previous years

or automotive suppliers, the year 2020 was exceptional. The scale of the disruption can be summarized in four statements: growth was only really possible through acquisitions; one in four companies recorded losses; a Chinese supplier made it into the Top 100 for the first time, and electromobility set the direction for the whole industry.

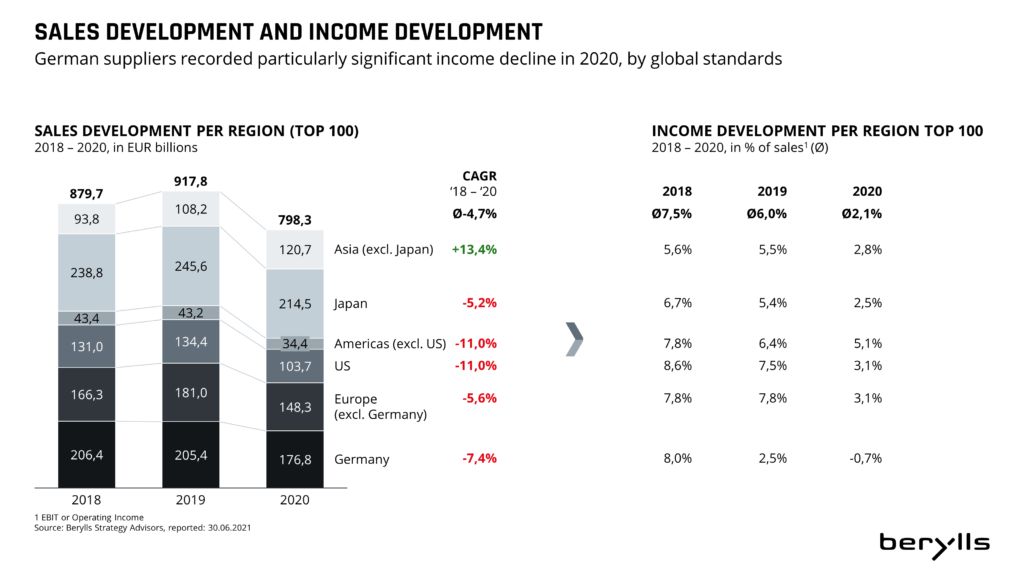

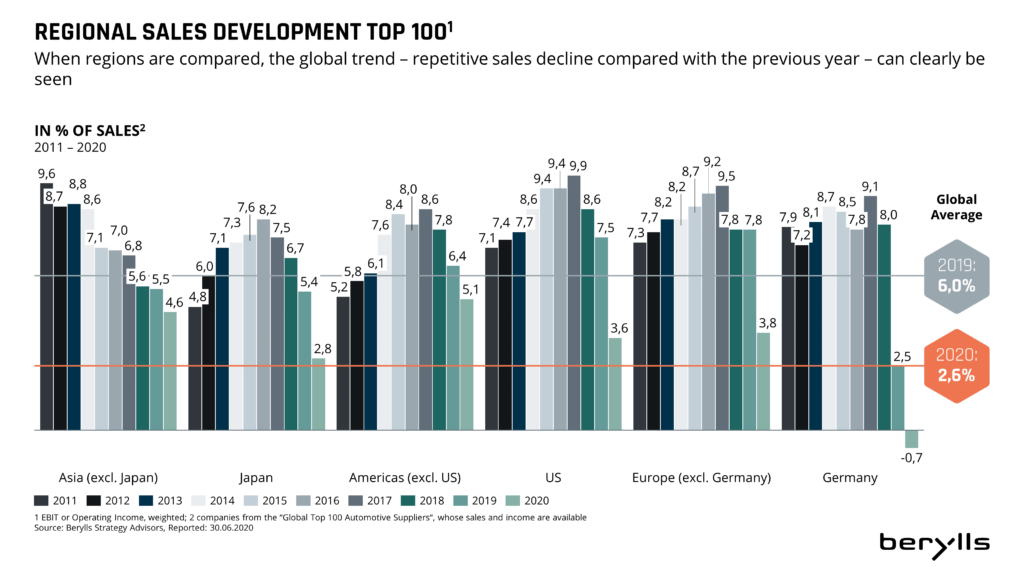

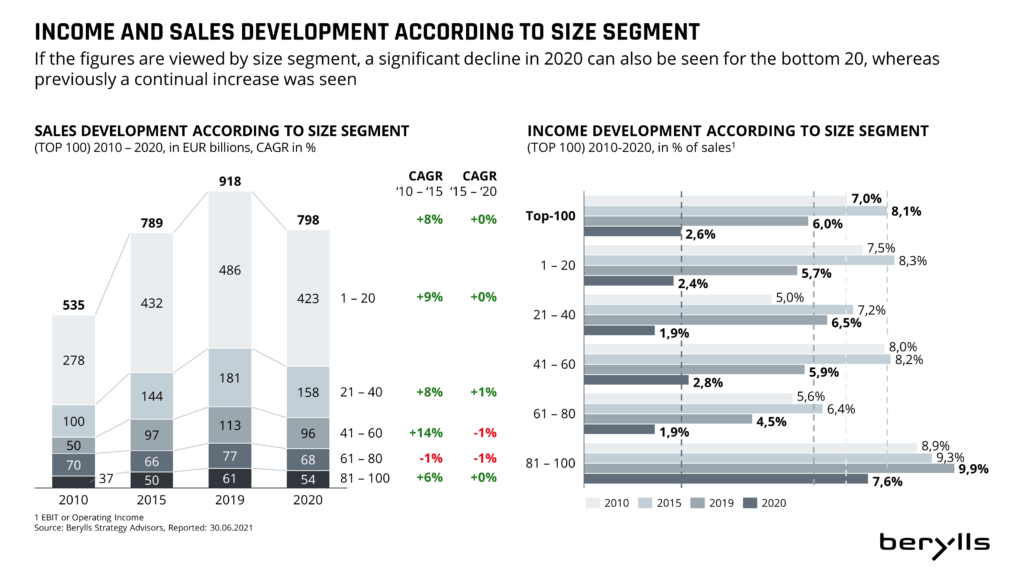

Looking in more detail at the numbers, turnover among the 100 largest automotive suppliers as identified by Berylls Strategy Advisors was 12.7 per cent down compared with 2019, when turnover increased by 4.3 per cent. Profitability among the top 100 declined by 58.1 per cent in 2020 in comparison with the previous year, and the average margin of the companies surveyed stood at 2.6 per cent less in 2020 – less than a half of the 6 per cent achieved in 2019.

