Featured Insights

Durch den Krieg gibt es nicht nur humanitäre, sondern auch wirtschaftliche Folgen, die sich teilweise auf die ganze Welt auswirken. Neben dem Anstieg der Öl- und Gaspreise, dem Fall des Rubels und dem Auschluss einiger russischer Banken aus dem Zahlungssystem Swift, werden auch einige Fertigungen und Kooperationen zu Automobilherstellern auf Eis gelegt beziehungsweise sogar ganz beendet. Wie stark sich die Unternehmen dem entgegensetzten müssen, erklärt Dr. Jan Burgard, CEO der Berylls Group im Podcast mit Börse hören.

Quelle: Börse hören.

https://www.brn-ag.de/40124-Burgard-Berylls-Strategy-Advisors-Russland

Dr. Jan Burgard (1973) ist CEO der Berylls Group, einer internationalen und auf die Automobilitätsindustrie spezialisierten Unternehmensgruppe.

Sein Aufgabengebiet umfasst die Transformation von Luxus- und Premiumherstellern, mit besonderen Schwerpunkten auf Digitalisierung, Big Data, Start-ups, Connectivity und künstliche Intelligenz. Dr. Jan Burgard verantwortet bei Berylls außerdem die Umsetzung digitaler Produkte und ist ausgewiesener Spezialist für den Markt China.

Dr. Jan Burgard begann seine Karriere bei der Investmentbank MAN GROUP in New York. Die Leidenschaft für die Automobilitätsindustrie entwickelte er während Zwischenstopps bei einer amerikanischen Beratung und als Manager eines deutschen Premiumherstellers.

Im Oktober 2011 komplettierte er die Gründungspartner von Berylls Strategy Advisors. Die Top-Management-Beratung ist die Basis der heutigen Group und weiterhin der fachliche Nukleus aller Einheiten.

An das Studium der Betriebs- und Volkswirtschaftslehre, schloss sich die Promotion über virtuelle Produktentwicklung in der Automobilindustrie an.

Featured Insights

y some estimates, metaverse activity will generate more than $1 trillion in annual revenues. But why and how should carmakers get involved?

Facebook renaming itself Meta in late 2021 kickstarted a significant amount of hype and often misinformed discussion around the metaverse. Even the notion of a single metaverse is – at least for now – misleading. We define a metaverse as an open virtual world with 3D graphics, in which users can roam and interact with one another as well as the structures within it.

You are right. Metaverses are nothing new per se: gamers have long been used to meeting and interacting with virtual personas in online worlds. Second Life, arguably the first pure metaverse, serves as a warning – it was launched in 2003 but never gained mainstream traction. However, two decades on, accelerated by Covid-19, the virtual world is now far more closely intertwined with the real world, VR and AR hardware is more financially attainable. Even more dramatically, what has changed in recent months is that companies have had an epiphany regarding the commercial potential of these virtual spaces.

Global brands including Nike are making bets on the metaverse, where young consumers are already congregating. The sportswear giant is launching “Nikeland”, a virtual brand experience within the Roblox metaverse, which is frequented by an estimated two-thirds of tomorrows car buyers in the US. At the end of 2021, Every Realm, a metaverse investor, had purchased $4.3 million of virtual land. However, this could potentially be dwarfed by the estimated $1 trillion of revenue that analysts at Greyscale Investments, a digital currency asset manager, estimate may be created each year in metaverse spaces. Some $25bn will be spent on virtual luxury goods and collectibles alone by 2030, Morgan Stanley forecasts.

We believe it is now safe to say: the metaverse matters and this time it is different.

Investing in the metaverse is similar to investing in the early days of the internet – the risks are undeniable, but so is the scale of the potential opportunity. In our view, the car industry has even more to gain from embracing the metaverse than many other sectors.

OEMs have an opportunity to increase their toplines by selling virtual vehicles or merchandise, as well as by positioning their brands in the virtual spaces that the car buyers of today and tomorrow are actively flocking to.

There is also an opportunity to reduce costs by improving operations. The key benefit of using the metaverse as an operational play is the ability to accelerate the planning process, with increasing precision and efficiency. By using the data produced by a virtual twin to anticipate how production operations will work in reality, OEMs can plan, test and optimize production lines before and during a model’s production cycle.

This is not science fiction. OEMs have already begun moving into the metaverse pursuing different strategies: Hyundai and Cupra, for example, have created virtual brand experiences in the metaverse, displaying their visions of the future of mobility as well as their new vehicles. BMW has teamed up with Nvidia to create a virtual twin of its Regensburg factory on Nvidia’s Omniverse platform, to plan, test and optimize production operations.

Metaverse: BMW Virtual Twin Production Line

We have assessed OEMs’ metaverse activities to date and grouped them in the illustration below. The result shows that carmakers have seen the visual branding value in metaverses, ranging from Ferrari creating a virtual twin for car configurations, to the creation of proprietary metaverses to advertise new vehicles.

At the same time, a small group of innovators are setting themselves apart: like BMW, Hyundai is also building a “meta-factory” at the company’s innovation center in Singapore. The aim is to learn how to maximize the use of robots in production by virtualizing robot-controlled processes, using experts with VR headsets to operate the robots remotely.

Merging the real and the virtual, Audi is currently working on a hybrid in-car experience, combining the sensation of a moving vehicle with travelling through a virtual metaverse, experienced via a VR headset while sitting in the real car.

What is more, Chinese OEM IM Motors is developing a hybrid sales experience in which users can earn points redeemable for parts and accessories through their driving behaviors.

As more carmakers enter the space, waiting could be costly. What actions can OEMs take now to stay ahead of the wave?

First: win acceptance from top management. Agreed, metaverse as an abstract topic may be neglected and shunned on OEMs top floors. Bringing tangible examples of how other established companies including OEMs are engaging in the Metaverse can create the urgency to act.

Second: Decide on a metaverse strategy to pursue. Should the strategic focus be on branding, sales, operational improvements, hybrid virtual-real customer experiences, or a combination of these? A decision is needed here: OEMs risk losing touch with the generation of brand-obsessed, digital-native car buyers who have grown up living in virtual spaces. These customers expect to interact with their chosen brands in both the physical and virtual world.

Third: Decide on how to enter the metaverse. Depending on OEM endowment and willingness to engage, a decision must be made whether to invest in a footprint in an established metaverse or to rent a space within it. On the other side of the spectrum, OEMs may opt to build a proprietary metaverse capturing full freedom and influence over the virtual space.

Fourth: Decide which metaverse to enter. Community size, growth, composition, and engagement differ across metaverses. Making sure these parameters match with the metaverse strategy is key. What is more: Depending on the metaverse, just as with real-world real estate, the amount of virtual land in a specific metaverse can be capped, and plots that are close to users’ favored spots are the most sought after. This creates scarcity and drives virtual land values higher. Swift action is needed to pre-empt exploding virtual real estate prices.

Last: Decide on key partners. OEMs will likely not have the capabilities for a metaverse strategy in-house. Partnerships are key. Depending on the level of metaverse engagement, different types of partners should be considered. These may range from freelance designers, useful, for example, for the creation of brand experiences in existing metaverses, all the way to tech companies that may serve the OEM in its full spectrum metaverse strategy.

Investing in a footprint in the metaverse is a high-risk, high-reward opportunity. Done right, OEMs can secure the attention of future car buyers, position their brands as innovative and optimize their operations. We believe that, as with the internet itself, joining the metaverse is not a question of when, but if.

Stay tuned: In upcoming posts, we will lift the curtain and deep dive on selected OEM metaverse strategies.

Timo Kronen (1979) is partner at Berylls Group with focus on operations. He brings 17 years of industry and consulting experience in the automotive industry. His focus is on production, development and purchasing as well as supplier task forces. Some of his recent projects include:

Restructuring of the Procurement Function (German Sports Car OEM), Supplier Task Force for an Onboard Charger (German Premium OEM), Strategy Development for the Component Production (German Premium OEM)

Before joining Berylls, Timo Kronen worked at PwC Strategy&, Porsche Consulting Group and Dr. Ing. h.c. F. Porsche AG. He holds a diploma degree in industrial engineering from the Karlsruhe Institute of Technology (KIT).

Featured Insights

Munich, March 2022

any CX improvements are planned and prototyped, but too often never make it to delivery. Berylls Mad Media’s four cornerstones enable carmakers to transform their customer experience.

As customer expectations for personalization and seamless cross-channel experiences continue to rise, there remains huge potential for optimizing customer interaction in the automotive industry.

For most companies, detailed customer insights are already to hand. Yet the mindset, capabilities, and infrastructure to use the data effectively for real-time decision-making are lacking. Corporate IT landscapes remain fragmented between business units and regions, inhibiting the optimization of customer journeys. Equally fragmented budget planning slows down innovation and incentivizes silo-thinking. Inconsistency between online and real-world touchpoints confuses customers and complicates customer journey development.

Yet it is possible to meet these challenges with a structured approach through all business units. We have identified four cornerstones that will enable OEMs to transform into organizations capable of providing a best-in-class customer experience (CX):

Journey execution framework

End-to-end data strategy

Centralized CX portfolio

Test and learn approach

#1 Journey execution framework

#2 End-to-end data strategy

#3 Centralized CX portfolio

#4 Test and learn approach

In our work with clients, we ensure that all organizational layers are enabled to work on common goals that establish industry-leading personalized customer experiences. This approach is underpinned by a harmonized technology infrastructure, an iterative approach to planning and KPI-driven touchpoint optimization.

Companies need to act today – because customer experience is the differentiator of tomorrow.

The methods and tools of CX are everywhere. Requests for proposals, design sprints and strategic war rooms are full of colored post-its, CX prototypes and designs, and demonstrations of journeys mapped. But the truth is that most CX initiatives don’t deliver. Most prototypes never make it to delivery, organizational priorities overrule customer needs, and journey maps end up doing little more than decorating the walls. The conclusion: companies need to address CX execution.

Issues to be tackled include:

Competing challenges such as rising customer expectations and intensifying competition result in fragmented and disconnected CX initiatives, wasting valuable resources and often undermining customer experience.

Focus on CX collides with commitment to follow-through. When change begins to hurt – when teams genuinely transform the way they work – organizations often falter and return to the familiar path of how things have always been done.

