(Expensive) in-house creative development of an OS with the aim of gaining independence and data sovereignty, facilitating simple cross-domain interfaces and increasing productivity through re-use of basic code

ehicles are increasingly defined by software

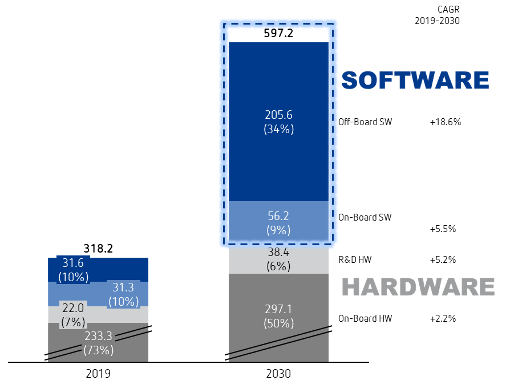

Any driver of a modern car can easily understand – and experience up close – why there is more and more talk of the future “software defined car”. Display screens are taking the place of analogue instrument panels; switches and buttons on centre consoles are increasingly being converted into large displays and vehicles can move about semi-autonomously in traffic and manoeuvre themselves into parking spaces. Those are just a few examples of how the user experience is increasingly being determined by software. User experience can also be changed by subsequently activating new features or updates/upgrades of existing features. This is clearly reflected in the development of market volumes for software and hardware. If the software portion (on & off-board) of the added value (automotive software and EE hardware) still amounts to 20% according to Berylls’ calculations, there is a projected increase of 43% for 2030. Most growth is generated off-board, referring to software outside the vehicle such as development tools, applications, and cloud services. Despite this, Berylls expects even on-board software such as control devices, infotainment, driving assistance systems etc. to almost double in market volume.

The huge increase in range of functionalities and the demands on the updateability of vehicles is leading to high expectations of EE architectures, which have to meet these needs accordingly. This means that classic architectures from about 70-110 control devices in vehicles are constantly being pushed to their limits. During autonomous parking via parking assistance, numerous sensors, cameras and control devices must be arranged to form an efficient overall process. Hardware such as control devices and cameras is frequently obtained from different suppliers and integrated by the OEM. A lack of standards/specifications relating to programming languages, software architectures etc. sometimes creates significant additional outlay and high levels of complexity in the integration process, particularly when altering individual components. Reactions to this include gradually implementing alternative EE architectures involving the centralization and consolidation of control devices. Industrial standards for architectures have not yet been set, despite the existence of various types ranging from zonal architectures to centralised computers. In any event the virtualization and abstraction of hardware layers is increasing, leading to a disengagement of hardware and software and the emergence of a new market dynamic – just when classic tier 1 suppliers are competing with software houses, “big tech” players and other organizations when it comes to software expertise. In order to remain competitive at control device level, numerous suppliers coming from the hardware side tend to see software as a part of the product rather than its core. They are increasingly being confronted with considerable demands on their capacities, skills and resources for software development and they need to find appropriate answers.

In order to reduce integration outlay and facilitate remote update/upgrade capacity and new, in particular algorithm-based functionalities (e.g. image processing), new software architecture concepts are being introduced along with new EE architectures. There is often talk of so-called “operating systems”, which are ultimately a mixture of software stacks. Attempts are made to solve the aforementioned issues, namely connection to the cloud, (greater) outsourcing of functionalities into the cloud, remote updates/upgrades, and uniform standards (as well as the existing ones such as classic/adaptive AUTOSAR). OEMs have recognized the value of new software architectures – and especially those induced through Tesla, which, with its thorough ‘Greenfield’ approach, has been able to redefine and apply this issue without the use of ‘Legacy’ systems. Traditional manufacturers have recognized Tesla’s competitive edge and advantage in this respect and are working hard to reduce it. They are relying on various strategies for this, from the development of their own operating system (OS, e.g. Tesla, VW, Daimler) to the integration of third-party solutions – first and foremost Android Automotive (e.g. Polestar).

The meaning of “operating system” is not clearly defined in current discourse. It is often equated with an operating system for infotainments (analogue Android, iOS), which can be equipped with apps etc. and offers one of the most distinctive features to the customer. In-house software stacks and universal software platforms are usually what is meant by OEM operating systems. These in-house developments present OEMs with significant challenges in the face of high costs and often a shortage of software developers. It is easy to understand why many OEMs look for alternatives and (have to) ask themselves what they have to gain from in-house developments. The advantages of strong in-house creative development lie above all in independence from tier 1, particularly big tech players such as Google, who have singled out vehicles as an attractive customer interface and are able to gain a dominant position in the market through an operating system, targeting infotainment in particular. OEMs pay for this with their customer data as well as the licencing fees. But for that they gain a comprehensive and well-integrated infotainment system with low investment costs and high customization potential. Additional Google services can, of course, be easily integrated. According to projections by Berylls, a market share of 17% in the next 2 – 3 years is an entirely realistic prospect. In addition, manufacturers have the opportunity to comply with industrial standards within the framework of partnerships such as the Genivi Allianz, which, as an alliance of automotive manufacturers and suppliers, has developed an infotainment system based on Linux.

As demonstrated, established EE architectures are not designed for current demands (connectivity, function upgrading, remote updates etc.). For this reason (established) OEMs are making an effort to catch up, despite the fact that this presents a sizeable challenge in the face of legacy structures and frequent shortage of in-house software architecture skills/resources. Within the complex field of software architecture and individual domains it is imperative that resources are correctly employed, especially in those areas with direct influence on competitiveness such as cloud connectivity, infotainment or autonomous/assisted driving. OEMs and suppliers can follow various strategies which make use of different approaches in order to set themselves apart, mainly according to degree of in-house creative development and relevant focus:

(Expensive) in-house creative development of an OS with the aim of gaining independence and data sovereignty, facilitating simple cross-domain interfaces and increasing productivity through re-use of basic code

Cooperate with other manufacturers and suppliers to draw up an industry solution in order to position themselves against the big tech players with an “industry standard” and thus make use of economies of scale and lower individual development costs

Cooperate with suppliers/big tech players (such as with Android Automotive in infotainment, and with Waymo in autonomic driving) bringing relevant advantages in cost and integration but also potential risks of being reduced to a hardware supplier for the “smartphone on wheels”

One thing can be said for sure: automotive software market dynamic has only just picked up speed, and is far from the finishing line. How OEMs and suppliers position themselves in this field will in many cases determine their future success.

Berylls Strategy Advisors would be happy to support you in this key decision process.

Arthur Kipferler complements the expertise of the Berylls partner team in the fields of market & customer, technologies, sales, and digitalization, as well as in the development and implementation of corporate, product, and regional strategies.