Featured Insights

lle behördlichen Genehmigungen sind erteilt, das Closing der Übernahme von Berylls durch AlixPartners erfolgte wie geplant zum Ende Mai 2024

München, 3. Juni 2024 – AlixPartners übernimmt wie geplant das Beratungsgeschäft von Berylls Strategy Advisors und Berylls Mad Media. Nach der Vereinbarung zwischen beiden Beratungshäusern vom 6. Mai 2024 ist das Closing offiziell zum 31. Mai 2024 erfolgt. Die Transaktion ist damit nach zwischenzeitlicher Erteilung der üblichen behördlichen Genehmigungen abgeschlossen.

Die renommierte und auf die Automobilindustrie spezialisierte Unternehmensberatung Berylls ist mehrfach ausgezeichnet und weltweit anerkannt für ihre Strategie-, Vertriebs- und Digitalberatung. Für AlixPartners ist die Transaktion ein bedeutender Schritt im Rahmen seiner Wachstumsambitionen. Ziel ist es, die strategische und funktionale Industrie-Kompetenz auszubauen und kritische Unternehmenstransformationen verstärkt entlang der gesamten Wertschöpfungskette zu unterstützen.

Andreas Rüter, Deutschlandchef von AlixPartners, zur Übernahme: „Diese Transaktion ist ein wegweisender Schritt für unser Wachstum in Deutschland. Für die multiplen Herausforderungen des Automobilsektors sind wir jetzt noch stärker aufgestellt. Wir freuen uns sehr, unsere neuen Kolleginnen und Kollegen in den Reihen von AlixPartners zu begrüßen.“

Dr. Jan Burgard, Mitgründer von Berylls und Co-Leader der globalen Automotive & Industrial Practice von AlixPartners, ergänzt: „Wir freuen uns sehr, durch diesen Zusammenschluss mit AlixPartners sowohl unserer Berylls-Familie als auch unserem Kundenkreis eine Vielzahl von neuen Möglichkeiten eröffnen zu können. Diese Zusammenführung ist weit mehr als die Summe ihrer einzelnen Bestandteile. Mit AlixPartners haben wir ein Zuhause gefunden, das die Marke Berylls und unser Team noch näher an unser Gründungsprinzip heranführen wird, die weltweite Nummer eins in der Automobilberatung zu sein.“

In der DACH-Region überschreitet AlixPartners durch den Zugewinn der Expertinnen und Experten von Berylls erstmals die Marke von 400 Mitarbeitenden. Die Dienstleistungen der übernommenen Unternehmensberatungs-Einheiten werden unter dem Namen „Berylls by AlixPartners“ angeboten.

Das hausinterne M&A-Team von AlixPartners wurde von Willkie Farr & Gallagher rechtlich beraten. Gleiss Lutz stand der Berylls Group beim Verkauf ihres Beratungsgeschäfts an AlixPartners unterstützend zur Seite.

Über AlixPartners

Expertise, Umsetzungsstärke, Verantwortung – AlixPartners steht für messbare Ergebnisse „when it really matters“. Als global agierende Unternehmensberatung helfen wir unseren Klienten dabei, schnell und entschlossen auf ihre wichtigsten Herausforderungen zu reagieren. Unsere erfahrenen BeraterInnen sind spezialisiert darauf, Unternehmenswerte zu schaffen, zu schützen und wiederherzustellen. Vom „manager magazin“ und der Wissenschaftlichen Gesellschaft für Management & Beratung (WGMB) wurde AlixPartners 2023 als umsetzungsstärkstes Beratungsunternehmen ausgezeichnet. Seit über 40 Jahren unterstützen rund 3.500 MitarbeiterInnen in 25 Büros weltweit die Klienten von AlixPartners.

Die gesamte Pressmitteilung ist zum Download verfügbar.

Andreas Radics (1973) ist seit 2001 als Strategieberater in der Automobilindustrie tätig und blickt darüber hinaus auf mehr als vier Jahre Berufs- und Führungserfahrung in der Industrie zurück. Bevor er als Gründungspartner 2011 Berylls ins Leben rief und aufbaute, war er bei den international agierenden Strategieberatungen Gemini Consulting und Oliver Wyman tätig.

Er zählt zu den führenden Köpfen für Mergers & Acquisitions sowie für die Entwicklung und Umsetzung von Unternehmensstrategien in der Automobilindustrie, ist Experte für eMobility und ausgewiesener Kenner des US-Marktes.

Studium der Betriebswirtschaftslehre an der Katholischen Universität Eichstätt, Wirtschaftswissenschaftliche Fakultät Ingolstadt.

Dr. Jan Burgard (1973) ist CEO der Berylls Group, einer internationalen und auf die Automobilitätsindustrie spezialisierten Unternehmensgruppe.

Sein Aufgabengebiet umfasst die Transformation von Luxus- und Premiumherstellern, mit besonderen Schwerpunkten auf Digitalisierung, Big Data, Start-ups, Connectivity und künstliche Intelligenz. Dr. Jan Burgard verantwortet bei Berylls außerdem die Umsetzung digitaler Produkte und ist ausgewiesener Spezialist für den Markt China.

Dr. Jan Burgard begann seine Karriere bei der Investmentbank MAN GROUP in New York. Die Leidenschaft für die Automobilitätsindustrie entwickelte er während Zwischenstopps bei einer amerikanischen Beratung und als Manager eines deutschen Premiumherstellers.

Im Oktober 2011 komplettierte er die Gründungspartner von Berylls Strategy Advisors. Die Top-Management-Beratung ist die Basis der heutigen Group und weiterhin der fachliche Nukleus aller Einheiten.

An das Studium der Betriebs- und Volkswirtschaftslehre, schloss sich die Promotion über virtuelle Produktentwicklung in der Automobilindustrie an.

Dr. Jan Dannenberg (1962) ist seit 1990 Berater der Automobilindustrie und seit Mai 2011 Gründungspartner bei Berylls Strategy Advisors. Bis zum Frühjahr 2011 war er acht Jahre international als Partner – davon fünf Jahre als Associate Partner – für Mercer Management Consulting und Oliver Wyman tätig. Er ist ausgewiesener Spezialist für Innovationen und Markenmanagement in der Automobilindustrie und berät im Schwerpunkt Zulieferer und Investoren zu Strategie, Mergers & Acquisitions und Performance Improvement. Zudem ist er Geschäftsführer von Berylls Equity Partners, eine auf Mobilitätsunternehmen spezialisierte Beteiligungsgesellschaft.

Bachelor of Arts in Volkswirtschaftslehre von der Stanford University, Studium der Betriebswirtschaftslehre und Promotion an der Universität Bamberg.

Andreas Radics (1973) ist seit 2001 als Strategieberater in der Automobilindustrie tätig und blickt darüber hinaus auf mehr als vier Jahre Berufs- und Führungserfahrung in der Industrie zurück. Bevor er als Gründungspartner 2011 Berylls ins Leben rief und aufbaute, war er bei den international agierenden Strategieberatungen Gemini Consulting und Oliver Wyman tätig.

Er zählt zu den führenden Köpfen für Mergers & Acquisitions sowie für die Entwicklung und Umsetzung von Unternehmensstrategien in der Automobilindustrie, ist Experte für eMobility und ausgewiesener Kenner des US-Marktes.

Studium der Betriebswirtschaftslehre an der Katholischen Universität Eichstätt, Wirtschaftswissenschaftliche Fakultät Ingolstadt.

Dr. Jan Burgard (1973) ist CEO der Berylls Group, einer internationalen und auf die Automobilitätsindustrie spezialisierten Unternehmensgruppe.

Sein Aufgabengebiet umfasst die Transformation von Luxus- und Premiumherstellern, mit besonderen Schwerpunkten auf Digitalisierung, Big Data, Start-ups, Connectivity und künstliche Intelligenz. Dr. Jan Burgard verantwortet bei Berylls außerdem die Umsetzung digitaler Produkte und ist ausgewiesener Spezialist für den Markt China.

Dr. Jan Burgard begann seine Karriere bei der Investmentbank MAN GROUP in New York. Die Leidenschaft für die Automobilitätsindustrie entwickelte er während Zwischenstopps bei einer amerikanischen Beratung und als Manager eines deutschen Premiumherstellers.

Im Oktober 2011 komplettierte er die Gründungspartner von Berylls Strategy Advisors. Die Top-Management-Beratung ist die Basis der heutigen Group und weiterhin der fachliche Nukleus aller Einheiten.

An das Studium der Betriebs- und Volkswirtschaftslehre, schloss sich die Promotion über virtuelle Produktentwicklung in der Automobilindustrie an.

Featured Insights

Munich, May 2024

or as long as we can remember, the aftersales business has been the cash cow within the automotive industry. Both OEMs and dealers willingly accepted lower vehicle sales margins, knowing that aftersales services contribute significantly to annual profits.