Deliverables in the form of prototypes are no longer enough: CX initiatives will be scrutinized more critically and CX managers will be asked to demonstrate a measurable contribution to both top-line and bottom-line growth.

The automotive industry is particularly vulnerable to CX failure. Disconnected organizational structures, outdated planning and budgeting processes, fragmented system and data infrastructures, and the lack of direct customer touchpoints constitute a highly explosive mixture.

Customer touchpoints can be digital, in the form of emails, app push notifications and website landing pages, or offline interactions, such as test drives. Often, OEMs are held back from engaging directly with customers through some of these touchpoints because dealers still control many of the interactions and thus the data, especially during the sales process.

Companies that do not optimize their CX development processes will struggle to achieve rapid innovation and digital experience execution, will experience disproportionally high development costs and fail to deliver connected experiences, and are unlikely to achieve personalization due to a fragmented supporting data and IT architecture.

These are the seeds of failure in any CX initiative. The existing toolbox used by customer experience teams does not contain solutions to the real problems out there. It must be scrutinized and refined. How? At Berylls Mad Media, we prioritize horizontal harmonization and vertical integration:

At a strategic level, companies must harmonize CX thinking to connect purpose with execution. They must connect customer journeys with employees and with the organization. Customer journey mapping needs to become the central source of truth for CX projects.

Three elements must drive the CX portfolio backlog: business and brand strategy, qualitative and quantitative insights, and technology-driven innovations. When organized this way, the CX portfolio owns a harmonized, cross-functional backlog that serves as a basis for roadmaps and agile implementation. This breaks up functional silos and helps to steer departments towards the same goals.

At a structural level, CX execution demands deep vertical integration. Front-end designs and click-dummies are only the first step. To evolve them into revenue-generating product features, all elements of an organization need to be involved: processes, organizational design and governance, enabling technologies and architecture blueprints, and an end-to-end data strategy, as well as external stakeholders. For this to work sustainably, it takes guiding principles, methods and frameworks that enable organizations to connect customer experiences directly with the corresponding value-creating delivery processes.

For OEMs, these two themes represent a fundamental transformation. Yet once CX becomes horizontally harmonized and vertically integrated, other challenges will be tackled more easily because integration enables OEMs to react more flexibly to customer needs, shorten time-to-market, outperform established competition, and go head-to-head with new competitors in areas including software and direct sales.

To deliver personalized customer experiences, OEMs need to know their customers and their journeys in the first place. Data may be the new gold – but many OEMs struggle to leverage the potential of their most precious customer data. Typically, they do not follow a clear and standardized data governance process, resulting in inefficient data management, and they lack organizational design and communication structures to connect, enhance and share insights. If data quality is poor or incomplete, the result will be uncertainty in planning marketing budgets and in projecting sales.

To maximize sales conversions and efficiently attribute campaigning efforts to the most successful touchpoints, it is crucial to first align on goals, objectives and KPIs. Once these are defined the required tracking infrastructure along the entire customer journey can be created, so that each touchpoint generates customer traffic and conversion insights, which in turn shapes marketing budget splits and touchpoint optimization measures.

Seamless customer journeys are hard to realize because touchpoints are often based on non-unified IT systems that cannot access the same data and that lack interfaces to provide truly personalized customer experiences. This is why enabling technologies are frequently optimized for single touchpoints. The result: national sales companies develop local solutions and define their individual local journeys, perpetuating highly fragmented system landscapes, data security inefficiencies and high maintenance costs.

Harmonization of this architecture can transform CX. Cross-functional teams rather than separated business and IT functions will help establish transparency, allowing accurate attribution of revenue growth and customer satisfaction to underlying technologies, and ultimately enabling continuous improvement, better customer focus and higher degrees of personalization.

This means that OEMs should bite the bullet and let go of legacy systems. Even if maintaining them seems cheaper than investments in modern platforms, they hinder the development of innovative solutions that cut long-term costs and improve CX targeting and business goal achievement.

Seamless customer journeys are hard to realize because touchpoints are often based on non-unified IT systems that cannot access the same data and that lack interfaces to provide truly personalized customer experiences. This is why enabling technologies are frequently optimized for single touchpoints. The result: national sales companies develop local solutions and define their individual local journeys, perpetuating highly fragmented system landscapes, data security inefficiencies and high maintenance costs.

Harmonization of this architecture can transform CX. Cross-functional teams rather than separated business and IT functions will help establish transparency, allowing accurate attribution of revenue growth and customer satisfaction to underlying technologies, and ultimately enabling continuous improvement, better customer focus and higher degrees of personalization.

This means that OEMs should bite the bullet and let go of legacy systems. Even if maintaining them seems cheaper than investments in modern platforms, they hinder the development of innovative solutions that cut long-term costs and improve CX targeting and business goal achievement.

Digital channels have made it easy to create customer touchpoints. Carmakers’ big marketing budgets make it easy to increase digital share of voice. Yet spending these budgets efficiently on touchpoints that encourage customers to convert is difficult. The rate at which new digital touchpoints are created exceeds the rate at which digital governance succeeds in aligning them.

This leaves OEMs trapped in a broken landscape of touchpoints that are not part of a centrally orchestrated customer journey. Typically, OEMs are not able to determine the success of specific touchpoints and whether to build upon or abandon them. More importantly, it leaves customers confused when they are confronted by information overload and touchpoint inconsistencies. Customers prefer logical sequences of touchpoints that build upon one another across channels with relevant information and relevant calls for action. Today’s customers have learned – mostly from industries other than automotive – to expect certain levels of consistency, transparency, and simplicity in communication. Some auto industry start-ups are confronting these challenges, but many incumbents are not.

Most OEMs plan their budgets long before they are utilized. By the end of the planning year, budgets are often set in stone, and some unused budgets transfer automatically to the following year or even two years. With this way of working, agility in the face of changing external and internal parameters is almost impossible.

Planning cycles of such length undermine making CX a high priority because no one can forecast exact customer needs in two years’ time, let alone the feature requirements that meet them.

OEMs are struggling to exit the budget trap due to rigid hierarchies and behaviors that incentivize self-optimization by single business functions. The delivery of a budgeted requirement counts as success, whether it improves CX or not. What is lacking is central direction capable of managing cross-functional backlogs, which should be the basis for planning. In a CX-focused organization, planning and delivery go hand-in-hand and are not governed by calendar years.

Most OEMs plan their budgets long before they are utilized. By the end of the planning year, budgets are often set in stone, and some unused budgets transfer automatically to the following year or even two years. With this way of working, agility in the face of changing external and internal parameters is almost impossible.

Planning cycles of such length undermine making CX a high priority because no one can forecast exact customer needs in two years’ time, let alone the feature requirements that meet them.

OEMs are struggling to exit the budget trap due to rigid hierarchies and behaviors that incentivize self-optimization by single business functions. The delivery of a budgeted requirement counts as success, whether it improves CX or not. What is lacking is central direction capable of managing cross-functional backlogs, which should be the basis for planning. In a CX-focused organization, planning and delivery go hand-in-hand and are not governed by calendar years.

Berylls Mad Media identifies four cornerstones that ensure CX focus from ideation to delivery and continuous optimization:

A journey execution framework to develop a central customer journey by standardizing data, systems and processes that build the foundation for personalization.

1. A journey execution framework to develop a central customer journey by standardizing data, systems and processes that build the foundation for personalization.

An end-to-end data strategy to track and analyze touchpoint performance across the customer journey.

2. An end-to-end data strategy to track and analyze touchpoint performance across the customer journey.

A centralized customer experience portfolio to ensure consistency across touchpoints and facilitate cross-domain prioritization and agile delivery of the product backlog.

3. A centralized customer experience portfolio to ensure consistency across touchpoints and facilitate cross-domain prioritization and agile delivery of the product backlog.

A test-and-learn approach to iteratively design touchpoints and gather high-frequency customer feedback to quickly validate or reject hypotheses.

4. A test-and-learn approach to iteratively design touchpoints and gather high-frequency customer feedback to quickly validate or reject hypotheses.

The journey execution framework (JEF) is a tool that integrates CX focus across organizational layers. It ensures that all teams – even those who have traditionally identified as backend functions – understand their impact on customer experience. The JEF consists of three interconnected levels:

Organizations need to understand the customer perspective. The JEF is centered around one target customer journey, an idealized process that illustrates how a customer moves from brand awareness, consideration, checkout, and purchase to ownership including aftersales and eventually repurchase.

• Even while customers seldom follow the exact target journey, the JEF sets important guidelines that facilitate product, marketing, and service decisions.

• The customer journey template provides OEMs with new levels of control over their customers’ experiences.

• The full target journey is broken down into use cases that can be put into operation, and each one becomes a micro journey with clear start and end points, that can be prioritized by their impact on purchase decisions.

Use cases can be put into operation with process charts that link touchpoints across online and offline channels, bounded by use case entry and exit points. Drafting effective use cases demands the involvement of experts – it is through collaborating with stakeholders that the charts show their true power as vehicles to drive discussions.

• The interaction blueprint for micro journeys offers a high level of control due to clear scoping and higher level of detail.

• The charts of sales-related use cases show how to loop users who abandoned the target journey back into the funnel.

• The interaction blueprint visualizes customers’ interactions with touchpoints and customer-facing services.

The architecture blueprint picks up where the interaction blueprint stops by mapping technology enablers to specific use cases. It serves as a key element for standardization by applying the architecture and data flow mapping approach to the use cases from the entire customer journey.

• Enabling technologies will be mapped to the interaction blueprint, including all relevant systems and data sources, with tech experts supporting this process.

• The blueprint across different micro journeys builds the foundation for and drives the overall IT target architecture.

• The resulting requirements flow into a central backlog that represents the basis for delivery. Critically, the backlog needs to be governed by a central body, authorized to manage crossfunctional requirements that historically were developed and delivered in functional silos.

Data must be a key source of truth that is consulted for every strategic decision. To achieve an overarching data strategy, a homogeneous data structure must be defined across information collected directly from customers, as well as third-party data (from data providers), and analytics data. From there, all the data must be collected and processed in a uniform system. Resources that are capable of processing and deriving insights must be established.

