Tension field

he German federal government has declared its aim to reduce greenhouse gases to a level 55% lower than that of 1990. It goes so far as to envisage complete carbon neutrality by 2050, which is in harmony with the aims of the European Green Deal. In order to achieve this, about 14 million vehicles, or 30% of existing vehicles on the road in Germany, would have to be powered solely by electricity by 2030.

With these regulatory conditions in the background it seems understandable that most European automotive manufacturers are consolidating their exit strategies now and some are envisaging short-term withdrawal scenarios. Audi, for example, is planning the final sales run of its combustion engines for 2025, except for the Chinese market. Production of conventionally powered cars is due to finally end in 2033. Its allied brand Volkswagen and competitors such as BMW and Daimler are following similar approaches.

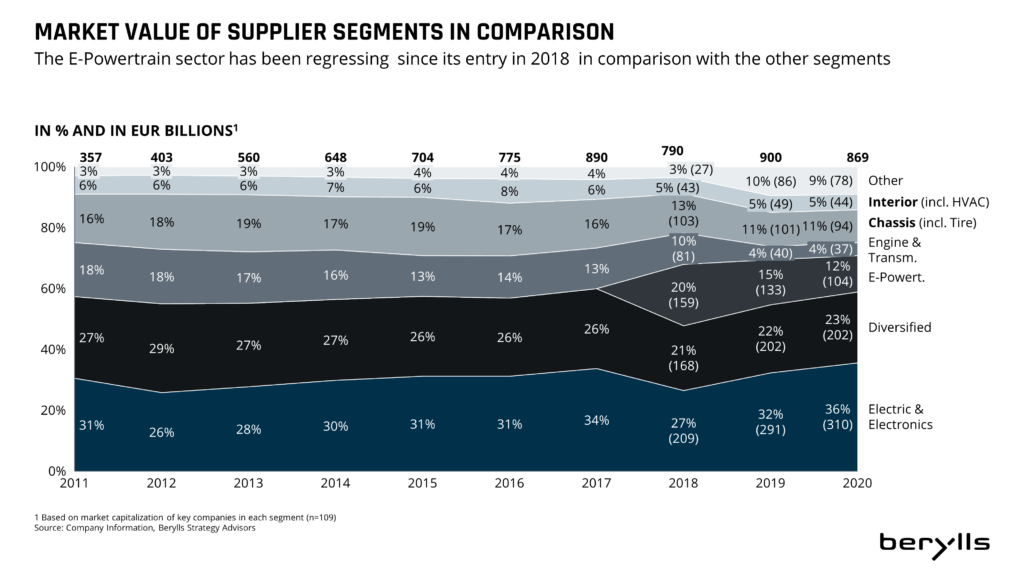

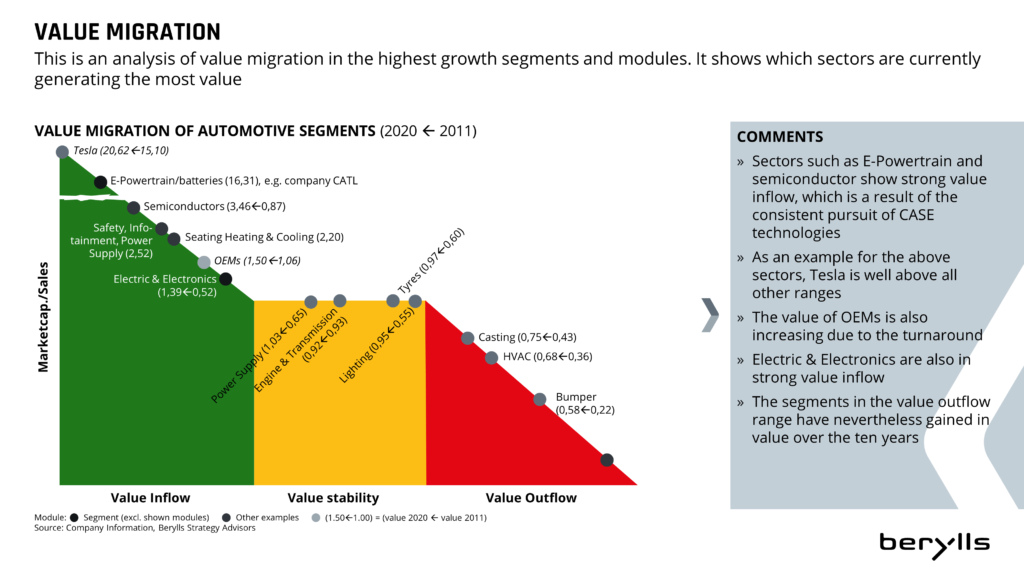

So the paradigm shift from classic combustion motor power to purring e-powertrain seems to be sealed. For the German supplier industry, which with a share of about 22 per cent is the second largest supplier in the global market, this opens up the opportunity to further develop their leading role.