Now is the time to identify known and emerging problems in software supplier management, and re-think supply processes end-to-end.

As software-defined vehicles revolutionize the automotive landscape, effective management of the software supply chain becomes paramount. Discover the challenges OEMs and suppliers face and seize the opportunity to redefine end-to-end supply processes.

Download the full insight now!

Paul Kummer (1983) joined Berylls by AlixPartners (formerly Berylls Strategy Advisors), an international strategy consultancy specializing in the automotive industry, as a partner in October 2021. He is an automotive downstream expert.

He has been advising automotive manufacturers in a global context since 2010. He has in-depth expert knowledge in the areas of sales and aftersales. His other areas of expertise include growth strategy development, business model development, portfolio optimization and digital transformation.

Prior to joining Berylls Strategy Advisors, he worked for Monitor Deloitte and Accenture.

Paul received his MBA from WHU Otto Beisheim School of Management and his Industrial Engineering degree from DHWB Mosbach.

Paul Kummer (1983) joined Berylls by AlixPartners (formerly Berylls Strategy Advisors), an international strategy consultancy specializing in the automotive industry, as a partner in October 2021. He is an automotive downstream expert.

He has been advising automotive manufacturers in a global context since 2010. He has in-depth expert knowledge in the areas of sales and aftersales. His other areas of expertise include growth strategy development, business model development, portfolio optimization and digital transformation.

Prior to joining Berylls Strategy Advisors, he worked for Monitor Deloitte and Accenture.

Paul received his MBA from WHU Otto Beisheim School of Management and his Industrial Engineering degree from DHWB Mosbach.

Paul Kummer (1983) joined Berylls by AlixPartners (formerly Berylls Strategy Advisors), an international strategy consultancy specializing in the automotive industry, as a partner in October 2021. He is an automotive downstream expert.

He has been advising automotive manufacturers in a global context since 2010. He has in-depth expert knowledge in the areas of sales and aftersales. His other areas of expertise include growth strategy development, business model development, portfolio optimization and digital transformation.

Prior to joining Berylls Strategy Advisors, he worked for Monitor Deloitte and Accenture.

Paul received his MBA from WHU Otto Beisheim School of Management and his Industrial Engineering degree from DHWB Mosbach.

Featured Insights

Munich, May 2024

The software supply chain is becoming increasingly critical to automotive success – yet OEMs and suppliers often struggle to manage it effectively.

Now is the time to identify known and emerging problems in software supplier management, and re-think supply processes end-to-end.

As software-defined vehicles revolutionize the automotive landscape, effective management of the software supply chain becomes paramount. Discover the challenges OEMs and suppliers face and seize the opportunity to redefine end-to-end supply processes.

Download the full insight now!

Christian Grimmelt has been an integral member of the Berylls by AlixPartners (formerly Berylls Strategy Advisors) team since February 2021. Previously, he gained extensive professional experience in top management consultancies and in the automotive supplier industry.

During his time at the world’s largest automotive supplier, he drove the establishment of a central unit to optimize the company’s global logistics and production network.

Christian Grimmelt’s consulting focus is logistics and production network optimization, purchasing and (digital) operations including launch and turnaround management for OEMs and especially suppliers.

Christian Grimmelt holds a university diploma in industrial engineering from the Karlsruhe Institute of Technology.

Christian Grimmelt has been an integral member of the Berylls by AlixPartners (formerly Berylls Strategy Advisors) team since February 2021. Previously, he gained extensive professional experience in top management consultancies and in the automotive supplier industry.

During his time at the world’s largest automotive supplier, he drove the establishment of a central unit to optimize the company’s global logistics and production network.

Christian Grimmelt’s consulting focus is logistics and production network optimization, purchasing and (digital) operations including launch and turnaround management for OEMs and especially suppliers.

Christian Grimmelt holds a university diploma in industrial engineering from the Karlsruhe Institute of Technology.

Christian Grimmelt has been an integral member of the Berylls by AlixPartners (formerly Berylls Strategy Advisors) team since February 2021. Previously, he gained extensive professional experience in top management consultancies and in the automotive supplier industry.

During his time at the world’s largest automotive supplier, he drove the establishment of a central unit to optimize the company’s global logistics and production network.

Christian Grimmelt’s consulting focus is logistics and production network optimization, purchasing and (digital) operations including launch and turnaround management for OEMs and especially suppliers.

Christian Grimmelt holds a university diploma in industrial engineering from the Karlsruhe Institute of Technology.

Featured Insights

lixPartners und Berylls ergänzen sich exzellent, um weltweit Automobilhersteller und Zulieferer entlang der gesamten Wertschöpfungskette zu unterstützen

München, 06. Mai 2024 – Die globale Unternehmensberatung AlixPartners hat mit der renommierten und auf die Automobilindustrie spezialisierten Unternehmensberatung Berylls eine Vereinbarung zur vollständigen Übernahme des Beratungsgeschäfts von Berylls Strategy Advisors und Berylls Mad Media getroffen. Berylls hat sich in 13 Jahren zur führenden Spezialberatung im Automobil-Sektor entwickelt und wird seit Jahren unter anderem mit dem Hidden Champions Award ausgezeichnet. Die Übernahme wird 160 Berylls-Mitarbeitende umfassen, die überwiegend in Deutschland, aber auch in Großbritannien, der Schweiz, in Österreich, den USA, in Südkorea und China tätig sind. AlixPartners wird damit in der DACH-Region auf über 400 Mitarbeitende wachsen. Berylls Digital Ventures, Berylls Green Mobility and Berylls Equity Partners verbleiben bei der Berylls Group.

Die Transaktion soll vorbehaltlich der üblichen behördlichen Genehmigungen im Laufe des 2. Quartals 2024 abgeschlossen sein. Über die Details haben die Beteiligten Stillschweigen vereinbart.

Berylls wird für seine herausragende Strategie-, Vertriebs- und Digitalberatung für internationale Automobilhersteller und Zulieferer wahrgenommen und genießt eine hohe Reputation sowie starke Markenbekanntheit in der Branche. Die Berylls-Expertise ergänzt das komplementäre Beratungsangebot von AlixPartners als führendem Anbieter von Restrukturierungs-, Transformations- und Performance Improvement-Services sowohl für OEMs als auch für deren Zulieferer optimal. Nach Vollzug der Übernahme werden die Dienstleistungen der übernommenen Unternehmensberatungs-Einheiten unter dem Namen „Berylls by AlixPartners“ angeboten.

Dr. Jan Burgard, CEO und Mitgründer von Berylls, wird die Rolle des Co-Leaders der globalen Automotive & Industrial Practice von AlixPartners übernehmen. Dr. Jan Dannenberg, Executive Partner und Mitgründer von Berylls, wird Co-Leader für AlixPartners in Deutschland gemeinsam mit Andreas Rüter, der seit neun Jahren das hiesige Geschäft für AlixPartners leitet. Andreas Radics als Geschäftsführer der Berylls-Einheiten und Andreas Rüter werden gemeinsam die Integration leiten.

Andreas Rüter über die geplante Akquisition: „Diese Transaktion ist ein entscheidender Meilenstein für unser weiteres Wachstum in Deutschland und darüber hinaus. Wir freuen uns sehr, unsere neuen Kolleginnen und Kollegen von Berylls in der AlixPartners-Familie willkommen zu heißen. Wir beobachten Berylls schon lange und sind tief beeindruckt von der Aufbauleistung und Kompetenz des Teams. Ich habe eine Kultur kennengelernt, die wie wir auf Kollaboration und unternehmerischen Spirit setzt, einen Umsetzungs-Fokus hat und auf tiefer Expertise aufbaut. Diese Transaktion ist ein weiterer Schritt, unsere strategische und funktionale Industrie-Kompetenz auszubauen und kritische Unternehmenstransformationen entlang der gesamten Wertschöpfungskette unterstützen zu können. When it really matters“.

Dr. Jan Burgard, geschäftsführender Gesellschafter und Mitgründer von Berylls, ergänzt: „Jeder bei Berylls ist unglaublich stolz darauf, was wir seit unserer Gründung vor 13 Jahren aufgebaut und erreicht haben. Das Übernahmeangebot von AlixPartners bestätigte uns darin, dass wir in der absoluten Top-Beratungsliga unterwegs sind und fortan gemeinsam weltweit unser ambitioniertes Wachstum als führendes Beratungsteam für die Automobilindustriefortsetzen werden. Mit AlixPartners haben wir den richtigen Partner gefunden und freuen uns sehr darauf, Teil eines fantastischen Teams zu werden, mit dem wir unseren Kunden noch umfassendere Beratungsdienstleistungen anbieten können werden.“

v. l. n. r.: Andreas Radics, Berylls Executive Partner; Andreas Rüter, AlixPartners Deutschland Chef; Dr. Jan Burgard, Berylls Group CEO und Dr. Jan Dannenberg, Berylls Executive Partner

Über AlixPartners

Expertise, Umsetzungsstärke, Verantwortung – AlixPartners steht für messbare Ergebnisse „when it really matters“. Als global agierende Unternehmensberatung helfen wir unseren Klienten dabei, schnell und entschlossen auf ihre wichtigsten Herausforderungen zu reagieren. Unsere erfahrenen BeraterInnen sind spezialisiert darauf, Unternehmenswerte zu schaffen, zu schützen und wiederherzustellen. Vom „manager magazin“ und der Wissenschaftlichen Gesellschaft für Management & Beratung (WGMB) wurde AlixPartners 2023 als umsetzungsstärkstes Beratungsunternehmen ausgezeichnet. Seit über 40 Jahren unterstützen rund 3.500 MitarbeiterInnen in 25 Büros weltweit die Klienten von AlixPartners.