Homogeneous data management is the cornerstone that enables the individualized touchpoints along the customer journey. To implement this strategy, OEMs need to achieve the following:

#1 Establish a holistic customer view across all channels, linking marketing, sales and service.

#2 Create real-time triggers based on customer data to achieve meaningful customer interactions.

#3 Define personalized next-best actions and install next-best offers based on learnings from customer interactions.

#4 Standardize communication patterns to provide consistency across the customer experience.

Understand your customer based on direct and third-party insights.

Show relevant content at the right time on the preferred channel.

Fully automate cross-channel views of campaign performance for real-time decision-making.

Understand your customer based on direct and third-party insights.

Show relevant content at the right time on the preferred channel.

Fully automate cross-channel views of campaign performance for real-time decision-making.

An organization capable of end-to-end CX focus requires a centralized portfolio:

All elements of the JEF are designed at a central level. Touchpoint blueprints and the system infrastructure can be centrally developed and maintained, and deployed in markets.

Some elements, especially offline touchpoints and legal requirements, continue to call for local adaptations, but these adaptations should be closely aligned with central objectives.

Clear processes enable cross-domain prioritization and agile delivery of central portfolio backlogs.

Resource and budget allocation is based on the central backlog to break up departmental silos.

#1 Definition of only one central target customer journey, from which use cases and touchpoints are reverse-engineered. While the customer journey is broken down into use cases that consist of several touchpoints, all elements aim to realize that one target journey.

#2 All elements of the JEF are designed at a central level. Touchpoint blueprints and the system infrastructure can be centrally developed and maintained, and deployed in markets.

#3 Some elements, especially offline touchpoints and legal requirements, continue to call for local adaptations, but these adaptations should be closely aligned with central objectives.

#4 Clear processes enable cross-domain prioritization and agile delivery of central portfolio backlogs.

#5 Resource and budget allocation is based on the central backlog to break up departmental silos.

Visualize the entire CX to ensure a smooth customer journey.

Reduce duplication and realize synergies.

Quickly adapt the target customer journey and its micro journeys based on changing customer needs.

Visualize the entire CX to ensure a smooth customer journey.

Reduce duplication and realize synergies.

Quickly adapt the target customer journey and its micro journeys based on changing customer needs.

The key characteristic of companies capable of anticipating changing customer needs is flexibility. From fixed long-term plans and rigid lists of high-level requirements, OEMs need to move towards short cross-channel planning increments, based on prioritized and regularly refined backlogs. While the high-level customer journey serves as an overarching target, an agile mindset ensures sufficient flexibility to reach it.

All OEMs should follow these fundamental guidelines:

#1 Don’t start with a plan, start with hypotheses.

#2 Validate or reject hypotheses by quickly gathering customer feedback with minimum viable product (MVP) launches, customer surveys and user testing.

#3 Iterate based on feedback to meet your customers’ needs better, and then even better.

#4 Don’t consider delivery itself as a success, define success as the desired changes in customer behavior based on your delivery.

#5 Confront failure by generating learnings for real change in future iterations; beware of the sunk-cost fallacy that puts failure on repeat.

Berylls Mad Media helps clients transform into truly customer-centric organizations that focus on personalized customer experiences. We are a team of CX specialists who have successfully guided clients across industries with this challenging endeavor.

We ensure that CX doesn’t stop with a design sprint or prototype. We facilitate the development of target customer journeys, from which we reverse-engineer a consistent landscape of marketing and sales touchpoints, based on standardized technologies. We build the foundation for tracking real-life customer journey performance end-to-end with a holistic KPI framework. We support the formation of a centralized governance model that embraces shorter planning cycles, agile methodologies, and hypothesis-driven development.

We believe that CX requires entire organizations to collaboratively work towards common goals.

Jonas Wagner, born in 1978, is a Partner and Managing Director of Berylls by AlixPartners (formerly Berylls Mad Media). With around 20 years of consulting experience in the automotive industry, Jonas is a trusted advisor for top management, specializing in strategy, organizational development and large transformation programs for leading, global automotive manufacturers.

Jonas excels in guiding automotive companies through the transformation of their sales and marketing functions. He has a proven track record in digitalizing customer interfaces to enhance customer experience, sales conversion and loyalty. His expertise includes introducing and implementing new sales and business models tailored to the evolving market landscape and developing data-driven sales and marketing organizations to optimize performance and efficiency. His expertise includes all on- and offline touchpoints as well as business segments, ranging from sales, after-sales, financial services to new business models.

Before joining Berylls, Jonas was a leading consultant within the Automotive Practise of Oliver Wyman, where he worked with global automotive manufacturers, enhancing their strategic initiatives and operations.

Jonas holds a degree in Business Administration from the Aarhus School of Business and the University of Mannheim, with a focus on International Management, Marketing, and Controlling. Combining deep industry knowledge with strategic acumen, Jonas Wagner is a valuable partner for automotive leaders navigating complex transformations.

Christian Herr (1988) is a Principal at Berylls Mad Media. He has been a consultant for more than 10 years, advising clients in IT and CX transformations, ranging from CX strategy definition to implementation.

His professional background builds around data driven sales & marketing, especially focusing on customer experience excellence, customer journey design and execution. This includes planning and implementing customer-centric and data-driven end-to-end solutions to deliver excellent customer experiences along the entire customer journey. Before joining Berylls, he worked for various clients in different industries in Germany and abroad.

Christian studied business informatics at KIT in Karlsruhe and at DHBW in Mannheim, with focus on service management, engineering, and business informatics.

Featured Insights

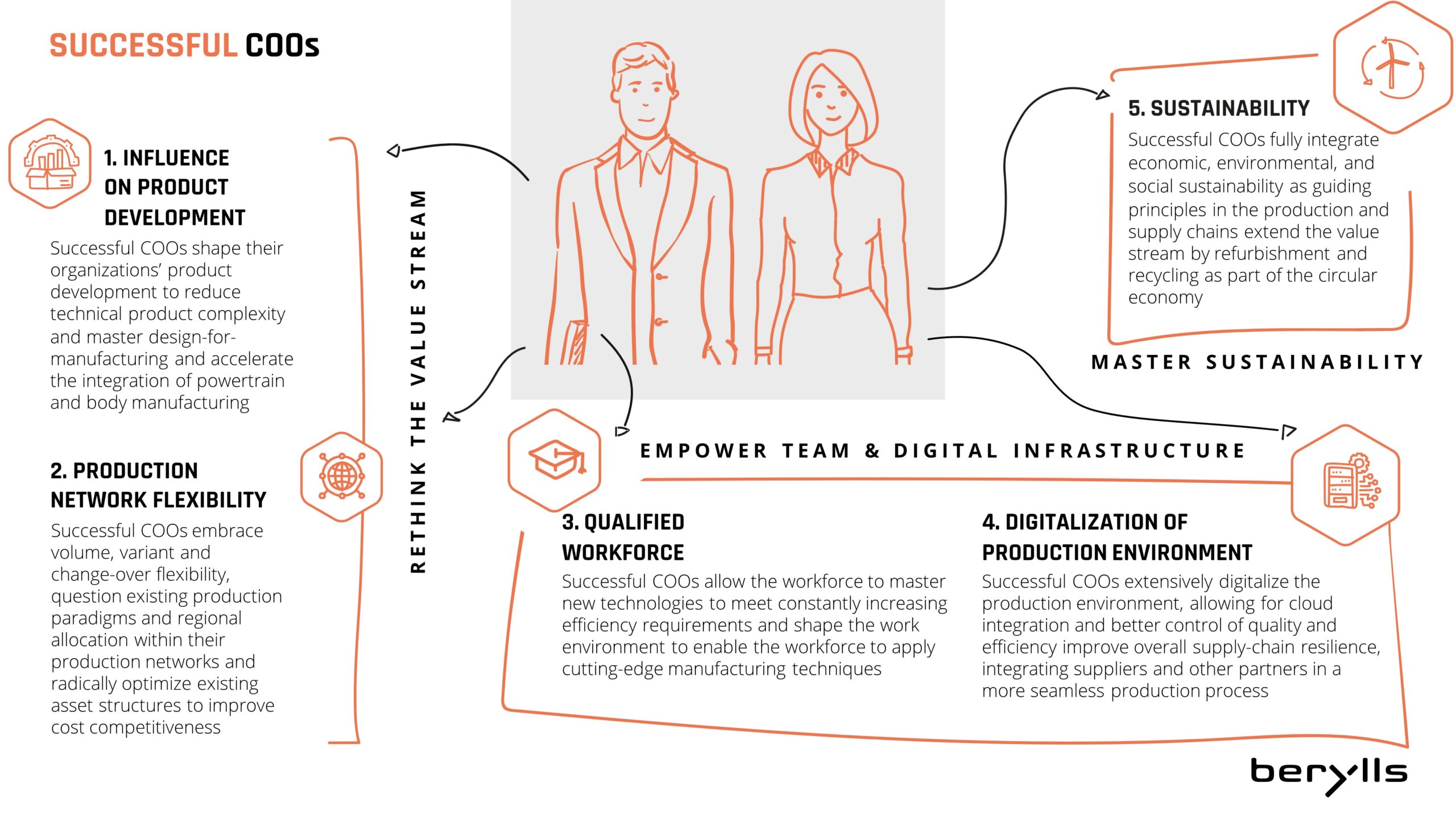

e discussed our five key principles for success with leading automotive COOs, and their perspectives confirm the changes OEMs need to make to sharpen their competitive edge.

OEMs and suppliers are under intense pressure on multiple fronts, from shortening product development cycles and streamlining production, to the transition to electric vehicles and meeting consumer demands for greater customization – and it is the COO who is expected to deliver.

Amid so much disruptive change, our COO Agenda 2021, launched last August, identified five guiding principles for COOs to follow to maintain their companies’ competitive edge:

Influence on product development

Production network flexibility

Qualified workforce

Digitalization of production environment

Sustainability

#1 Influence on product development

#2 Production network flexibility

#3 Qualified workforce

#4 Digitalization of production environment

#5 Sustainability

To take the agenda forward, we interviewed 26 automotive COOs and leading industry production professionals at the end of 2021. Over the course of some very fruitful conversations, for which we thank our interviewees, we asked them to rank our five principles in order of importance to their work. We also asked them to identify any other issues that COOs will need to address in a rapidly evolving market. Two additional themes came to the fore – operational excellence and culture. We regard both as essential enablers of the changes OEMs and suppliers are making.

