten Strategieberatung. Er ist Experte für ganzheitliche Transformationsprozesse und kann auf eine langjährige Erfahrung im Vertriebs- / Marketing- und Operations-Umfeld zurückschauen.

Peter Eltze berät seit 1994 Automobilhersteller und -zulieferer im globalen Kontext. Er verfügt über ein fundiertes Expertenwissen in den Bereichen Strategie- und Organisationsentwicklung. Zu seinen weiteren fachlichen Schwerpunkten zählen unter anderem Top Executive Coaching und der Themenkomplex rund um die Gestaltung von Führungsstrukturen und -konzepten.

Vor seinem Einstieg bei Berylls Strategy Advisors war er für MP und Malik als Mitglied der Geschäftsführung.

Im Anschluss an seine kaufmännische Ausbildung bei Siemens studierte er Verwaltungswissenschaften mit dem Schwerpunkt Managementlehre an der Uni Konstanz.

NO TIME TO READ THIS WEBSITE?