Die gesamte Pressmitteilung ist zum Download verfügbar.

Andreas Radics (1973) ist seit 2001 als Strategieberater in der Automobilindustrie tätig und blickt darüber hinaus auf mehr als vier Jahre Berufs- und Führungserfahrung in der Industrie zurück. Bevor er als Gründungspartner 2011 Berylls ins Leben rief und aufbaute, war er bei den international agierenden Strategieberatungen Gemini Consulting und Oliver Wyman tätig.

Er zählt zu den führenden Köpfen für Mergers & Acquisitions sowie für die Entwicklung und Umsetzung von Unternehmensstrategien in der Automobilindustrie, ist Experte für eMobility und ausgewiesener Kenner des US-Marktes.

Studium der Betriebswirtschaftslehre an der Katholischen Universität Eichstätt, Wirtschaftswissenschaftliche Fakultät Ingolstadt.

Dr. Jan Burgard (1973) ist CEO der Berylls Group, einer internationalen und auf die Automobilitätsindustrie spezialisierten Unternehmensgruppe.

Sein Aufgabengebiet umfasst die Transformation von Luxus- und Premiumherstellern, mit besonderen Schwerpunkten auf Digitalisierung, Big Data, Start-ups, Connectivity und künstliche Intelligenz. Dr. Jan Burgard verantwortet bei Berylls außerdem die Umsetzung digitaler Produkte und ist ausgewiesener Spezialist für den Markt China.

Dr. Jan Burgard begann seine Karriere bei der Investmentbank MAN GROUP in New York. Die Leidenschaft für die Automobilitätsindustrie entwickelte er während Zwischenstopps bei einer amerikanischen Beratung und als Manager eines deutschen Premiumherstellers.

Im Oktober 2011 komplettierte er die Gründungspartner von Berylls Strategy Advisors. Die Top-Management-Beratung ist die Basis der heutigen Group und weiterhin der fachliche Nukleus aller Einheiten.

An das Studium der Betriebs- und Volkswirtschaftslehre, schloss sich die Promotion über virtuelle Produktentwicklung in der Automobilindustrie an.

Dr. Jan Dannenberg (1962) ist seit 1990 Berater der Automobilindustrie und seit Mai 2011 Gründungspartner bei Berylls Strategy Advisors. Bis zum Frühjahr 2011 war er acht Jahre international als Partner – davon fünf Jahre als Associate Partner – für Mercer Management Consulting und Oliver Wyman tätig. Er ist ausgewiesener Spezialist für Innovationen und Markenmanagement in der Automobilindustrie und berät im Schwerpunkt Zulieferer und Investoren zu Strategie, Mergers & Acquisitions und Performance Improvement. Zudem ist er Geschäftsführer von Berylls Equity Partners, eine auf Mobilitätsunternehmen spezialisierte Beteiligungsgesellschaft.

Bachelor of Arts in Volkswirtschaftslehre von der Stanford University, Studium der Betriebswirtschaftslehre und Promotion an der Universität Bamberg.

Andreas Radics (1973) ist seit 2001 als Strategieberater in der Automobilindustrie tätig und blickt darüber hinaus auf mehr als vier Jahre Berufs- und Führungserfahrung in der Industrie zurück. Bevor er als Gründungspartner 2011 Berylls ins Leben rief und aufbaute, war er bei den international agierenden Strategieberatungen Gemini Consulting und Oliver Wyman tätig.

Er zählt zu den führenden Köpfen für Mergers & Acquisitions sowie für die Entwicklung und Umsetzung von Unternehmensstrategien in der Automobilindustrie, ist Experte für eMobility und ausgewiesener Kenner des US-Marktes.

Studium der Betriebswirtschaftslehre an der Katholischen Universität Eichstätt, Wirtschaftswissenschaftliche Fakultät Ingolstadt.

Dr. Jan Burgard (1973) ist CEO der Berylls Group, einer internationalen und auf die Automobilitätsindustrie spezialisierten Unternehmensgruppe.

Sein Aufgabengebiet umfasst die Transformation von Luxus- und Premiumherstellern, mit besonderen Schwerpunkten auf Digitalisierung, Big Data, Start-ups, Connectivity und künstliche Intelligenz. Dr. Jan Burgard verantwortet bei Berylls außerdem die Umsetzung digitaler Produkte und ist ausgewiesener Spezialist für den Markt China.

Dr. Jan Burgard begann seine Karriere bei der Investmentbank MAN GROUP in New York. Die Leidenschaft für die Automobilitätsindustrie entwickelte er während Zwischenstopps bei einer amerikanischen Beratung und als Manager eines deutschen Premiumherstellers.

Im Oktober 2011 komplettierte er die Gründungspartner von Berylls Strategy Advisors. Die Top-Management-Beratung ist die Basis der heutigen Group und weiterhin der fachliche Nukleus aller Einheiten.

An das Studium der Betriebs- und Volkswirtschaftslehre, schloss sich die Promotion über virtuelle Produktentwicklung in der Automobilindustrie an.

Featured Insights

ie Analyse zur Nutzung von Elektromobilität in 35 Ländern weltweit zeigt: Im Jahr 2023 ist der Absatz elektrischer Fahrzeuge in Europa¹ erneut leicht gewachsen. Obwohl 2024 holprig startete, wird im Jahresmittel weiterhin ein Anstieg im Bereich der E-Auto-Verkäufe erwartet – und das ist mit Blick auf die ab 2025 in Europa geltenden CO₂-Grenzwerte für die Hersteller auch dringend erforderlich.

¹ Europa = EU-Länder, EFTA-Länder + Vereinigte Königreich

Ein turbulentes Jahr für die globale Wirtschaft und die Automobilindustrie liegt hinter uns. Nach der Chip-Krise und der daraus resultierenden Angebotsverknappung machte sich auch die Inflation beim Fahrzeugabsatz bemerkbar. Trotz der globalen Herausforderungen konnte der Marktanteil batterieelektrischer Fahrzeuge (BEV) in vielen Märkten aber weiter erhöht und damit der Erfolg des Vorjahres fortgesetzt werden (ABBILDUNG 1).

Wirklich starke BEV-Wachstumsraten wurden jedoch nur noch in einzelnen Märkten erreicht. Während Norwegen weiterhin unantastbar an erster Stelle des Rankings, gemessen am BEV-Absatz, steht, steigt Finnland einen und Dänemark drei Plätze auf und sie überholen somit die Niederlande. Belgien macht sogar sechs Plätze gut. Diese Bewegungen spiegeln die Entwicklungen im Steuermodell der jeweiligen Länder wider – hier wurden die Steuern auf Fahrzeuge mit Verbrennungsmotor erhöht und die Steuern auf emissionsfreie Fahrzeuge gesenkt. Dagegen verlor Deutschland vier Plätze und das Vereinigte Königreich sogar sieben Plätze – zwei Länder, deren Steuermodell noch sehr attraktiv für Verbrenner bleibt.

ABBILDUNG 1 – ENTWICKLUNG DES ANTEILS DER BEV-NEUZULASSUNGEN IM JAHR 2023 IM VERGLEICH ZUM VORJAHR, NACH LÄNDERN

(in %-Punkten)

Quelle: Berylls Strategy Advisors

Anders verhält es sich mit den Plug-in-Hybriden (PHEVs): Hier setzte sich der negative Trend des vorherigen Jahres fort, der Anteil der Neuzulassungen sank in vielen europäischen Ländern (ABBILDUNG 2). Primär in den skandinavischen Ländern zeigt sich deutlich, dass die Zeit der PHEVs zu Ende geht und diese mittelfristig durch BEVs abgelöst werden. Hingegen nimmt China mit einem großen Anstieg der PHEV-Verkäufe in den letzten zwei Jahren eine besondere Rolle ein. Da PHEVs hier gemeinsam mit den BEVs als „New Energy Vehicles“ (NEVs) gelten, sind sie nach wie vor relevant für Chinas OEM-Ziele hinsichtlich NEV-Fahrzeugen.