In the coming months, we will share more detailed insights, starting with two of the priority areas for COOs – production network flexibility and sustainability. We look forward to your feedback on these subjects and will be publishing further insights on the other principles later this year.

“The key challenge when introducing flexibility is to find the optimum,” the COO of one OEM told us. “Do I look at a single plant or the network and how large is the ultimate benefit?” Most of our interviewees confirmed that while their companies are increasing flexibility by focusing on production lines and plants, this is not happening yet at network level. We are convinced that the network has to deliver flexibility, although this does not mean that every single plant in the network has to be fully transformed.

Going forward, we expect successful COOs to embrace volume, variant and change-over flexibility, while challenging current production processes and streamlining assets to improve cost competitiveness.

RELATIVE IMPORTANCE

Relative Importance: Very High

“The key challenge when introducing flexibility is to find the optimum,” the COO of one OEM told us. “Do I look at a single plant or the network and how large is the ultimate benefit?” Most of our interviewees confirmed that while their companies are increasing flexibility by focusing on production lines and plants, this is not happening yet at network level. We are convinced that the network has to deliver flexibility, although this does not mean that every single plant in the network has to be fully transformed.

Going forward, we expect successful COOs to embrace volume, variant and change-over flexibility, while challenging current production processes and streamlining assets to improve cost competitiveness.

Our interviewees agreed that being able to influence product development is a key enabler for achieving flexibility. “The product needs to fit the lines, [so] we need to influence R&D and drastically reduce complexity,” said the plant manager at one OEM, a view shared by many other respondents. We believe that in future the most competitive companies will empower COOs to simplify products through design-for-manufacturing and the integration of powertrain and body manufacturing.

RELATIVE IMPORTANCE

Relative Importance: High

Our interviewees agreed that being able to influence product development is a key enabler for achieving flexibility. “The product needs to fit the lines, [so] we need to influence R&D and drastically reduce complexity,” said the plant manager at one OEM, a view shared by many other respondents. We believe that in future the most competitive companies will empower COOs to simplify products through design-for-manufacturing and the integration of powertrain and body manufacturing.

“A couple of years ago, colleagues smiled when sustainability was mentioned,” the COO of one OEM recalled. “However, ultimately it will give us our license to build cars and is central to our strategy.” Overall, the survey responses indicate that COOs understand why sustainability must be a guiding principle for production and supply chains, with vehicle refurbishment and component recycling also extending the value stream as part of a circular economy in future. However, we found that the motivation of interviewees to take action now to promote sustainability varied between companies.

RELATIVE IMPORTANCE

Relative Importance: High

“A couple of years ago, colleagues smiled when sustainability was mentioned,” the COO of one OEM recalled. “However, ultimately it will give us our license to build cars and is central to our strategy.” Overall, the survey responses indicate that COOs understand why sustainability must be a guiding principle for production and supply chains, with vehicle refurbishment and component recycling also extending the value stream as part of a circular economy in future. However, we found that the motivation of interviewees to take action now to promote sustainability varied between companies.

“It is getting continuously harder to find the right employees, even in major cities where you might think you have a choice,” the COO of one leading OEM remarked in frustration. Meanwhile, another COO stressed that despite introducing various upskilling programs, “you cannot take everyone in your organization on this journey”. We expect remaining employee resistance to change to weaken as it becomes clear that the jobs of the future will only be open to digitally-skilled workers with the ability to use the latest manufacturing technologies.

RELATIVE IMPORTANCE

Relative Importance: Medium

“It is getting continuously harder to find the right employees, even in major cities where you might think you have a choice,” the COO of one leading OEM remarked in frustration. Meanwhile, another COO stressed that despite introducing various upskilling programs, “you cannot take everyone in your organization on this journey”. We expect remaining employee resistance to change to weaken as it becomes clear that the jobs of the future will only be open to digitally-skilled workers with the ability to use the latest manufacturing technologies.

“Currently we make the mistake that IT departments ask what plant managers want – but they do not know what is possible with today’s technology,” a COO observed. Meanwhile, a plant manager said that his company was only collecting data, without deploying data analytics to add value and enable better decisions. These observations should act as a wake-up call for COOs to make production digitalization an urgent priority, in order to strengthen supply-chain resilience and integrate suppliers and other partners in a more seamless process.

RELATIVE IMPORTANCE

Relative Importance: Medium

“Currently we make the mistake that IT departments ask what plant managers want – but they do not know what is possible with today’s technology,” a COO observed. Meanwhile, a plant manager said that his company was only collecting data, without deploying data analytics to add value and enable better decisions. These observations should act as a wake-up call for COOs to make production digitalization an urgent priority, in order to strengthen supply-chain resilience and integrate suppliers and other partners in a more seamless process.

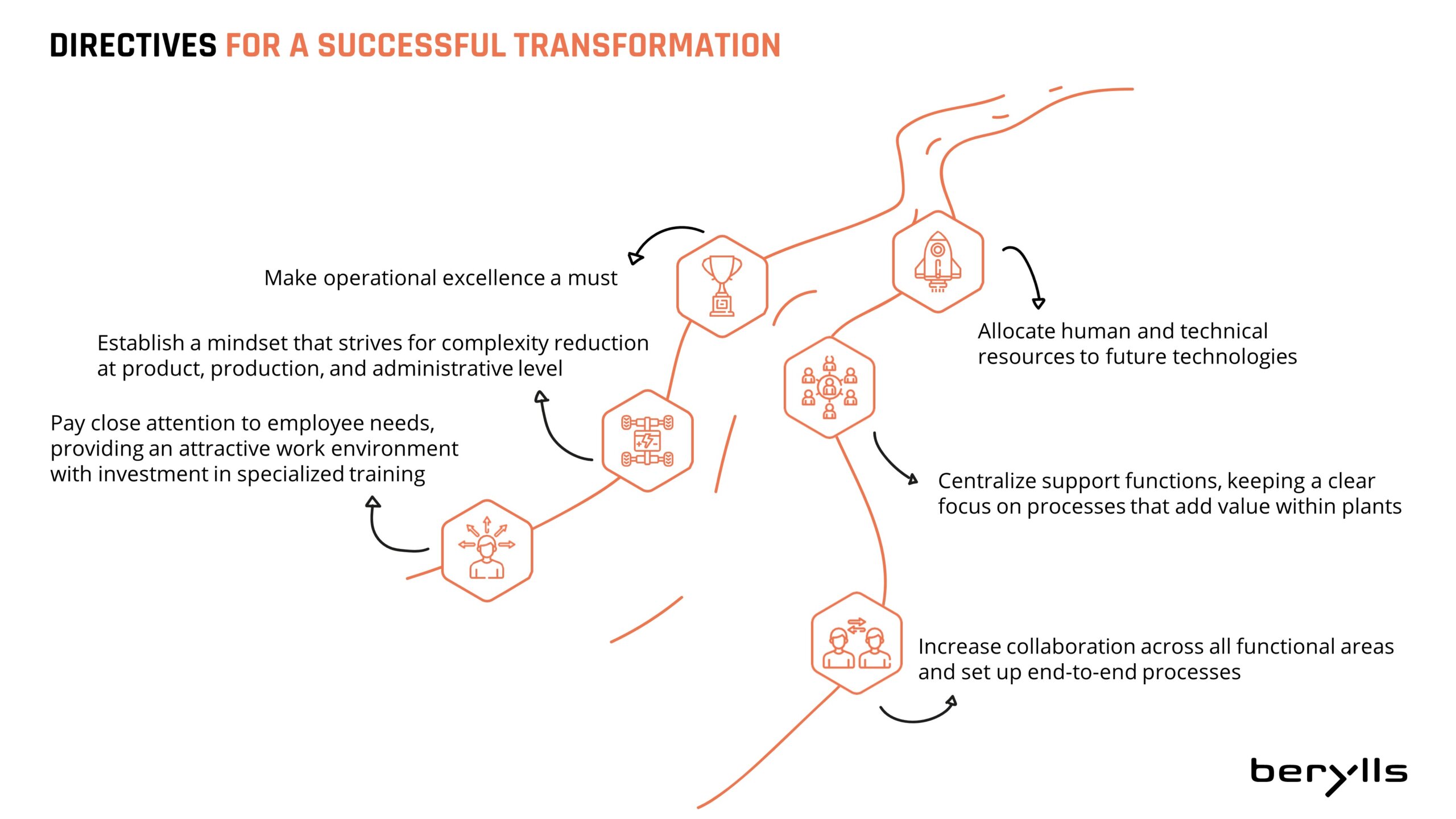

Berylls agrees strongly with the consensus among our interviewees that the two following elements are essential for success as the industry’s transformation accelerates:

“We still need to get better at the things we are currently doing,” the COO of one leading auto supplier declared. “We need to be more disciplined and follow our processes more stringently, not forgetting our continous improvement processes.” Other survey respondents echoed the same viewpoint, especially in the context of increasing competition from China.

However, this is not just about going back to the basics of efficient manufacturing. By reducing costs, operational excellence will enable OEMs to invest in the flexible factories they need.

“We still need to get better at the things we are currently doing,” the COO of one leading auto supplier declared. “We need to be more disciplined and follow our processes more stringently, not forgetting our continous improvement processes.” Other survey respondents echoed the same viewpoint, especially in the context of increasing competition from China.

However, this is not just about going back to the basics of efficient manufacturing. By reducing costs, operational excellence will enable OEMs to invest in the flexible factories they need.

COOs must ensure they have the right culture in place to support implementation of the key guiding principles for success. “We need to introduce a high-performance culture if we want to stay relevant in the future,” one COO said. Yet the experience of many respondents suggests this is easier said than done. “The difficulty is that culture is much harder to influence than production KPIs,” said the COO at another OEM.

For example, it is far more difficult for a production environment to switch to agile ways of working, compared with the sales or other office-based parts of the organization. Nonetheless, COOs cannot ignore such issues – not least because an attractive culture is critical for recruiting and retaining the best talent.

COOs must ensure they have the right culture in place to support implementation of the key guiding principles for success. “We need to introduce a high-performance culture if we want to stay relevant in the future,” one COO said. Yet the experience of many respondents suggests this is easier said than done. “The difficulty is that culture is much harder to influence than production KPIs,” said the COO at another OEM.