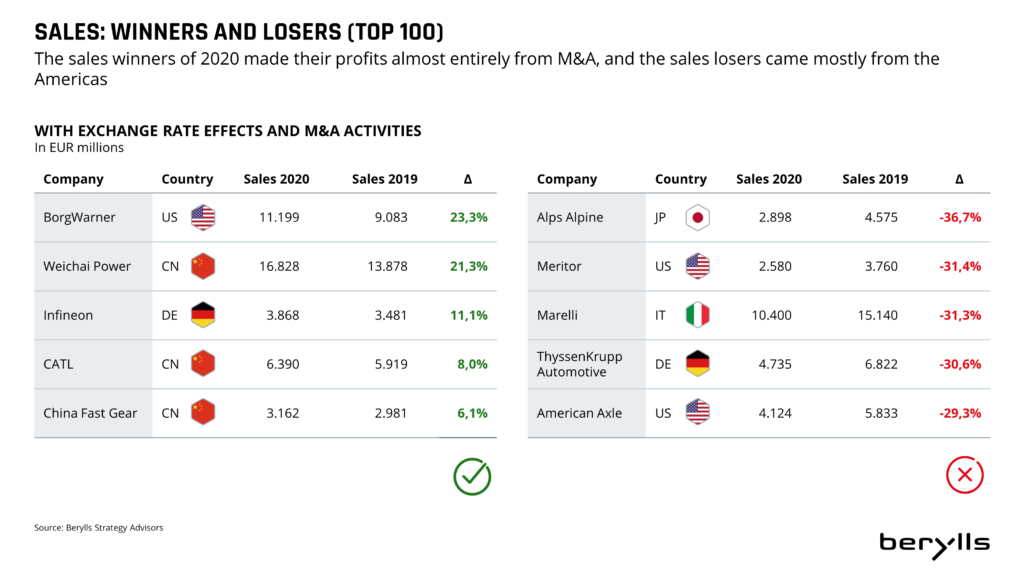

After a stormy year, for which the omens were already clear in 2019, the analysis by Berylls shows that whereas normally ten companies with the strongest growth in turnover could be selected, this time there were only eight. That was the number achieving a greater turnover than in the previous year. The 9th and 10th places in 2020 went to the two suppliers showing the least reduction in turnover in the Top 100. The main reasons for this are the effects of the Coronavirus pandemic. In the course of the past year both OEMs and suppliers had production stoppages. These stoppages along with reduced demand were the cause of significant loss of sales for the companies. It was mainly through acquisitions that companies such as BorgWarner (Delphi Technologies), Weichai Power (Aradex, VDS) or Infineon (Cypress) succeeded in increasing sales into a respectable double figure range.

There were mergers throughout the year. For example, Hitachi Automotive Systems, Keihin Corporation, Showa Corporation and Nissin Kogyo merged with the Japanese “Top 20” supplier (planned turnover for 2021 of 13 billion euros) Hitachi Astemo.