ABBILDUNG 2 – ENTWICKLUNG DES ANTEILS DER NEUEN PHEV-VERKÄUFE IM JAHR 2023 IM VERGLEICH ZUM VORJAHR, NACH LÄNDERN

(in %-Punkten)

Quelle: Berylls Strategy Advisors

Ein Treiber für die Zunahme an BEV-Neuzulassungen ist der weitere Ausbau der Ladeinfrastruktur (ABBILDUNG 3). Während sich die Situation beim Standard- und Schnellladen (bis zu 150 kW) weiter verbessert, lag in 2023 der Fokus insbesondere auf dem Ausbau des Ladepunktnetzes fürs Ultraschnellladen (150 kW und mehr). Hierbei kann die Batterie in wenigen Minuten aufgeladen werden, was für die Kunden vor allem auf Langstrecken wichtig ist. Mit zumeist dreistelligen Wachstumsraten wurden in Europa marktübergreifend Ladepunkte für ultraschnelles Laden installiert. Gleiches gilt für Osteuropa, auch wenn hier derzeit im Vergleich noch ein deutlicher Rückstand besteht. Durch diese Entwicklungen wird das Argument „fehlende Langstreckentauglichkeit bei BEVs“ zunehmend entkräftet.

ABBILDUNG 3 – ENTWICKLUNG DER ANZAHL DER ÖFFENTLICHEN LADEPUNKTE PRO 10.000 EINWOHNER IM JAHR 2023 IM VERGLEICH ZUM VORJAHR, NACH LÄNDERN

(in Einheiten)

Quelle: Berylls Strategy Advisors

Im Jahr 2025 tritt die zweite Stufe des EU-Gesetzes zur Reduzierung der CO₂-Emissionen von in Europa zugelassenen Neufahrzeugen (Verordnung [EU] 2019/631) in Kraft. Diese Stufe sieht eine gegenüber den heutigen Zielen um weitere 15 % gesteigerte Reduktion der CO₂-Emissionen für OEMs in Europa vor. Gipfeln soll dies im Jahr 2035 in dem Verbot von Neufahrzeugen mit Verbrennungsmotor – auch wenn dieses ehrgeizige Ziel in Politik sowie Wirtschaft regelmäßig in Frage gestellt wird und 2026 erneut überprüft werden soll.

Daher wird für das Jahr 2024 zwar ein leichter Anstieg der BEV-Neuzulassungen in Europa erwartet. Dieser dürfte aber ähnlich wie im vergangenen Jahr mit einer erwarteten Marktdurchdringung von rund 16 bis 18 % (15,7 % in 2023) relativ gering bleiben. Im Gegensatz dazu wird für das Jahr 2025 vor dem Hintergrund der neuen europäischen Anforderungen an die CO₂-Emissionen ein sehr starkes Wachstum erwartet. So sollen BEVs im Jahr 2025 knapp ein Viertel der europäischen Neuzulassungen ausmachen.

Um dieses ehrgeizige Ziel zu erreichen, müssen die OEMs ihr BEV-Portfolio erheblich ausbauen und die Attraktivität ihrer Fahrzeuge steigern. Aus diesem Grund wurden bereits zahlreiche neue Modelle angekündigt (z. B. Fiat Panda) oder schon vorgestellt (z. B. Citroën ë-C3, Renault 5 oder Audi Q6), die bis Ende 2024 verfügbar sein werden. Insbesondere in den Segmenten B (Kleinwagen) und C (Mittelklasse), die sich in Europa bei weitem der größten Beliebtheit erfreuen, wird die Modellauswahl auf dem Markt deutlich gesteigert werden. Bisher gab es hierfür nur ein sehr begrenztes und wenig wettbewerbsfähiges Elektroangebot. Besondere Relevanz werden die preiswerten Modelle Renault 5, Citroën ë-C3 und Fiat Panda haben, die ab 2025 für weniger als 25.000 € bei einer vernünftigen Reichweite (über 300 km nach WLTP) angeboten werden sollen und damit einen völlig neuen Markt eröffnen werden.

Andererseits werden die OEMs den BEV-Absatz auch in den süd- und osteuropäischen Ländern steigern müssen, die bisher nur eine marginale Rolle bei der Elektrifizierung in Europa gespielt haben. Da Norwegen eine nahezu vollständige Elektrifizierung der Fahrzeugzulassungen erreicht hat (über 90 % Absatz-Anteil von BEVs und PHEVs in 2023), ist hier kaum noch Wachstum zu erwarten. Große Märkte wie Italien und Spanien, die 12 % bzw. 7 % der Verkäufe Europas ausmachen, werden sich daher stärker an der Elektrifizierung der Neuzulassungen in Europa beteiligen müssen.

Obwohl die öffentliche Debatte über dieses Thema noch sehr angespannt ist, gibt es zahlreiche Anzeichen dafür, dass viele europäische Endkunden bereit sind, den Kauf eines BEVs in Erwägung zu ziehen. Zwar ist ein BEV heute in der Anschaffung noch oft teurer als ein vergleichbares Verbrennerfahrzeug, jedoch punktet das Elektrofahrzeug hinsichtlich der Gesamtbetriebskosten – so fallen die Betriebskosten (Kraftstoff, Wartung usw.) gegenüber einem Verbrenner geringer aus.

Dass geringere Kosten ein wesentliches Argument für die Anschaffung von BEV-Fahrzeugen sein können, zeigt auch das Beispiel des Sozialleasings für einkommensschwache Haushalte in Frankreich. Hierbei konnte für 100 € pro Monat ein in Europa hergestelltes Elektrofahrzeug geleast werden; dies wurde teilweise vom Staat finanziert. Das Programm wurde Anfang 2024 gestartet – und nur einen Monat später wieder eingestellt, da das Jahresbudget bereits überschritten war. Ein Beleg dafür, dass die BEV-Kunden da sind – sofern das Angebot finanziell attraktiv ist.

Auch war das meistverkaufte Modell im letzten Jahr in Europa (und auch weltweit) ein Elektrofahrzeug: das Tesla Model Y. Es hat Tesla vor allem dazu verholfen, mit sehr beliebten Automarken wie Citroën oder Fiat gleichzuziehen (gemessen am PKW-Verkauf in Europa) und etablierte Hersteller wie Volvo oder Nissan auf dem europäischen Markt zu überholen. Dieser Trend bestätigt sich, wenn man einen Blick auf die chinesischen Hersteller wirft. So schnellten beispielsweise bei den Herstellern MG (SAIC) oder BYD die Verkaufszahlen in Europa in die Höhe, was größtenteils auf ein sehr wettbewerbsfähiges Elektroangebot zurückzuführen ist. MG schaffte es 2023 unter die Top-20-Marken in Europa – ein Novum für eine chinesische Marke – und sein Spitzenmodell, der elektrische MG4, sicherte sich einen Platz unter den Top 5 der meistverkauften Elektrofahrzeuge 2023 in Europa. Dies unterstreicht, wie wichtig es für die etablierten Hersteller ist, ein wettbewerbsfähiges Portfolio an Modellen in den Hauptmarktsegmenten Europas anzubieten, um nicht Anteile an neue Marktteilnehmer zu verlieren.

Der Markt beginnt, sich an diese neue Realität anzupassen, indem viele Hersteller die Preise für ihre Elektromodelle (teilweise erheblich) senken, um sie auf dem Markt wettbewerbsfähiger zu positionieren. Dies war beispielsweise bei Renault und Volkswagen der Fall, aber auch bei Toyota, wo die Preise für das Mittelklasse-SUV bZ4X in Frankreich zwischen Mitte 2023 (damals ab 55.000 €) und Februar 2024 (ab 35.000 €) um 20.000 € gesenkt wurden. Durch den zuvor deutlich höheren Preis wurde das Fahrzeug im Jahr 2023 in Frankreich nur 626-mal verkauft.

Bereits seit einigen Jahren werden die von den europäischen Regierungen angebotenen Prämien für den Kauf eines BEVs sukzessive reduziert, da deren Attraktivität (Preis, Ladeinfrastruktur, technische Reife) steigt und die Zulassungen zunehmen. Das Jahr 2024 bildet hier keine Ausnahme; so wurde z. B. in Frankreich die Prämie für den Kauf eines BEV von 5.000 € auf 4.000 € gesenkt. Diese Absenkungen haben bisher nie die schrittweise Erhöhung des Anteils von BEVs an den Neuwagenverkäufen behindert, was das Beispiel Norwegen sehr gut veranschaulicht: So hatte das nordische Land eine vollständige Mehrwertsteuerermäßigung für BEVs eingeführt, die am 1. Januar 2023 abgeschafft wurde. Zwar hatte dies zur Folge, dass der Anteil der BEVs in den ersten Monaten des Jahres 2023 deutlich zurückging, der Aufwärtstrend über das gesamte Jahr wurde dadurch jedoch nicht umgekehrt.