For example, it is far more difficult for a production environment to switch to agile ways of working, compared with the sales or other office-based parts of the organization. Nonetheless, COOs cannot ignore such issues – not least because an attractive culture is critical for recruiting and retaining the best talent.

We are grateful to our interviewees for sharing their time and insights, and enriching our analysis of the most pressing issues confronting COOs today. In particular, our discussions have highlighted the importance of production network flexibility and sustainability. During the coming months, we will be producing follow-up reports on these subjects, as well as the other three principles of product development, workforce qualification and digitalization. Drawing on this research, we look forward to continuing our engagement with COOs about the next steps they need to take to maintain their competitive edge.

Heiko Weber (1972), Partner at Berylls Strategy Advisors, is an automotive expert in operations.

He started his career at the former DaimlerChrysler AG, where he worked for seven years and was most recently responsible for quality assurance and production of an engine line. Since moving to Management Engineers in 2006, he has been contributing his experience and expertise to projects for automotive manufacturers as well as suppliers in development, purchasing, production and supply chain. Heiko Weber has extensive experience in the development of functional strategies in these areas and also possesses the operational management expertise to promptly catch critical situations in the supply chain through task force operations or to prevent them from occurring in the first place.

As a partner of Management Engineers, he accompanied the firm’s integration first into Booz & Co. and later into PwC Strategy&, where he was most recently responsible for the European automotive business until 2020.

Weber holds a degree in industrial engineering from the Technical University of Berlin and completed semesters abroad at Dublin City University in Marketing and Languages.

Featured Insights

he Chinese government has backed EV development for two decades, but the number of ICE cars on the roads will still be increasing in 2030

By every measure, China is the world’s most important car market – this year 29 million vehicles are expected to be sold in the country, compared with 21 million in the US and 20 million in the EU. China will further eclipse these two regions in the coming decade: by 2030, Berylls expects 38 million new vehicles to be registered annually in China, equivalent to 31% of the global market, compared with 20% and 18% market share in the EU and US respectively.

The country is also the world’s biggest xEV market, with around 3 million of what the Chinese government calls ‘new energy vehicles’ (NEVs) sold in 2021. Will it retain this leading position over the next decade, as European and US carbon emissions commitments drive the xEV transition in those regions?

NEW ENERGY VEHICLES SOLD (in 2021)

At the UN Climate Change Conference (COP26) in Glasgow in 2021, China committed to the 2015 Paris Climate Agreement to limit global warming by 1.5 °C, and the country (the world’s biggest greenhouse gas emitter) has set a goal of being carbon neutral by 2060. Around 10% of China’s emissions come from the transport sector, and one of the key milestones en route to 2060 is the Chinese Communist Party (CCP)’s target for NEVs to account for 40% of all new vehicle sales by 2030.

In this report, we will look at China’s plans for decarbonizing road transport and how realistic its goal is, in light of the following market dynamics:

China will be the biggest xEV producer worldwide, making 13 million battery electric vehicles (BEVs) a year by 2029

The country will more than triple its battery cell production capacity by 2030

Customer sentiment seems to have fully embraced electrification, and Chinese OEMs such as NIO are ranked more highly than international brands

However, the number of internal combustion engine (ICE) vehicles sold will still be rising in 2030, and make up the largest proportion of cars on China’s roads

China has had a systematic NEV strategy for decades: the target of reaching 40% of new vehicle sales from NEVs by 2030 is not a hurried concession to the growing international pressure to address climate change. Even before the turn of the millennium, the country had a goal to become the world’s leading automotive nation, and new electric drivetrains were a potential route to overtaking established leading markets such as Germany and the US.

NEV development was first funded in the CCP’s tenth Five-Year Plan in 2001, and up to 2008 the focus was on developing pilot vehicles with electric drivetrains. From 2009 to 2016, NEVs were sold to the local market with significant government subsidies and purchase incentives.

Since 2017, subsidies have been much more strictly linked to technical specifications such as range. The current funding program will finish at the end of 2022, however, as has happened in the past, subsidies may be extended, with stricter requirements for eligible EVs. The NEV market is also supported by the “dual credit policy”, a form of carbon market, where OEMs have to meet quotas for NEV production (16% in 2022).

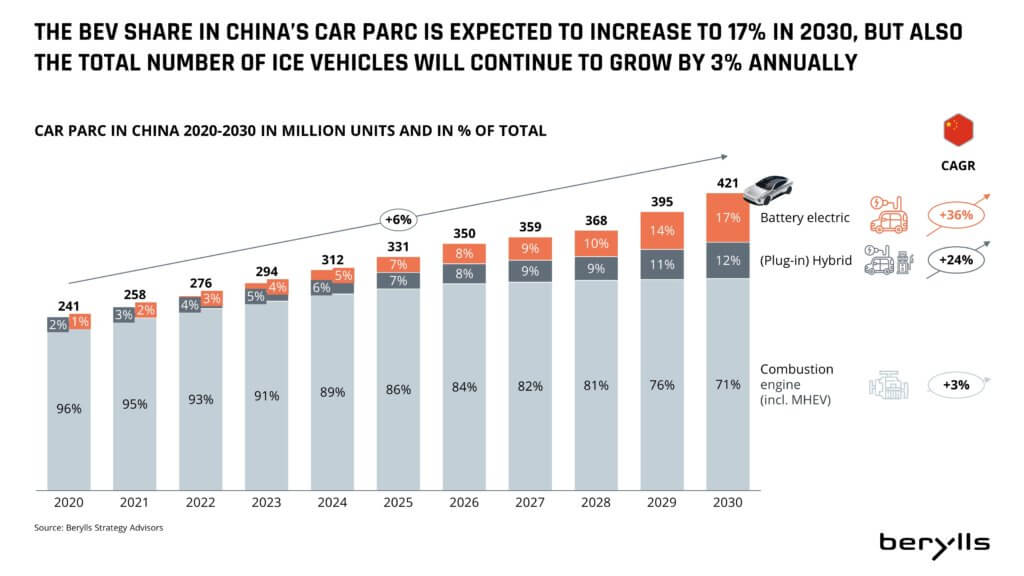

However, despite two decades of government support for e-mobility as a means to close the gap between Chinese and foreign OEMs, our analysis shows that the total number of ICE vehicles on the road in China will continue to increase by 3% a year out to 2030, even if the target quota of 40% NEVs is reached.

As the chart below shows, traditional drivetrains (including mild hybrid vehicles) will account for 71% of cars on the road, the equivalent of 300 million vehicles, at the end of the decade. China’s current NEV targets therefore do not go far enough to cut the number of carbon-emitting vehicles on the road.

Figure 1

While the task of cutting the number of polluting vehicles on the road is far from complete, in several key areas China’s long-term NEV strategy has put it far ahead of Europe and the US.

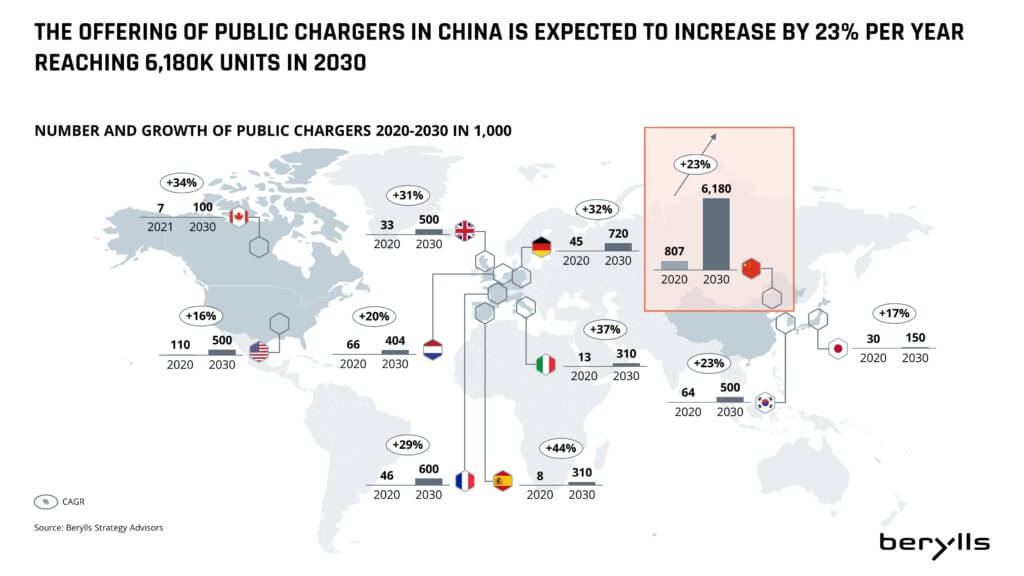

The CCP recognized early on, for example, that the success of NEVs would depend heavily on the availability of charging points. Government programs have subsidized the building of public charging stations since 2014, and approximately 1 million have now been installed.

This means China has by far the largest network of EV charging infrastructure worldwide, with a ratio of 8 BEVs to one charging station. That compares with a ratio of 20:1 in the EU, and sets the global benchmark. Progress is not stopping – as Figure 2 shows, the number of public charging points is expected to increase by 23% a year to reach 6.18 million by 2030.