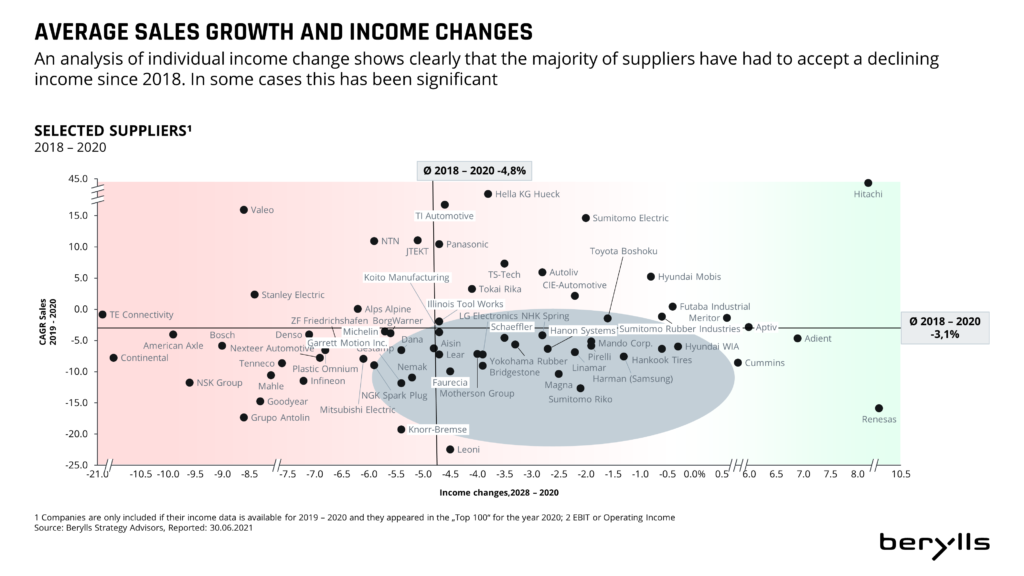

It was mainly the Coronavirus pandemic and the resulting production stoppages which caused sales drops for the automotive suppliers industry in the past year. Every second German supplier is currently planning additional job reductions because of the effects of the crisis. To add to this, sales fell considerably and costs did not fall to the same extent. One prominent example for the problems caused by the pandemic is the German cable and wiring specialist Leoni, which had already got into difficulties beforehand and is included in the 2020 Top 100 companies even with a negative margin. 80 factories belonging to this supplier all over the world were closed at various times, and the majority of its 4,800 staff in Germany were on short-time work. Rescue came in the form of a guarantee issued by Bavaria, Niedersachsen and Nordrhein-Westfalen for an operating loan. This prevented the company from going bankrupt, and it promises improvements in sales and results for the current year. Some smaller German suppliers which are not included in the Top 100 had to tread the path to insolvency in 2020, such as rim manufacturer BBS, the battery factory Moll, the aluminium casting experts Finoba, the plastic components manufacturer Weberit Dräbing, and the die-cast components manufacturer Minda KTSN. Some have already been taken over by investors or at least have the prospect of a restructuring. So the wave of bankruptcies announced in the previous year’s report has well and truly arrived. However, unlike the finance crisis of 2009 it has turned out to be a lot milder and mostly affects medium-sized companies in the supplier industry.