Subventionen für BEVs sind ein Weg der Politik, die Elektrifizierung zu beschleunigen – auch die Besteuerung der Verbrennerfahrzeuge dient diesem Zweck, teilweise wird darüber auch die Subventionierung finanziert. So haben Norwegen, die Niederlande und bis zu einem gewissen Grad auch Frankreich ein Steuersystem implementiert, das den Kauf von Fahrzeugen mit Verbrennungsmotor – insbesondere solchen mit hohem CO₂-Ausstoß – wesentlich unattraktiver macht (ABBILDUNG 4, ABBILDUNG 5).

ABBILDUNG 4 – KOSTENVERGLEICH ZWISCHEN DEM KAUF EINES HYUNDAI KONA (B-SUV–SEGMENT) IN EINER BEV-VARIANTE UND EINER BENZINVARIANTE IN AUSGEWÄHLTEN EUROPÄISCHEN LÄNDERN

(in Tsd. EUR)

Quelle: Berylls Strategy Advisors

Deutschland stellte aus vorwiegend exogenen Gründen (Bundeshaushalt 2024) sein Fördersystem für den Kauf von BEVs im Land zum Jahresende 2023 abrupt ein.

Im Gegensatz zu anderen Ländern gab es hier jedoch keine entsprechende Anpassung oder Änderung des Steuermodells, die den Kauf von Fahrzeugen mit Verbrennungsmotoren unattraktiver machen würde. Die Kombination aus diesen beiden Aspekten hat zur Konsequenz, dass die Attraktivität von BEVs gegenüber Verbrennern gesunken und infolgedessen der BEV-Absatz im ersten Quartal 2024 deutlich geschrumpft ist. Da die CO₂–Flottenziele der OEMs auf dem Spiel stehen, müssen die OEMs in Deutschland potenziell höhere Rabatte gewähren, um ihre Elektrofahrzeuge wieder attraktiv zu machen und das Auslaufen der Umweltprämien teilweise zu kompensieren. Dies fällt bei hochwertigen Modellen deutlich leichter, da hier die Margen am höchsten sind und der Preisunterschied zu einem Verbrennerfahrzeug weitaus geringer ist – teilweise sogar zum Vorteil des vergleichbaren BEV-Modells (ABBILDUNG 5).

ABBILDUNG 5 – KOSTENVERGLEICH ZWISCHEN DEM KAUF EINES BMW X5 / iX (E-SUV–SEGMENT) IN EINER BEV-VARIANTE UND EINER BENZINVARIANTE IN AUSGEWÄHLTEN EUROPÄISCHEN LÄNDERN

(in Tsd. EUR)

Quelle: Berylls Strategy Advisors

Die Einstellung der Prämien wird vor allem Privatkunden treffen, da die Steuervorteile für elektrische Dienstwagen beibehalten werden (oder sogar ausgeweitet werden, wenn man die Erhöhung der Preisobergrenze für den reduzierten Steuersatz auf 0,25 % berücksichtigt). Da Firmenfahrzeuge 60 % des deutschen Automobilmarktes ausmachen (im Vergleich zu z. B. 20 % in Frankreich), dürfte dies einen möglichen Rückgang der BEV-Verkäufe in 2024 abfedern. Die OEMs sind also gut beraten, insbesondere im Bereich des Dienstwagenleasings attraktive BEV-Angebote zu machen und sie hervorzuheben.

Die Ladeinfrastruktur ist von langfristigen Investitionen abhängig und unterliegt nicht so stark den Schwankungen des Automobilmarktes. Neben dem Anstieg der Anzahl von Ladepunkten um 38 % im letzten Jahr in Europa (ABBILDUNG 6) verdeutlicht insbesondere die Verdoppelung (+110 %) der Ladepunkte für ultraschnelles Laden (150 kW und mehr) die Dynamik in Europa (ABBILDUNG 7).

ABBILDUNG 6 – ENTWICKLUNG DER ANZAHL DER ÖFFENTLICHEN LADEPUNKTE IM JAHR 2023 IM VERGLEICH ZUM VORJAHR, NACH LÄNDERN

(in Tsd.)

Quelle: Berylls Strategy Advisors

ABBILDUNG 7 – ENTWICKLUNG DER ANZAHL DER ÖFFENTLICHEN LADEPUNKTE FÜR ULTRASCHNELLES LADEN (150 KW UND MEHR) IM JAHR 2023 IM VERGLEICH ZUM VORJAHR, NACH LÄNDERN

Quelle: Berylls Strategy Advisors

Dieser Trend dürfte bis 2024 und sogar darüber hinaus nicht nachlassen, da bereits zahlreiche Investitionen angekündigt wurden, die oft mit staatlichen oder europäischen Fördermitteln kombiniert werden. Die EU unterstützt die Entwicklung der Ladeinfrastruktur durch ihr AFIR-Gesetz. Dieses verpflichtet die Mitgliedsstaaten dazu, zwei Bedingungen zu erfüllen: zum einen eine bestimmte installierte Leistung pro im Land zugelassenem Elektrofahrzeug (1,3 kW pro BEV und 0,8 kW pro PHEV) sicherzustellen und zum anderen eine Mindestabdeckung der Hauptverkehrsachsen mit Ladepunkten für ultraschnelles Laden (eine Ladestation von mind. 150 kW pro 60 km im europäischen „Core TEN-T Network“ bis 2025) zu gewährleisten. Ersteres hat zum Ziel, den Druck auf die EU-Staaten aufrechtzuerhalten, damit die Infrastruktur in Zukunft mit ausreichender Geschwindigkeit ausgebaut wird und so der Bedarf der immer größer werdenden BEV-Flotten gedeckt werden kann. Zum gegenwärtigen Zeitpunkt erfüllen alle EU-Staaten außer Malta dieses Kriterium. Bei der zweiten Bedingung geht es darum, die Entwicklung einer ausreichend schnellen Infrastruktur zu beschleunigen, um komfortable Fernreisen durch ganz Europa zu ermöglichen – ein Punkt, der in einigen osteuropäischen Ländern derzeit noch ein Problem darstellen kann.

Viele Ladebetreiber sowie Energieversorger und Ölkonzerne steigen weiterhin in diesen dynamischen Markt ein bzw. investieren hier zunehmend. So trat beispielsweise Mercedes-Benz Mobility im letzten Jahr in den Markt fürs Ultraschnellladen ein, während Total Energies in 2023 einige seiner Tankstellen vollständig in Ladestationen für Elektrofahrzeuge umgewandelt hat – und damit einen weiteren Schritt auf seinem Weg vom reinen Ölkonzern hin zum Energieversorger geht. Der schnell wachsende Markt macht hohe Investitionen in den Ausbau der Infrastruktur erforderlich. Diese werden sich jedoch erst später auszahlen. Auch müssen die vielen neuen Akteure aktuell entsprechend viel investieren, um später eine Rolle auf dem zukunftsträchtigen Markt zu spielen. Da dieser jedoch zurzeit noch nicht so groß ist, sind die Unternehmen bisher nicht profitabel. Der Markt steuert somit zwangsläufig auf eine Konsolidierung zu.

Dr. Alexander Timmer (1981) ist seit Mai 2021 als Partner bei Berylls by AlixPartners (ehemals Berylls Strategy Advisors) tätig, einer internationalen und auf die Automobilitätsindustrie spezialisierten Strategieberatung. Er ist Experte für Markteintritts- und Wachstumsstrategien, M&A und kann auf eine langjährige Erfahrung im Operations-Umfeld zurückschauen. Dr. Alexander Timmer berät seit 2012 Automobilhersteller und -zulieferer im globalen Kontext. Er verfügt über ein fundiertes Expertenwissen in den Bereichen Portfolioplanung, Entwicklung und Produktion. Zu seinen weiteren fachlichen Schwerpunkten zählen unter anderem Digitalisierung und der Themenkomplex rund um die Elektromobilität.

Vor seinem Einstieg bei Berylls Strategy Advisors war er unter anderem für Booz & Company und PwC Strategy& als Mitglied der Geschäftsführung in Nordamerika, Asien und Europa tätig.

Im Anschluss an sein Maschinenbaustudium an der RWTH Aachen und der Chalmers University in Göteborg promovierte er im Bereich der Fertigungstechnologien am Werkzeugmaschinenlabor der RWTH Aachen.

Dr. Alexander Timmer (1981) ist seit Mai 2021 als Partner bei Berylls by AlixPartners (ehemals Berylls Strategy Advisors) tätig, einer internationalen und auf die Automobilitätsindustrie spezialisierten Strategieberatung. Er ist Experte für Markteintritts- und Wachstumsstrategien, M&A und kann auf eine langjährige Erfahrung im Operations-Umfeld zurückschauen. Dr. Alexander Timmer berät seit 2012 Automobilhersteller und -zulieferer im globalen Kontext. Er verfügt über ein fundiertes Expertenwissen in den Bereichen Portfolioplanung, Entwicklung und Produktion. Zu seinen weiteren fachlichen Schwerpunkten zählen unter anderem Digitalisierung und der Themenkomplex rund um die Elektromobilität.