Figure 2

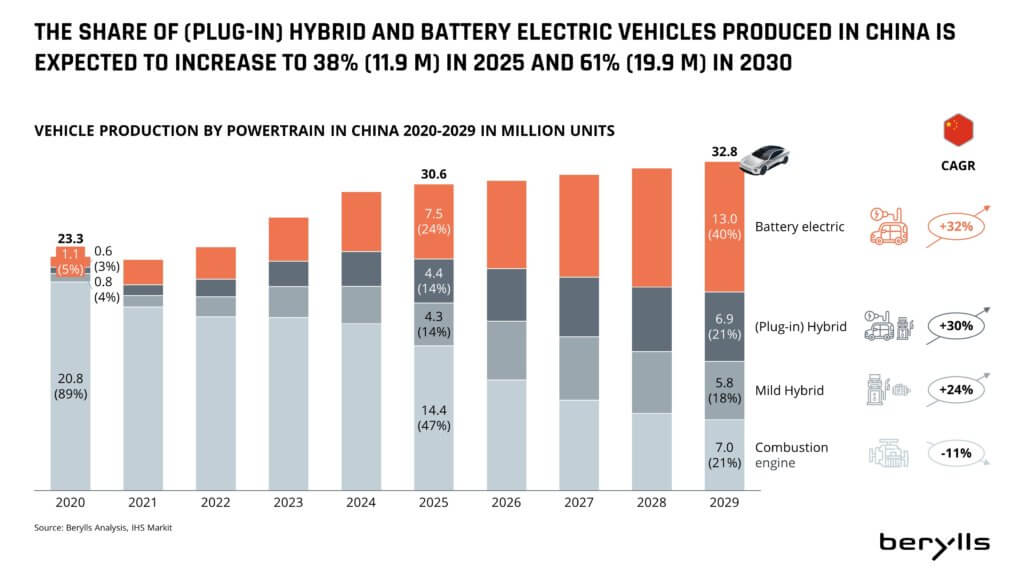

BEV production is also ramping up – today the segment accounts for around 5% of vehicle production, and plug-in hybrids (PHEVs) for another 3%. However, we expect BEV production to accelerate significantly, growing by 32% a year to reach 13 million vehicles annually in 2029 – the equivalent of 40% of all car production (Figure 3). By comparison, we expect the US to produce 4 million BEVs a year in 2029, or 36% of total production volume.

Figure 4

China’s long-term strategy for NEVs also means it has built up a world-leading advantage, in the critical area of battery supply.

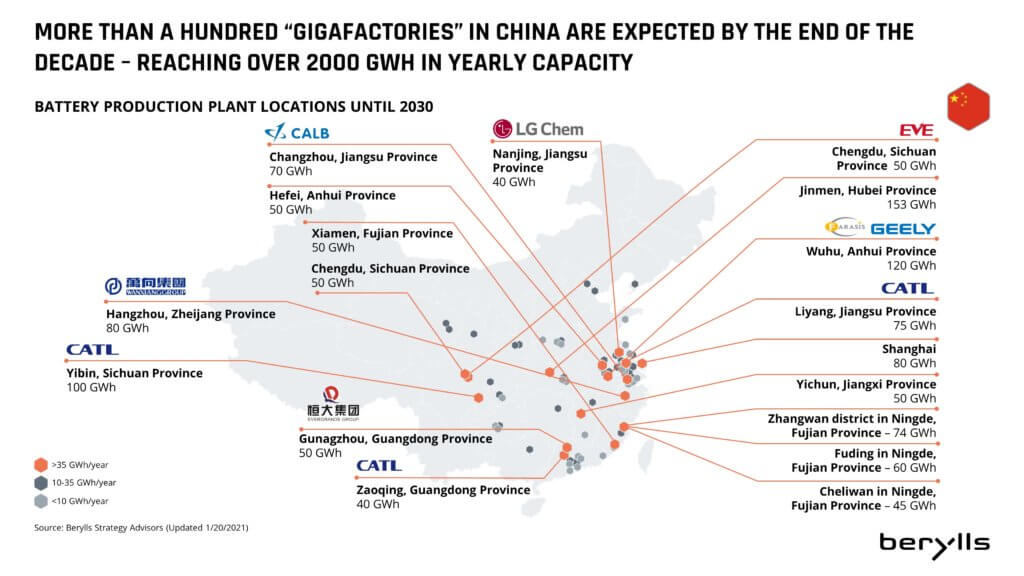

At present, about 80% of the world’s EV batteries are made in China, and OEMs worldwide are heavily dependent on exports from the country: around 70 percent of the battery cells needed for cars manufactured in Europe, for example, come from China. China’s CATL is now the global market leader in lithium-ion EV batteries, along with LG Energy Solution (South Korea) and Panasonic (Japan).

Today’s installed production capacity in China is about 650 GWh/year; we expect capacity to increase more than three-fold to 2,260 GWh by 2030, equivalent to a compound annual growth rate (CAGR) of 16.5%.

Assuming an average capacity of 90 kWh (BEV) / 15 kWh (PHEV), we expect domestic demand in 2029 to be around 1,300 GWh a year, so China will still have plenty of capacity to export battery cells.

Highlighting the scale of China’s battery cell production advantage in comparison with other large automotive markets, there are already several dozen „gigafactories“ for Li-ion cells in the country, whereas in the US there are just five. By the end of this decade, there will be more than 100 gigafactories in China, while in the US, 17 have been announced (Figure 5).

Local production of battery cells is a key advantage for Chinese OEMs, and a vital enabling factor in making the country a leading automotive nation. A key question in the years ahead is whether the country can maintain its pioneering role, not only in terms of quantity, but also in terms of battery technology.

Figure 4

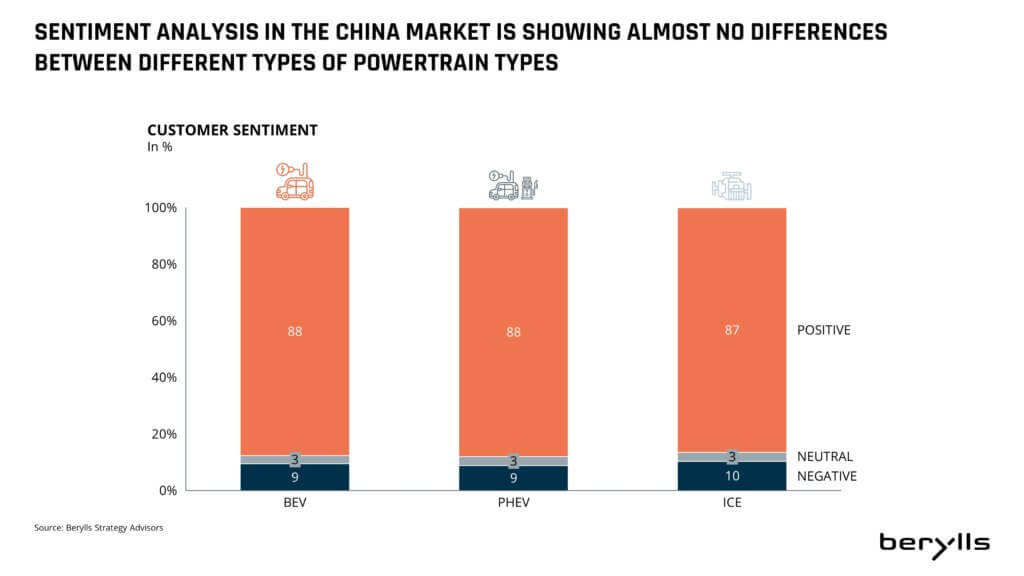

Customers in China seem to have fully embraced electrification. Our analysis of customer sentiment in the country showed almost no differences between the various powertrain types (Figure 6). In fact, the differences between their positive or negative feelings about individual models are significantly greater than between BEV, PHEV or ICE groups.

Figure 5

Reasons for this include the fact that a high proportion of driving happens in urban areas in China (compared to the US for example) and BEVs and PHEVs have a clear advantage in that environment. Other advantages are being able to drive NEVs on days when ICE vehicles are banned due to high pollution levels, and government subsidies for NEVs. An appealing range of NEVs in the lower price segments made by Chinese OEMs also firmly established BEVs and (P)HEVs in the Chinese volume market at an early stage.

Figure 6

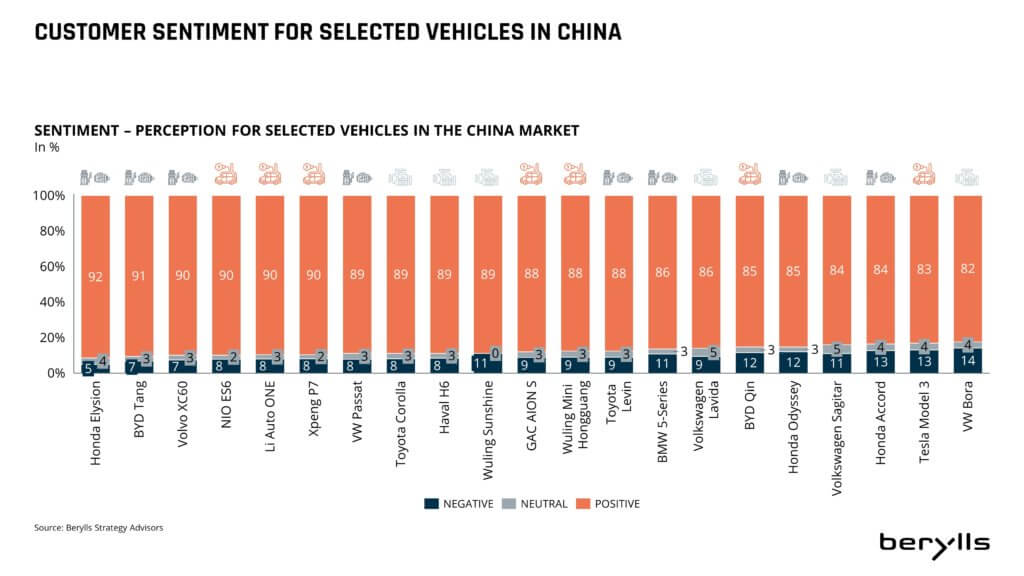

Chinese OEMs also know their customers: the NIO ES 6 performs significantly better in customer sentiment scores than a Tesla Model 3, for example, and a BYD Tang PHEV ranks significantly higher than a BMW 5 Series PHEV (Figure 7).

Driving performance and technical details are not as relevant to NEV customers in China as in other markets, whereas cars with a modern aesthetic and a spacious interior win positive ratings.

The driving range of NEVs has a big impact when it comes to negative sentiment, particularly any difference between real daily range and available range as displayed in the vehicle. Range anxiety is still an important issue for China’s NEV customers, but for different reasons than in the US and Europe – in regions with very high or very low temperatures, heating or cooling can lower the range significantly, and being stuck in traffic also significantly drains the car’s battery. However, the growing number of charging stations in China means drivers are less concerned about being unable to charge when they need to, or during a long journey.