Five German and five Japanese Top 100 companies were making a loss in 2020 and account for over a half of the 17 suppliers with a negative margin. However, taken as a whole these companies are more like exceptions for Germany and Japan, as a total of 17 German and 27 Japanese automotive suppliers are represented in the Top 100. Germany’s loss-making companies are ZF Friedrichshafen, Continental, Bosch, Mahle and Leoni. The US loss-making companies range from American Axle which leads the loss-making companies with a -8.4 per cent operating income margin, to Goodyear which has a -0.1 per cent operating income margin and is the last on the negative list. Three Japanese companies are nudging zero growth: NTN (-1.1 percent OI), JTEKT (-0.7 per cent OI) and Denso (-0.7 per cent OI). The loss side consists of manufacturers from various fields, from mechanics to electronics.

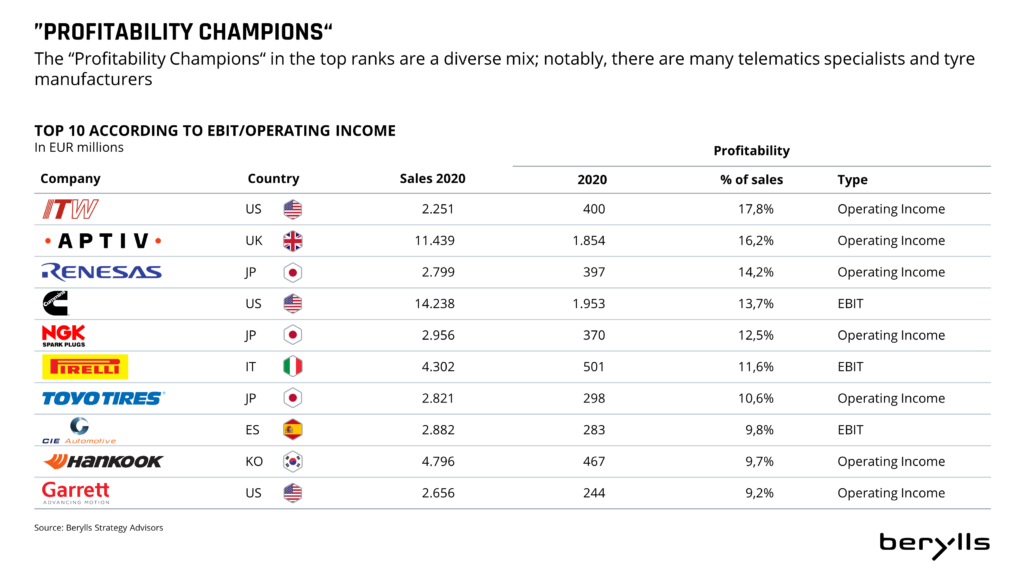

On the other side, this year’s “Profitability Champions“ are also from a very heterogeneous field. The most profitable companies occupying the top ten places are a varied mixture. The top performers come from six different countries and it is mostly telematic specialists and tyre manufacturers realizing positive margins. The top 3 most profitable companies in 2020 are Illinois Tool Works (USA, 17.8 per cent OI), Aptiv (Great Britain, 16.2 per cent OI), and Renesas (Japan, 14.2 per cent OI). The manufacturers with the highest margins were all tyre manufacturers: Pirelli (Italy, 11.6 per cent EBIT), Toyo Tire Corporation (Japan, 10.6 per cent OI), and Hankook Tires (Korea, 10.6 per cent OI). This is despite considerably lower demand in 2020 which had a negative effect on the margins of many other suppliers.