Vor seinem Einstieg bei Berylls Strategy Advisors war er unter anderem für Booz & Company und PwC Strategy& als Mitglied der Geschäftsführung in Nordamerika, Asien und Europa tätig.

Im Anschluss an sein Maschinenbaustudium an der RWTH Aachen und der Chalmers University in Göteborg promovierte er im Bereich der Fertigungstechnologien am Werkzeugmaschinenlabor der RWTH Aachen.

Dr. Alexander Timmer (1981) ist seit Mai 2021 als Partner bei Berylls by AlixPartners (ehemals Berylls Strategy Advisors) tätig, einer internationalen und auf die Automobilitätsindustrie spezialisierten Strategieberatung. Er ist Experte für Markteintritts- und Wachstumsstrategien, M&A und kann auf eine langjährige Erfahrung im Operations-Umfeld zurückschauen. Dr. Alexander Timmer berät seit 2012 Automobilhersteller und -zulieferer im globalen Kontext. Er verfügt über ein fundiertes Expertenwissen in den Bereichen Portfolioplanung, Entwicklung und Produktion. Zu seinen weiteren fachlichen Schwerpunkten zählen unter anderem Digitalisierung und der Themenkomplex rund um die Elektromobilität.

Vor seinem Einstieg bei Berylls Strategy Advisors war er unter anderem für Booz & Company und PwC Strategy& als Mitglied der Geschäftsführung in Nordamerika, Asien und Europa tätig.

Im Anschluss an sein Maschinenbaustudium an der RWTH Aachen und der Chalmers University in Göteborg promovierte er im Bereich der Fertigungstechnologien am Werkzeugmaschinenlabor der RWTH Aachen.

Featured Insights

Munich, April 2024

he year 2023 was characterized by changes in the automotive industry.

While numerous new suppliers and OEMs are trying to gain a foothold, the established OEMs are fighting for their position and strug- gling with their strategic realignment.

A high interest rate environment and low consumer spending due to the high inflation period suggest that 2024 will be another subdued year. Geopolitical tensions and disruptions in supply chains continue to prevent a sigh of relief.

Download the full insight now!

Malte is an expert in the development and implementation of automotive digitization strategies.

He focuses on helping clients scale (generative) artificial intelligence to improve their bottom line across the entire automotive value chain. His primary customers are automotive manufacturers and their suppliers, especially those active in the Software-Defined-Vehicle space.

Before his time at Berylls by AlixPartners (formerly Berylls Strategy Advisors), he advised leading North American utility companies. Prior to that, he saved lives as emergency medical technician. Malte holds master’s degrees in economics from Maastricht University and Queen’s University in Canada.

Dr. Jan Burgard (1973) is CEO of Berylls Group, an international group of companies providing professional services to the automotive industry.

His responsibilities include accelerating the transformation of luxury and premium OEMs, with a particular focus on digitalization, big data, connectivity and artificial intelligence. Dr. Jan Burgard is also responsible for the implementation of digital products at Berylls and is a proven expert for the Chinese market.

Dr. Jan Burgard started his career at the investment bank MAN GROUP in New York. He developed a passion for the automotive industry during stopovers at an American consultancy and as manager at a German premium manufacturer. In October 2011, he became a founding partner of Berylls Strategy Advisors. The top management consultancy was the origin of today’s Group and continues to be the professional nucleus of the Group.

After studying business administration and economics, he earned his doctorate with a thesis on virtual product development in the automotive industry.

Malte is an expert in the development and implementation of automotive digitization strategies.

He focuses on helping clients scale (generative) artificial intelligence to improve their bottom line across the entire automotive value chain. His primary customers are automotive manufacturers and their suppliers, especially those active in the Software-Defined-Vehicle space.

Before his time at Berylls by AlixPartners (formerly Berylls Strategy Advisors), he advised leading North American utility companies. Prior to that, he saved lives as emergency medical technician. Malte holds master’s degrees in economics from Maastricht University and Queen’s University in Canada.

Dr. Jan Burgard (1973) is CEO of Berylls Group, an international group of companies providing professional services to the automotive industry.

His responsibilities include accelerating the transformation of luxury and premium OEMs, with a particular focus on digitalization, big data, connectivity and artificial intelligence. Dr. Jan Burgard is also responsible for the implementation of digital products at Berylls and is a proven expert for the Chinese market.

Dr. Jan Burgard started his career at the investment bank MAN GROUP in New York. He developed a passion for the automotive industry during stopovers at an American consultancy and as manager at a German premium manufacturer. In October 2011, he became a founding partner of Berylls Strategy Advisors. The top management consultancy was the origin of today’s Group and continues to be the professional nucleus of the Group.

After studying business administration and economics, he earned his doctorate with a thesis on virtual product development in the automotive industry.

Featured Insights

he automotive industry is in the midst of immense transformation, affecting all departments and established industry mechanisms.

As part of that, sales and marketing functions are undergoing a huge shift toward a direct retail sales model.

Download the full insight now.

Jonas Wagner, born in 1978, is a Partner and Managing Director of Berylls by AlixPartners (formerly Berylls Mad Media). With around 20 years of consulting experience in the automotive industry, Jonas is a trusted advisor for top management, specializing in strategy, organizational development and large transformation programs for leading, global automotive manufacturers.

Jonas excels in guiding automotive companies through the transformation of their sales and marketing functions. He has a proven track record in digitalizing customer interfaces to enhance customer experience, sales conversion and loyalty. His expertise includes introducing and implementing new sales and business models tailored to the evolving market landscape and developing data-driven sales and marketing organizations to optimize performance and efficiency. His expertise includes all on- and offline touchpoints as well as business segments, ranging from sales, after-sales, financial services to new business models.

Before joining Berylls, Jonas was a leading consultant within the Automotive Practise of Oliver Wyman, where he worked with global automotive manufacturers, enhancing their strategic initiatives and operations.

Jonas holds a degree in Business Administration from the Aarhus School of Business and the University of Mannheim, with a focus on International Management, Marketing, and Controlling. Combining deep industry knowledge with strategic acumen, Jonas Wagner is a valuable partner for automotive leaders navigating complex transformations.

Theresa Stütz (1991) joined Berylls Strategy Advisors in December 2017. Meanwhile she is associate partner and automotive downstream expert.

She has been advising automotive manufacturers in a global context both in the luxury and premium segment. She has in-depth expert knowledge in the areas of sales and marketing, particularly in the context of customer experience strategies. Other areas of expertise include strategy development processes, Go-to-market strategies and transformation management.

Theresa received both Bachelor and Master of Science in Management and Technology (Mechanical Engineering) at Technical University of Munich.

Jonas Wagner, born in 1978, is a Partner and Managing Director of Berylls by AlixPartners (formerly Berylls Mad Media). With around 20 years of consulting experience in the automotive industry, Jonas is a trusted advisor for top management, specializing in strategy, organizational development and large transformation programs for leading, global automotive manufacturers.

Jonas excels in guiding automotive companies through the transformation of their sales and marketing functions. He has a proven track record in digitalizing customer interfaces to enhance customer experience, sales conversion and loyalty. His expertise includes introducing and implementing new sales and business models tailored to the evolving market landscape and developing data-driven sales and marketing organizations to optimize performance and efficiency. His expertise includes all on- and offline touchpoints as well as business segments, ranging from sales, after-sales, financial services to new business models.

Before joining Berylls, Jonas was a leading consultant within the Automotive Practise of Oliver Wyman, where he worked with global automotive manufacturers, enhancing their strategic initiatives and operations.

Jonas holds a degree in Business Administration from the Aarhus School of Business and the University of Mannheim, with a focus on International Management, Marketing, and Controlling. Combining deep industry knowledge with strategic acumen, Jonas Wagner is a valuable partner for automotive leaders navigating complex transformations.

Featured Insights

Munich, March 2024

ow OEMs successfully navigate an insecure environment with volatile incentives and reluctant customers as well as retailers.

In 2024, the automotive industry is supposed to be at the tipping point of the transformation to the battery electric vehicle (BEV). This paradigm shift is exemplified by the imminent launch of over 50 new battery electric vehicle models in Germany alone, coupled with more than 15 Chinese brands operating in the fiercely competitive European market.

But will the shift happen, or will it be dismissed? The dramatic drop of BEV sales in December 2023 (compared with 2022), shows clear signals of a weakening commitment and volatile demand. So how do you navigate through this difficult time without wasting effort and budget?

Download the full insight now!