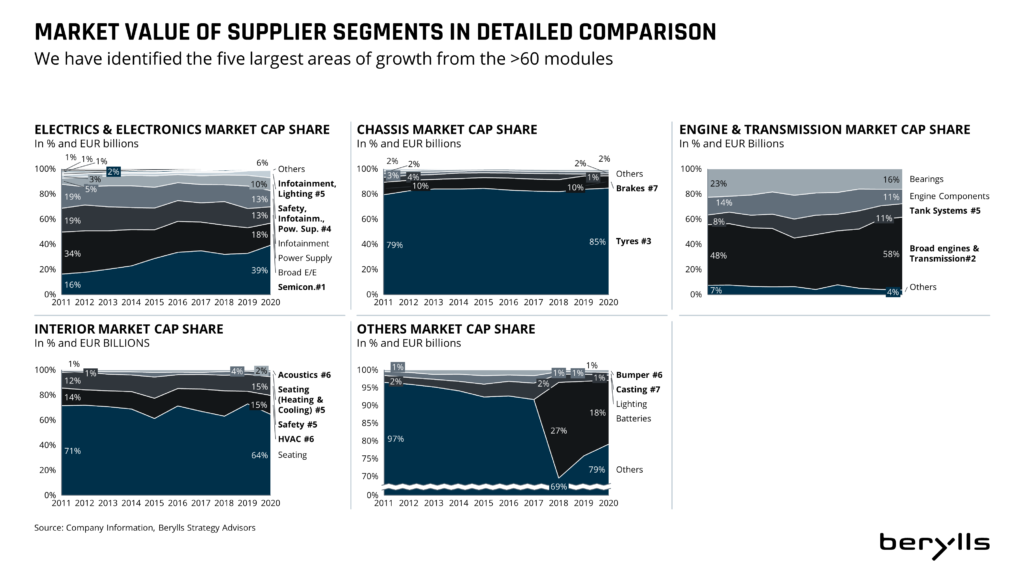

An industrial standard for the high volt architecture (HV) of future vehicle platforms is being established in the electric powertrain sector. The battery system, the e-axis and high-performance electronics are the central components of the electrified powertrain. The battery system constitutes 70 to 80 per cent of the total cost of the powertrain. The concept of central HV architectures is increasingly prominent in the future vehicle platforms up to 2030, in which the individual components of the high-performance electronics are moved to one location at the rear. The aim of this is to gain significant advantages when it comes to material costs and system complexity.

High performance electronics have a significant effect on range, charging time and durability of vehicle batteries. This is another reason why automotive manufacturers increasingly consider installing power electronics like inverters, DC converters and control devices themselves, for part of this volume. In this way the manufacturers can develop their own evaluation skills alongside the established suppliers, and in the tendering process they can negotiate with the suppliers on an equal footing.

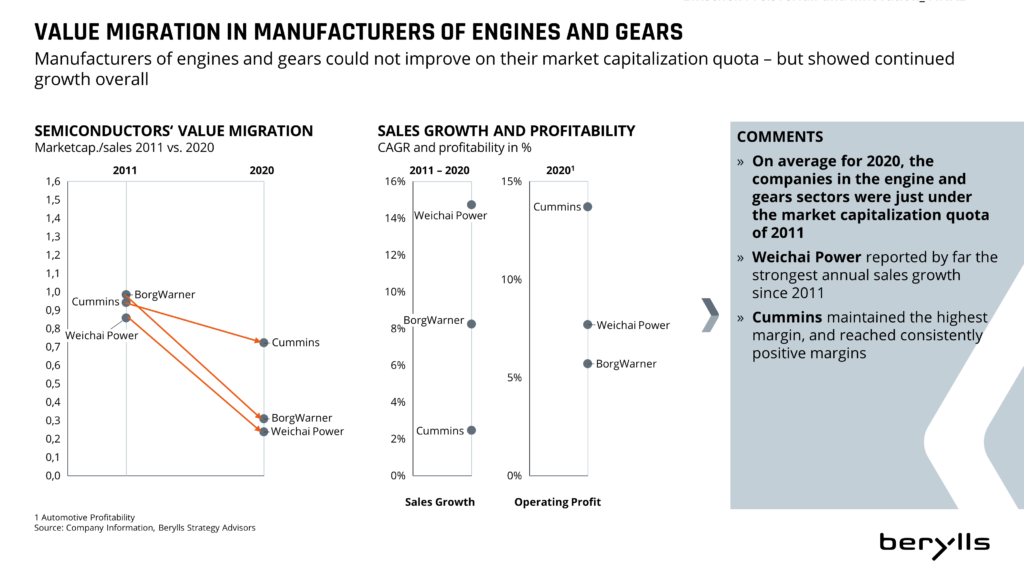

The components of the e-powertrain are increasingly subject to heavy pressure on prices, which is partly the result of economies of scale through rising unit sales and increasing customer acceptance of electric drive systems.

New registrations for electric vehicles rose during the past year by 264 per cent in Germany alone, and globally the increase was 38 per cent. By 2026 we estimate that the production of purely electric vehicles will rise by more than 200 per cent.

At the same time as the rise in volume, we can expect price reductions of up to 50 to 70 per cent for individual components in the e-powertrain. To counteract this, the big suppliers are increasingly entering development partnerships with semiconductor manufacturers. They are focusing on improvement of efficiencies in power electronics, in order to increase the range of battery-electric vehicles. Suppliers are hoping to counteract price reductions in the long term with technological innovations of this sort.

2021 is a decisive year for suppliers, as they need to get the tenders for the new e-platforms into position and thus secure their share of the e-mobility growth market. This also appears to be a targeted approach against a background of job retainment. Because of the planned discontinuation of the combustion business and the lower staff intensity needed to make electric engines, suppliers are under intense pressure to overcompensate for the expected gap with new projects in the e-mobility sector. The result is a bitter pricing competition for the benefit of the end customer, to make electromobility affordable for the general public.

Berylls Strategy Advisors would be happy to support you in this key decision process.

Arthur Kipferler complements the expertise of the Berylls partner team in the fields of market & customer, technologies, sales, and digitalization, as well as in the development and implementation of corporate, product, and regional strategies.