For the sixth year running Bosch is top of the list of the 100 largest automotive suppliers worldwide. The places immediately below Bosch, down to 9th place, go to the same companies as in the previous year. Weichai Power secures 10th place as the first Chinese company in the Top 10, dislodging Valeo (consistently at 10th or 11th place since 2017). This Chinese motor specialist is already well-known as one of the rare sales winners in 2020 and was only at 27th place when the Top 10 list was first published in 2011. Some companies did better than others in the crisis year, and this is largely dependent on geographical location. Suppliers based in Asia and/or with customers in Asia were able to profit from the ability of these countries to regain an attractive economy relatively early. Denso sends Continental down to third place and secures the 2020 silver medal. Magna slides from place four to place five, while ZF profits mainly from the acquisition of Wabco. Also, competitors Michelin and Bridgestone swop positions and now occupy places 8 and 9.

In the past year the effects of the Coronavirus pandemic converged with strong growth in the electromobility sector. Automotive suppliers had falls in sales and production stops to contend with and the majority could not avoid making job cuts. Battery and semiconductor manufacturers remain on a growth path, and so manufacturers such as CATL are increasingly looking for new staff. But European OEMs are dependent on Asian manufacturers such as CATL, Panasonic, BYD or LG Chem. In order to counteract this dependency, Germany will be developed into a European battery centre in the coming years. Various corporations are already working with battery specialists, both on the OEM side and on the supplier side, and throughout Europe Germany is scheduling by far the most projects in the battery manufacturing sector. By 2030 up to 100,000 new jobs will be created in Germany for this sector. German automotive suppliers such as Dräxlmaier, Webasto or Elring, which are already suppliers of battery technology, can also benefit from this.

Suppliers are increasingly adapting their strategies under the keywords electromobility and future technologies. LG is leaving the smartphone business and planning to concentrate on the growth area of components for electro vehicles, networked devices and artificial intelligence. BorgWarner would like to base their growth on acquisitions and at the same time develop more in the electro sector. Infineon’s strategy is to strengthen their core business with semiconductors and the exploitation of new growth markets, and this is what led to the above-mentioned acquisition of Cypress.

Berylls has been observing the Top 100 worldwide automotive suppliers for ten years. During this time there has been much movement and change both on the markets and on the shop floor. Back in 2011 the industry was on an upswing after the global financial crisis. After that, sales rose year on year, from 2011 onwards (663 billion euros) until 2019 (914 billion euros), by 38 per cent altogether which is a yearly average of 4.1 per cent. And the profitability of the 100 largest suppliers improved every year until 2017, standing at consistently over 7 per cent from 2012 until 2018. In 2020 the total sales of the Top 100 stood at around 800 billion euros – about 20 per cent above the level ten years ago. Profitability, on the other hand, stands at an all-time low of only around 3 per cent – although in 2020 this was largely determined by the pandemic. In 2019, the year before the pandemic, the margin still stood at 6 per cent, a comparable level to 2011 (6.7 per cent). So what has been going on these past ten years?