Sascha Kurth (1987) is a Partner at Berylls by AlixPartners (formerly Berylls Mad Media), a company specializing in the automotive industry. He is an expert in building, transforming, and restructuring sales and marketing organizations and has experience from more than 30 projects in this context. From his perspective, it is particularly important for sales and marketing organizations to have clear and measurable goals and a clear and comprehensible strategy for achieving them. Subsequently, the focus is on creating an effective, efficient, and self-optimizing organization from the right people, processes, partners, and necessary governance. Technology and data are crucial enablers for leveraging the efficiency and effectiveness of the resources used multiple times. This is essential to be competitive, remain competitive, and develop competitive advantages for the future. However, they are not an end in themselves but always enablers to achieve the goals (better). Sascha Kurth is convinced that building effective and efficient sales and marketing organizations is a crucial long-term competitive advantage for the entire company and that paid advertising (especially increasing the budget) should be one of the last initiatives to achieve strategic goals.

Sascha Kurth has been supporting automotive manufacturers in a global context since 2013. He has extensive expertise in goal-oriented sales and marketing planning, Paid, Earned, Owned- funnel management, data management platforms & customer data platforms, e-commerce platforms, programmatic advertising, customer relation management, smart KPIs, and management dashboards.

Prior to joining Berylls Mad Media, he supported leading OEMs, e-mobility start-ups, telecommunications companies, and fast-moving consumer goods manufacturers in their sales & marketing transformation at various consulting firms.

Jonas Wagner, born in 1978, is a Partner and Managing Director of Berylls by AlixPartners (formerly Berylls Mad Media). With around 20 years of consulting experience in the automotive industry, Jonas is a trusted advisor for top management, specializing in strategy, organizational development and large transformation programs for leading, global automotive manufacturers.

Jonas excels in guiding automotive companies through the transformation of their sales and marketing functions. He has a proven track record in digitalizing customer interfaces to enhance customer experience, sales conversion and loyalty. His expertise includes introducing and implementing new sales and business models tailored to the evolving market landscape and developing data-driven sales and marketing organizations to optimize performance and efficiency. His expertise includes all on- and offline touchpoints as well as business segments, ranging from sales, after-sales, financial services to new business models.

Before joining Berylls, Jonas was a leading consultant within the Automotive Practise of Oliver Wyman, where he worked with global automotive manufacturers, enhancing their strategic initiatives and operations.

Jonas holds a degree in Business Administration from the Aarhus School of Business and the University of Mannheim, with a focus on International Management, Marketing, and Controlling. Combining deep industry knowledge with strategic acumen, Jonas Wagner is a valuable partner for automotive leaders navigating complex transformations.

Sascha Kurth (1987) is a Partner at Berylls by AlixPartners (formerly Berylls Mad Media), a company specializing in the automotive industry. He is an expert in building, transforming, and restructuring sales and marketing organizations and has experience from more than 30 projects in this context. From his perspective, it is particularly important for sales and marketing organizations to have clear and measurable goals and a clear and comprehensible strategy for achieving them. Subsequently, the focus is on creating an effective, efficient, and self-optimizing organization from the right people, processes, partners, and necessary governance. Technology and data are crucial enablers for leveraging the efficiency and effectiveness of the resources used multiple times. This is essential to be competitive, remain competitive, and develop competitive advantages for the future. However, they are not an end in themselves but always enablers to achieve the goals (better). Sascha Kurth is convinced that building effective and efficient sales and marketing organizations is a crucial long-term competitive advantage for the entire company and that paid advertising (especially increasing the budget) should be one of the last initiatives to achieve strategic goals.

Sascha Kurth has been supporting automotive manufacturers in a global context since 2013. He has extensive expertise in goal-oriented sales and marketing planning, Paid, Earned, Owned- funnel management, data management platforms & customer data platforms, e-commerce platforms, programmatic advertising, customer relation management, smart KPIs, and management dashboards.

Prior to joining Berylls Mad Media, he supported leading OEMs, e-mobility start-ups, telecommunications companies, and fast-moving consumer goods manufacturers in their sales & marketing transformation at various consulting firms.

Jonas Wagner, born in 1978, is a Partner and Managing Director of Berylls by AlixPartners (formerly Berylls Mad Media). With around 20 years of consulting experience in the automotive industry, Jonas is a trusted advisor for top management, specializing in strategy, organizational development and large transformation programs for leading, global automotive manufacturers.

Jonas excels in guiding automotive companies through the transformation of their sales and marketing functions. He has a proven track record in digitalizing customer interfaces to enhance customer experience, sales conversion and loyalty. His expertise includes introducing and implementing new sales and business models tailored to the evolving market landscape and developing data-driven sales and marketing organizations to optimize performance and efficiency. His expertise includes all on- and offline touchpoints as well as business segments, ranging from sales, after-sales, financial services to new business models.

Before joining Berylls, Jonas was a leading consultant within the Automotive Practise of Oliver Wyman, where he worked with global automotive manufacturers, enhancing their strategic initiatives and operations.

Jonas holds a degree in Business Administration from the Aarhus School of Business and the University of Mannheim, with a focus on International Management, Marketing, and Controlling. Combining deep industry knowledge with strategic acumen, Jonas Wagner is a valuable partner for automotive leaders navigating complex transformations.

Featured Insights

Munich, April 2024

ncertain demand in a weak economy, a mix of powertrains, skills shortages and the influence of subsidies are making network design more important - and more complex

Automotive suppliers and OEMS are being forced to make hard decisions about their production networks, as they focus on efficiencies and protecting margins in an uncertain economy. Existing footprints are also being challenged by the electric vehicle (EV) transition, sustainability requirements, new skills needs and more political influence in the form of national subsidy programs.

Supplier ZF Friedrichshafen, for example, announced plans in January to close two plants in Germany with the intention of moving production to lower-cost locations in eastern Europe or India, and the future of Audi’s plant in Brussels is in doubt, according to multiple news reports. At the same time, Chinese EV maker BYD is building its first European factory in Hungary, which has a growing car battery industry.

Footprint decisions for suppliers are always complex because of the high costs involved – particularly after the rise in interest rates from years of historic lows – and the social and political impact of closures and job losses. But the range of current considerations, including the impact of generous new EV subsidies in the US under the Inflation Reduction Act, are making the process even more challenging.

Here we look at how suppliers can asses their overall network capacity in light of current and future market demands, to align with their strategic objectives.

Suppliers currently face complex additional footprint considerations, the first of which is undoubtedly politics. Governments are exerting more influence over where OEMs and suppliers locate production than they have done for a number of years, as national subsidy programs linked to the EV transition significantly affect the business case for factory locations.

The biggest is the US Inflation Reduction Act (IRA), signed into law by President Joe Biden in 2022. The IRA promises $433 billion of investments in the US economy, of which $369 billion are for energy security and climate change. The measures that directly affect the auto industry include tax incentives for consumers to buy EVs and grants to retrofit factories for low-emissions vehicle production. However, the subsidies only apply to EVs that are made with a proportion of materials that are sourced in the US or countries with US free trade agreements, such as Japan. The proportion was 30% in 2023, rising to 80% by 2027.

The earlier Bipartisan Infratsructure Law, signed in 2021, also awarded $6 billion of grants for companies investing in battery manufacturing and components.

The intention of the legislation is to build up the US’s domestic battery and EV production and reduce reliance on Chinese components, and the result is that OEMs and suppliers will have to move production to the US in order to sell EVs and components there.

We believe the effect on the automototive labor market will go beyond job losses in Europe and Asia if new factories are located or older ones re-located to the US. Tech talent is also likely to move to the US, because subsidies are focused on future clean technologies, and innovation will go with them. This will cause Europe to lose further ground against the US.

This is not to say Europe is stepping back from the race to build up its EV and battery production capacity. EU member states made €6.1bn available to support battery innovation and production through two Important Projects of Common European Interest (IPCEI) agreed in 2019 and 2021. There are no restrictions on the origin of the raw materials for batteries, in order to build up production of EVs and battery cells in the region.

From 2026, the European Union’s Carbon Border Adjustment Mechanism (CBAM) means companies will have to pay for certificates to cover the cost of emissions created during the production of goods they import, making low-carbon local production sites more financially attractive.

There are also EU subsidies available to build up manufacturing in less wealthy parts of the bloc such as eastern Europe. Building new plants with the latest automation and digital production tools will increase efficiency and likely will cost less than modernizing an existing production site. The cost advantage will be a strong factor in suppliers’ footprint decisions.

Beyond politics, new types of workforce considerations are also now affecting footprint decisions. The first issue is the availability of people with the right skills: new, highly digitalized and automated factories need workers with a broad range of technology skills, including engineering, computer science, robotics and experience with artificial intelligence (AI). Creative problem-solving by humans will become increasingly important as routine production tasks are taken over by machines, and we see a growing need for hybrid experts, who combine technical skills with creativity.

We expect a significant impact on traditional factory job profiles as a result of increased digitization and automation, especially at the operational level in factories making lower-cost, mass-produced models (we define these as volume or variant champions here). We see the number of shopfloor logistics roles declining by 63% in volume champion sites and 56% at variant champions’ plants by 2035 while the number of factory operator roles will shrink by 53% and 40% respectively, and the number of line managers by 24% in both types of factories.