China has vital first-mover advantages in battery cell production and NEV charging infrastructure, as well as NEV production. Customers accept EV engine technology and Chinese OEMs are well liked. Yet if China is serious about decarbonizing road transport, it must go further to ensure the number of carbon-emitting ICE vehicles on the roads are reduced. Currently, there will be 300 million of them on the road in 2030, compared with 257 million this year.

Extending the subsidies due to expire at the end of 2022 would encourage greater NEV adoption, although we would expect the government to make future subsidies smaller and add more requirements for the NEVs they apply to. A more intensive dual credit policy for OEMs, with higher quotas for NEV production, would also drive the market forward.

Dr. Jan Burgard (1973) is CEO of Berylls Group, an international group of companies providing professional services to the automotive industry.

His responsibilities include accelerating the transformation of luxury and premium OEMs, with a particular focus on digitalization, big data, connectivity and artificial intelligence. Dr. Jan Burgard is also responsible for the implementation of digital products at Berylls and is a proven expert for the Chinese market. Dr. Jan Burgard started his career at the investment bank MAN GROUP in New York. He developed a passion for the automotive industry during stopovers at an American consultancy and as manager at a German premium manufacturer.

In October 2011, he became a founding partners of Berylls Strategy Advisors. The top management consultancy was the origin of today’s Group and continues to be the professional nucleus of the Group. After studying business administration and economics, he earned his doctorate with a thesis on virtual product development in the automotive industry.

Featured Insights

ew things shape modern life as much as individual mobility. Be it as an expression of freedom and individuality, or as an economic driver.

To reflect this, we have developed the Solactive Berylls LeanVal Automobility Leaders 100 Index – the AUTO100. It tracks the performance of the 100 most relevant publicly listed automobility players worldwide. By design, the AUTO100 covers the industry’s entire value chain – from vehicle manufacturers and suppliers, to dealer groups, and providers of mobility services or infrastructure.

Due to Chinese New Year and the associated bank holidays, the timing of this second rebalancing of AUTO100 has been slightly adjusted and took place on 07.02.2022.

After a bullish market throughout October and November, December 2021 was quite volatile and fore-shadowed a market correction. In January 2022 global equities experienced their worst monthly overall performance since March 2020.

Nonetheless, the automobility industry’s performance has been received largely positive by investors: Driven by for example electromobility-related activities, the index has achieved a performance of 89.3% since its start (31.12.2018), totaling an active return (market) of 28.5%.

Can’t wait to read more? Download the Insight now!

Dr. Jan Burgard (1973) is CEO of Berylls Group, an international group of companies providing professional services to the automotive industry.

His responsibilities include accelerating the transformation of luxury and premium OEMs, with a particular focus on digitalization, big data, connectivity and artificial intelligence. Dr. Jan Burgard is also responsible for the implementation of digital products at Berylls and is a proven expert for the Chinese market. Dr. Jan Burgard started his career at the investment bank MAN GROUP in New York. He developed a passion for the automotive industry during stopovers at an American consultancy and as manager at a German premium manufacturer.

In October 2011, he became a founding partners of Berylls Strategy Advisors. The top management consultancy was the origin of today’s Group and continues to be the professional nucleus of the Group. After studying business administration and economics, he earned his doctorate with a thesis on virtual product development in the automotive industry.

Featured Insights

hina’s Year of the Tiger began on February 1 with the government determined to demonstrate the country’s strength and stability. So what does this overriding priority signify for China’s automobility industry in the year ahead?

Berylls can make several broad economic forecasts with reasonable confidence: China’s Producer Price Index (PPI) fell for two consecutive months at the end of 2021, suggesting that the policy of maintaining supply and price stability will continue to be effective. New construction projects increased significantly in December, adding weight to other evidence that the economy is strengthening.

At the same time, don’t expect runaway growth in 2022: the consensus among economists inside and outside China is that GDP will increase year-on-year by 5 to 6 percent. There is one last point of particular interest to carmakers. Carbon neutrality by 2060 is now a major policy priority, as China gets closer to its first national target of ensuring that rising emissions peak by 2030.

Against this background, foreign carmakers and suppliers in China confront a series of challenges and opportunities that demand answers now. They include whether China is still a safe bet for making a profit, especially for premium OEMs; what are the right price points; and whether there are any hidden gems that OEMs have overlooked. For example, we think it’s time to enter China’s rapidly expanding and increasingly mature used car market.

If you are curious, download our Insight now!

Dr. Jan Burgard (1973) is CEO of Berylls Group, an international group of companies providing professional services to the automotive industry.

His responsibilities include accelerating the transformation of luxury and premium OEMs, with a particular focus on digitalization, big data, connectivity and artificial intelligence. Dr. Jan Burgard is also responsible for the implementation of digital products at Berylls and is a proven expert for the Chinese market. Dr. Jan Burgard started his career at the investment bank MAN GROUP in New York. He developed a passion for the automotive industry during stopovers at an American consultancy and as manager at a German premium manufacturer.

In October 2011, he became a founding partners of Berylls Strategy Advisors. The top management consultancy was the origin of today’s Group and continues to be the professional nucleus of the Group. After studying business administration and economics, he earned his doctorate with a thesis on virtual product development in the automotive industry.

Featured Insights

arket dynamics have created a sweet spot and OEMs must position themselves to capture their share of the growth story.

US automakers have typically seen the fleet segment as a volume driver, rather than treating it as a strategic channel to pursue. This is mainly due to its relative importance to the overall car market – in the US, fleet vehicles accounted for 12 percent of total light vehicle sales in 2020¹. By comparison, in Europe the share was around 55 percent, driven by tax incentives for companies supplying vehicles to their employees.

Supply challenges resulting from Covid-19 and vehicle shortages have certainly clouded the medium-term outlook. However, we believe there are two significant drivers of growth that will make the fleet segment significantly more attractive to OEMs in the coming years. The first is the transition to electric vehicles (EVs) in both corporate and government fleets. The second is the M&A wave among fleet management companies, which will further consolidate the access to corporate fleets.

So how can OEMs capitalize on this period of transformation? Below we look in detail at the market opportunities created by the two forces of change, and three possible business models for OEMs and their captive financing arms to pursue.

In the US, the vehicle market is dominated by light trucks, which accounted for 75.6 percent of new vehicles sold in 2021 (see Figure 1). Best-selling models include the Ford F-150, RAM 1500, and the Chevrolet Silverado. The light vehicle category, which includes cars as well as light trucks, made up 97 percent of the vehicle market last year.

Figure 1

As described above, corporate fleets account for a smaller share of the overall vehicle market in the US compared with Europe. However, with 1.68 million light vehicles sold to corporate fleets in 2020, it’s still an important market segment for OEMs².

Pre-pandemic, the fleet segment was also growing ahead of the overall market, and we expect that trend to resume as the US vehicle industry overall recovers from the ca. 15 percent decline in sales in 2020. In 2019, the last full year unaffected by Covid-19 disruption, fleet sales grew by 8.6 percent compared with 2018, while overall vehicle sales fell by 1.8 percent. Within the fleet market, we expect a particularly strong recovery in commercial and government fleet vehicles. In 2020, around 887,000 vehicles were sold in those two strands of the fleet segment (see Figure 2).

Figure 2

We expect growth to be driven by the Biden administration’s commitment at the end of last year to accelerate the transition to electric vehicles (Berylls’ detailed insights into the EV revolution in the US are set out in this recent study). Both commercial and government fleets will need to replace internal combustion engine vehicles with new zero emissions models. Under an executive order signed in December 2021, all light duty vehicles purchased by federal government agencies must be zero emissions by 2027, and the entire fleet by 2035³. To give a sense of the scale of the change that is coming, in 2021 the federal government bought 643 EVs, equivalent to less than 1 percent of its total vehicle stock⁴.

Meanwhile, commercial fleets will be impacted by the EV targets set by states and large corporations. California, for example, has set a target that only zero-emissions new cars and light-duty trucks will be sold by 2035⁵, while Walmart has pledged to reach zero emissions from its operations by 2040⁶.

Fleets account for an average of 10 percent of OEMs’ sales in the US, but for the big three US automakers, that proportion increases to closer to 20 percent: fleets accounted for 18 percent of Ford’s US sales in December 2021, 17 percent for GM, and 19 percent for Stellantis, the parent company of Chrysler. In absolute unit terms, Ford is the largest fleet supplier, followed by GM and then Stellantis (see Figure 3).

Figure 3

In line with the US vehicle market overall, fleet sales are currently dominated by light trucks such as the F-150, Silverado and RAM 1500. Electric vehicles are still a very low proportion of total vehicles produced in the US, at between 4 and 5 percent⁷. However, we expect the mix to change significantly as a result of the legislative changes and targets described above. 90% of a group of 300 fleet managers surveyed by Wakefield and Samsara believe that electric is the inevitable future of commercial vehicles⁸.

We believe electrification will transform the US fleet segment, and the new EV-only players are betting the same: car rental chain Hertz has ordered 100,000 Teslas for its fleet, electric SUV and pick-up maker Rivian plans to supply delivery vehicles to Amazon and Cox Automotive has set up a new mobility division to provide data, insights and technical expertise for fleet services and operations, and EV battery solutions. A further notable fleet opportunity in future will be self-driving electric cabs, already being trialed in San Francisco, for example.

Two of the biggest incumbent players, Ford and GM, also have ambitious EV fleet expansion plans:

Ford aims to grow its fleet revenues from $27bn in 2019 to $45bn by 2025, through sales of both commercial vehicles and related services including charging points. The automaker’s strategy is to build on its 40 percent market share in the vans and light trucks segments with the Transit and F-150, and its existing 125,000 fleet customers, through a separate business unit called Ford Pro⁹.

Ford Pro will supply commercial vehicles and offer charging, telematics and aftersales services, as well as financing and fuel cards. The division also plans to roll out 120 additional service hubs and 1,200 fleet service vehicles by 2025. To persuade small and medium-sized businesses to switch over to electric minivans and the electric F-150, due to come to market in 2022, Ford Pro aims to work with customers along the electrification journey, from identifying incentives to charging installation consultation.

Ford’s Pro software for managing EV fleet charging can also be used for non-Ford vehicles. A look across the pond may provide some indication of where Ford’s fleet plans are heading. In Europe, Ford has a partnership with ALD to offer full leasing and fleet management solutions.