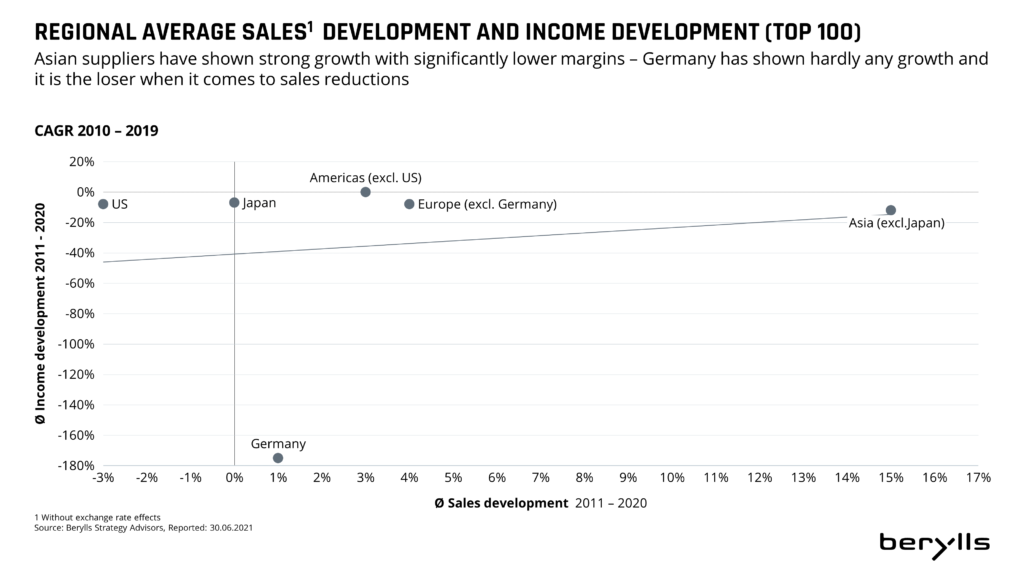

The geographic distribution of the large suppliers changed in the course of time. There were marked relocations of suppliers from Germany, Japan and the US to Asia. Asian suppliers (apart from Japan) have been forfeiting profitability since 2011 due to their huge sales growth, but have increasingly appeared in the Top 100.

Nine times as many Chinese suppliers made it into the Top 100 in 2020 as in 2011. At that time only Weichai Power was on the list, at 25th place; for 2020 they are ranked 10th, and they now have eight other Chinese companies spread out over the whole of the Top 100 behind them.

The biggest sales winners since 2011 are ZF Friedrichshafen and Tenneco. Bosch took over the top position from Continental in 2015 and has successfully defended this position every year since then. Continental held the top position from 2011 until 2014, slightly ahead of Bosch every year. The Top 100 companies recorded four completely loss-free years between 2013 and 2016.

The best progress within the Top 100 was made by Dräxlmaier (+ 31 places), Grupo Antolin (+ 25 places), and NGK Spark Plug (+ 21 places). The companies who lost the most places were TS Tech (- 41 places), Pirelli (- 31 places) and Meritor (-28 places, after splitting up).

Some companies were seen to come and go during the last decade. Concerns such as Johnson Controls and Honeywell split off their automotive sectors. The suppliers TRW, Delphi Technologies, Calsonic, Behr and Wabco were taken over. Yet more were not able to keep up with the continual sales increases exhibited by the other Top 100 participants and were removed because they were too small, for example IAC, Rheinmetall Automotive and Cooper Standard. The splitting off of parts of companies has also led to new additions over the years. So current occupants of the Top 100 such as Aptiv, Adient, Clarios or Garret Motion have been there for a few years now in the course of their independence. Some suppliers have made it onto the top performers‘ list under their own steam because of strong growth in sales, such as Flex-N-Gate, CATL, Piston Group an the German representatives Aunde, Freudenberg and Infineon.

The coming 10 years will see more marked upheaval. Suppliers with a high proportion of combustion engines like Mahle, BorgWarner, Tenneco or Eberspächer will be pushed to the bottom if they do not take countermeasures. Electric/electronic concerns with strong software skills, like Continental, Bosch or Hella, will grow disproportionately. The Asian concerns, especially the Chinese supplier companies such as the players from IT and entertainment electronics, Huawei, Samsung and LG, will continue to gain importance through acquisitions (also) from traditional companies. The emphasis will shift more strongly in the direction of Asia. However, German suppliers are well equipped to master the next phase of the transformation.

Berylls Strategy Advisors would be happy to support you in this key decision process.

Arthur Kipferler complements the expertise of the Berylls partner team in the fields of market & customer, technologies, sales, and digitalization, as well as in the development and implementation of corporate, product, and regional strategies.