In their place, we see high demand for new job profiles as the use of smart machines increases, and databases and data flow become more important. The number of data engineer roles is expected to increase by 78% in volume champion factories and 98% in variant champions’ sites, for example.

For employers, recruiting people to fill these roles will be highly competitive because their skills are in short supply across all manufacturing sectors. Suppliers will need to adjust wages accordingly and offer additional benefits to attract skilled staff to their production sites. The location of plants will become increasingly important – factories close to existing tech or automotive hubs, for example, may find it easier to hire the talent they need.

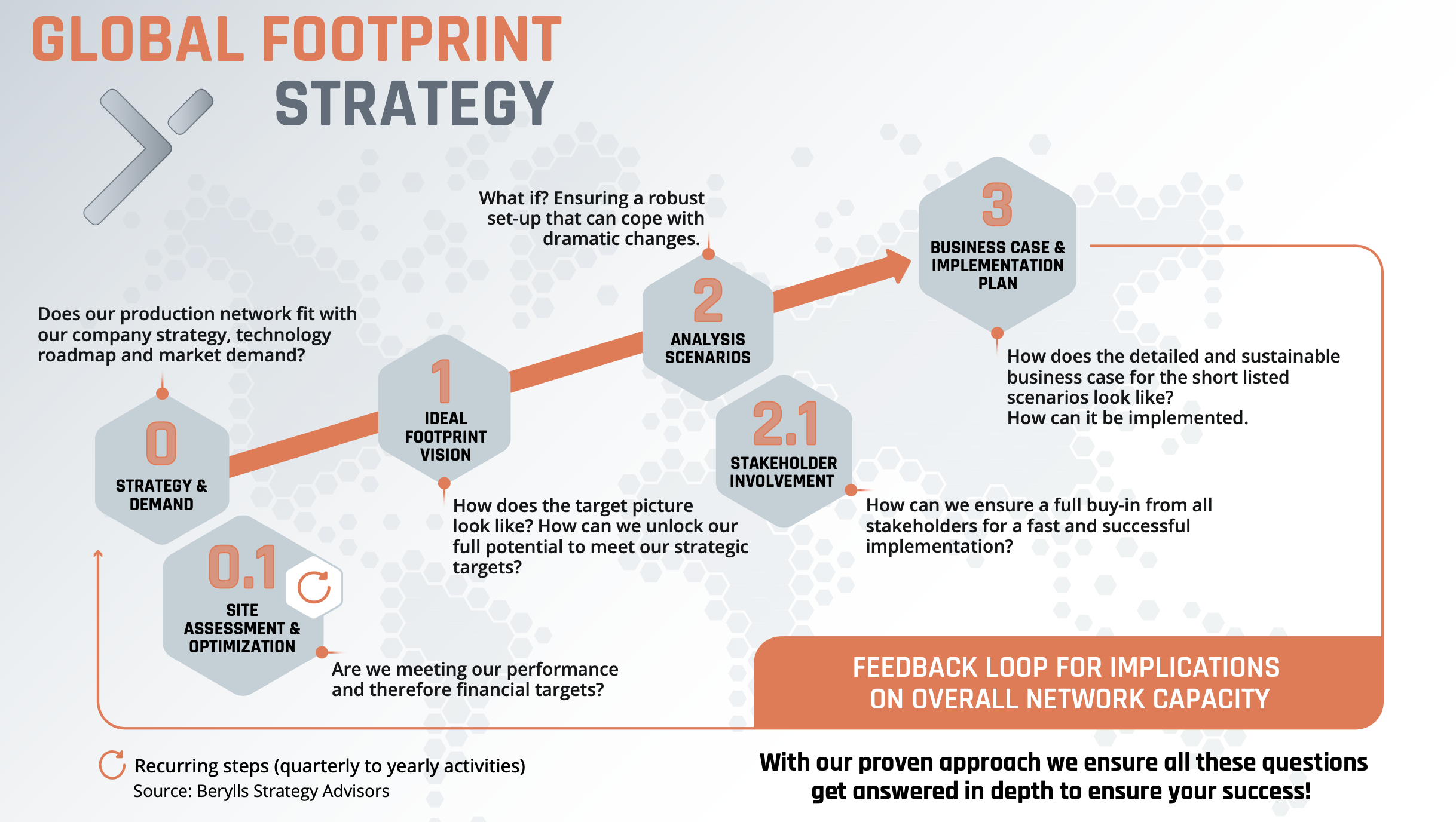

Figure 1: Global Footprint Strategy

Source: Berylls Strategy Advisors

Looking in detail now at a typical supplier’s footprint decision process (see chart above), the first step has not changed despite the complex new challenges described above. Footprint decisions need to be aligned with the company’s strategic objectives, and whether the current network meets them. How is demand expected to develop in different markets and can production sites adapt?

The next step is 360-degree site assessments of performance, cost structure and capacity, to give transparency over each production site’s future potential and improvement opportunities.

Suppliers can then shape the ideal future footprint, defining the plant archetypes and logistics networks they will need. These become the guiding concepts for scenario analysis, that will cover each of the major areas that would be impacted by a change in footprint: cost; the potential effect of subsidies and other government initiatives; the supply chain and logistics network; regulatory compliance; environmental impact; technology and innovation; human resources, and risk assessment.

The evaluated scenarios are narrowed down to a shortlist for evaluation by a wider group of stakeholders, and the final stage is a business case calulation on the short-listed network options, before moving into implementation planning and final decision-making.

Footprint decisions are among the most crucial that any auto supplier will make. The right production network is a critical part of the long-term financial and non-financial success of the company: new production facilities are very expensive, but so is keeping under-used or inefficient sites open. The impact of the investment decision, good or bad, will be felt by the company for years.

Cost efficiency is still a top priority for any footprint decision, but after a period of time in which the auto industry has been hit with one crisis after another, resilience is now ranked just as highly. Important production network considerations to reduce complexity and increase flexibility can include building factories close to customers to reduce the chance of supply chain disruption, and ensuring sites are located in places where there are enough skilled staff, or that are attractive to new hires.

Sustainability throughout the supply chain is also a key consideration for OEMs, and suppliers must be able to ensure their production locations meet customer and regulatory ESG requirements.

And as described above, the auto industry has become a key part of many governments’ industrial policy as they seek to meet commitments to transform their economies. Striking the balance between the short-term benefits of subsidies and the long-term results of choosing a particular location is now an important part of the footprint decision-making process. Some uncertainty is inevitable, as for example in the US where the outcome of the presidential election in November may change the position on EV subsidies.

However, what suppliers can do is make a thorough assessment of their product portfolio and expected future market demands, and consider the results alongside subsidy benefits, to see whether government support makes entering a new market worthwhile. They should also consider how reliant their product portfolio is on subsidies, and how that impacts their production network flexibility.

All these factors – cost, resilience, sustainability and subsidies – deserve thorough consideration in footprint decision-making, to reduce the risk inherent to such large and long-lasting decisions.

At Berylls, we have worked with clients on production network strategy and supply chain design for years, building up deep expertise in defining the right criteria and evaluations for your company’s footprint decisions. We would be delighted to discuss this or any other aspect of manufacturing footprint with you.

Christian Grimmelt has been an integral member of the Berylls by AlixPartners (formerly Berylls Strategy Advisors) team since February 2021. Previously, he gained extensive professional experience in top management consultancies and in the automotive supplier industry.

During his time at the world’s largest automotive supplier, he drove the establishment of a central unit to optimize the company’s global logistics and production network.

Christian Grimmelt’s consulting focus is logistics and production network optimization, purchasing and (digital) operations including launch and turnaround management for OEMs and especially suppliers.

Christian Grimmelt holds a university diploma in industrial engineering from the Karlsruhe Institute of Technology.

Christian Grimmelt has been an integral member of the Berylls by AlixPartners (formerly Berylls Strategy Advisors) team since February 2021. Previously, he gained extensive professional experience in top management consultancies and in the automotive supplier industry.

During his time at the world’s largest automotive supplier, he drove the establishment of a central unit to optimize the company’s global logistics and production network.

Christian Grimmelt’s consulting focus is logistics and production network optimization, purchasing and (digital) operations including launch and turnaround management for OEMs and especially suppliers.

Christian Grimmelt holds a university diploma in industrial engineering from the Karlsruhe Institute of Technology.

Christian Grimmelt has been an integral member of the Berylls by AlixPartners (formerly Berylls Strategy Advisors) team since February 2021. Previously, he gained extensive professional experience in top management consultancies and in the automotive supplier industry.

During his time at the world’s largest automotive supplier, he drove the establishment of a central unit to optimize the company’s global logistics and production network.

Christian Grimmelt’s consulting focus is logistics and production network optimization, purchasing and (digital) operations including launch and turnaround management for OEMs and especially suppliers.

Christian Grimmelt holds a university diploma in industrial engineering from the Karlsruhe Institute of Technology.