Ford aims to grow its fleet revenues from $27bn in 2019 to $45bn by 2025, through sales of both commercial vehicles and related services including charging points. The automaker’s strategy is to build on its 40 percent market share in the vans and light trucks segments with the Transit and F-150, and its existing 125,000 fleet customers, through a separate business unit called Ford Pro⁹.

Ford Pro will supply commercial vehicles and offer charging, telematics and aftersales services, as well as financing and fuel cards. The division also plans to roll out 120 additional service hubs and 1,200 fleet service vehicles by 2025. To persuade small and medium-sized businesses to switch over to electric minivans and the electric F-150, due to come to market in 2022, Ford Pro aims to work with customers along the electrification journey, from identifying incentives to charging installation consultation.

Ford’s Pro software for managing EV fleet charging can also be used for non-Ford vehicles. A look across the pond may provide some indication of where Ford’s fleet plans are heading. In Europe, Ford has a partnership with ALD to offer full leasing and fleet management solutions.

GM is similarly embracing the promise of commercial vehicle growth as a result of electrification. The company is particularly focusing on the delivery segment with its Brightdrop commercial EV startup, and fleet tracking (telematics) with OnStar. Both ventures seek to capitalize on the macro trend of increasing home delivery.

Through Brightdrop, GM is also helping fleet customers to go electric with a commercial vehicle charging service called Ultium. As well as charging facilities, Ultium’s services include helping customers from the start of their EV decision-making, including choosing utility providers¹⁰). Like Ford, GM aims to offer its services beyond its own vehicle customers – OnStar’s telematics can also be used with non-GM vehicles using an adapter, for example.

GM is similarly embracing the promise of commercial vehicle growth as a result of electrification. The company is particularly focusing on the delivery segment with its Brightdrop commercial EV startup, and fleet tracking (telematics) with OnStar. Both ventures seek to capitalize on the macro trend of increasing home delivery.

Through Brightdrop, GM is also helping fleet customers to go electric with a commercial vehicle charging service called Ultium. As well as charging facilities, Ultium’s services include helping customers from the start of their EV decision-making, including choosing utility providers¹⁰). Like Ford, GM aims to offer its services beyond its own vehicle customers – OnStar’s telematics can also be used with non-GM vehicles using an adapter, for example.

Managing large vehicle fleets made up of many different models and brands, plus vehicle financing, is complex, and is treated as a non-core part of the business by many US corporates. As a result, they frequently outsource the task to specialized fleet management companies (FMCs).

These companies typically make around 50 percent of their profit from financing and the other 50 percent from vehicle and driver-related services such as procurement, maintenance, and telematics. Economies of scale are key, with the US market dominated by a few large players (Figure 4). The biggest, including ARI, Enterprise and Donlen, typically have links to dealerships or rental companies, or like Element, have been created by large mergers.

Similarly, the European market is also dominated by a small number of FMCs. Some have ties to financial institutions, such as ALD, partly owned by Société Générale, and Arval, part of BNP Paribas, and some are owned by OEMs, such as Alphabet, part of BMW, and Athlon, owned by Daimler. Consolidation among FMCs is further ahead in Europe than in the US, where (as we set out below) a new wave of mergers has begun.

We believe US OEMs and their captive financing arms should consider the fleet management market as a future key capability in a world of autonomous vehicles. With the current round of consolidation, the hurdles for OEMs to enter this market as late followers might become even higher:

Figure 4

In October 2021, two significant deals were announced in the US fleet management sector: Donlen, previously owned by Hertz, announced it was merging with Wheels Inc. The same month, ALD said it was planning to merge with LeasePlan, giving ALD direct access to the US market. Before the mergers were announced, Donlen had been the partner of Athlon in North America, while Wheels had partnered with ALD in the region. In Europe, ALD and Athlon are rivals.

We believe these two mergers will put further pressure on Element in North America and Arval in Europe to build up their scale. Both are among the top three players in their home territories. They have a contractual relationship for Arval to work with Element’s customers with business in Europe, and vice versa in North America. Facing a competitor that is directly active in both markets, as ALD will be, will present both companies with new challenges.

In addition to consolidation, fleet management companies are joining the likes of Ford and GM and gearing up their EV capabilities: Wheels and Donlen will add EVs to their merged fleet¹¹, while ARI and Element are partnering with a range of EV vehicle and infrastructure suppliers. These include Electrada, a developer and operator of EV charging infrastructure, and Ayro, which supplies last-mile delivery EVs¹². Enterprise Fleet Management is using data analytics to assess the cost-saving opportunities of potential EV deployment within its clients’ fleets¹³.

OEMs in the US have traditionally had diverse views on the fleet market. For some, it was very important, particularly manufacturers specializing in mass-market vehicles perfectly suited to most fleet users’ needs. Others have avoided the segment because it was perceived as offering volume at the expense of profit and margins. Discounts are typically steep and vehicles low spec; fleet cars are often homogenous, down to the same color.

We believe the market changes identified above, in particular the transition to EVs and the need to renew the stock of fleet vehicles, mean all OEMs should look again at their fleet strategy. Fleet management services, for example, are a good fit for OEMs expanding their “Vehicle as a Service” business, where cars are no longer sold to one owner but leased or offered on short-term contracts to a number of users over time, while the car remains the property of the OEM (see Figure 5).

Our detailed thinking on integrated VaaS models for OEM groups is available in our recent study “From vehicle sales to customer & vehicle lifetime value management”.

Figure 5

The expected growth in the US fleet segment as commercial and government customers replace traditional vehicles with EVs is a transformational moment that OEMs cannot afford to ignore. Rivals will step in to take market share from the automakers that are not ready with vehicle and service offerings, including charging or fleet management technology.

The merger activity that started in late 2021 also looks set to continue as fleet management companies build even greater scale. For OEMs and their captive financing arms, this is the moment to consider building their own dedicated FMCs, as European OEMs have done. Whatever OEMs decide, their access to fleet owners will change as a result of the market’s consolidation. Fleets are entering uncharted waters, and OEMs must have their strategic options ready.

Christopher Ley (1984) joined Berylls in October 2021 as Principal. He has over twelve years of top management consulting experience with focus on new business models and market expansions within the automotive & mobility industry. He is an expert around Vehicle-as-a-Service, comprising vehicle finance & leasing, fleet management and mobility services. Christopher Ley is advising OEMs, Captives, Financial Services Companies & Investors, Leasing & Rental Companies, Fleet Managers and Mobility Startups around the transformation from one-time sales towards use-based multi-cycle business models on a global level.

Prior to joining Berylls, Christopher Ley has been working for other international management consulting firms, amongst others Monitor Deloitte and Alvarez & Marsal. He holds a diploma degree in business administration from Johannes Gutenberg-Universität in Mainz and an MBA from Colorado State University.

Featured Insights

erylls’ five-step software excellence framework enables OEMs and suppliers to combine their automotive expertise with best practices from Big Tech

Software is the key component driving innovation in modern cars, from electric engines to increasing levels of vehicle automation and infotainment systems. Yet while it is pulling the industry forward, software is also increasingly a source of problems for OEMs. Carmakers are being forced to recall vehicles already on the road, or postpone the start of production and sales, due to issues with new software.

Last year, one German OEM had to issue a recall affecting 1.3 million vehicles in the US and 2.6 million vehicles in China, due to defective emergency call software. A second German OEM had to stop production of one of its highest volume models for a few weeks due to software problems in 2019, again in the mandatory emergency call function.

Such problems don’t just impact carmakers’ reputations for reliability and custo- mer service – we estimate that for a premium model, the cost of a single week of lost production around the launch date could range from €34 million to as much as €101 million.

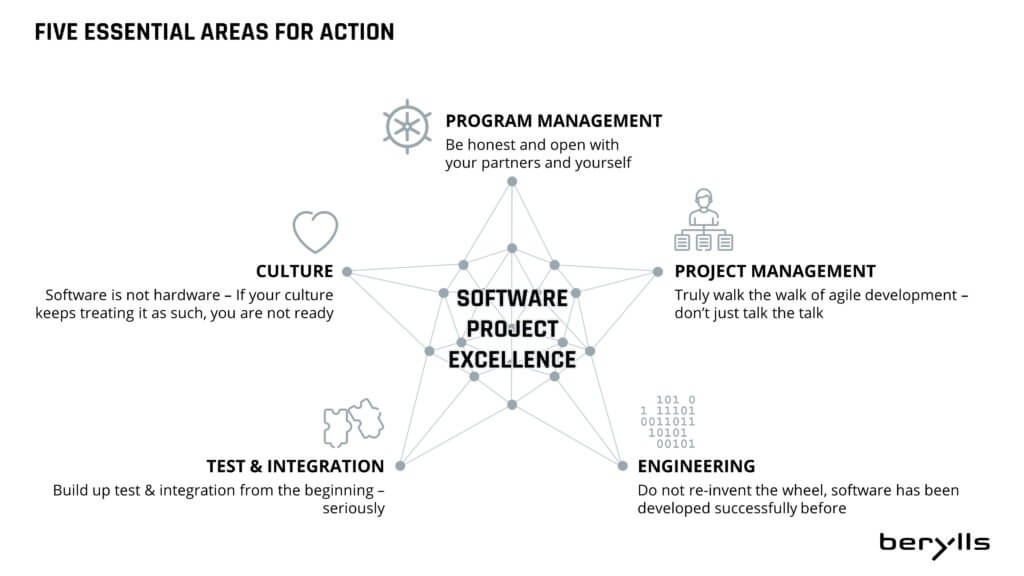

To avoid such additional costs, and to successfully tackle the challenges raised by future projects, we have developed a software project excellence framework around five essential areas for action (Chart 1):

Timo Kronen (1979) is partner at Berylls Group with focus on operations. He brings 17 years of industry and consulting experience in the automotive industry. His focus is on production, development and purchasing as well as supplier task forces. Some of his recent projects include Restructuring of the Procurement Function (German Sports Car OEM), Supplier Task Force for an Onboard Charger (German Premium OEM) and Strategy Development for the Component Production (German Premium OEM).

Before joining Berylls, Timo Kronen worked at PwC Strategy, Porsche Consulting Group and Dr. Ing. h.c. F. Porsche AG. He holds a diploma degree in industrial engineering from the Karlsruhe Institute of Technology (KIT)